Joe Salomon has been the CEO of Oilex Ltd (ASX:OEX) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Oilex pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Oilex

How Does Total Compensation For Joe Salomon Compare With Other Companies In The Industry?

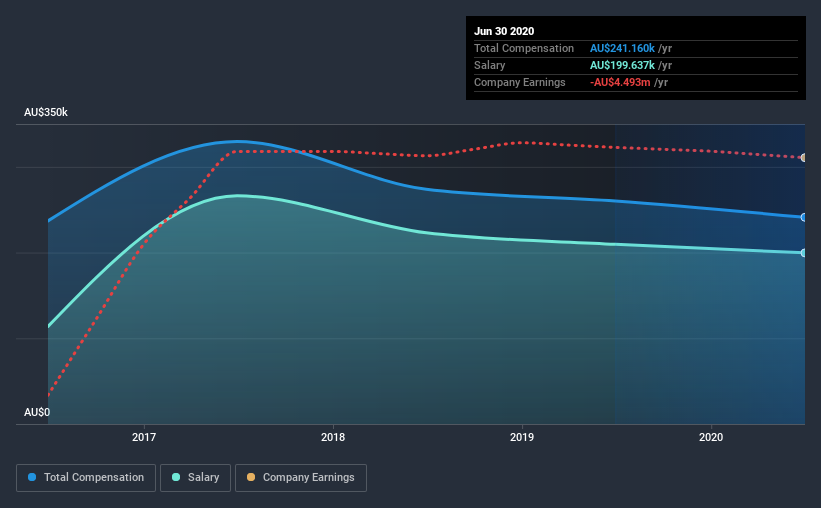

At the time of writing, our data shows that Oilex Ltd has a market capitalization of AU$13m, and reported total annual CEO compensation of AU$241k for the year to June 2020. We note that's a small decrease of 7.3% on last year. Notably, the salary which is AU$199.6k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below AU$259m, we found that the median total CEO compensation was AU$343k. From this we gather that Joe Salomon is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$200k | AU$210k | 83% |

| Other | AU$42k | AU$50k | 17% |

| Total Compensation | AU$241k | AU$260k | 100% |

On an industry level, around 71% of total compensation represents salary and 29% is other remuneration. Oilex is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Oilex Ltd's Growth Numbers

Over the past three years, Oilex Ltd has seen its earnings per share (EPS) grow by 35% per year. Its revenue is down 96% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Oilex Ltd Been A Good Investment?

With a three year total loss of 25% for the shareholders, Oilex Ltd would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, Oilex Ltd is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, shareholder returns paint a sorry picture for the company, finishing in the red over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for Oilex (of which 3 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Oilex, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Oilex, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SYN

Synergia Energy

Engages in the exploration, appraisal, development, production, and sale of oil and gas.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives