- Australia

- /

- Oil and Gas

- /

- ASX:NHC

Top ASX Dividend Stocks To Consider In August 2024

Reviewed by Simply Wall St

The Australian market has seen significant fluctuations recently, with the ASX200 closing down more than 2% at 7,943 points after hitting a fresh all-time record. Despite this volatility and sector-wide declines, dividend stocks remain an attractive option for investors seeking steady income streams amidst uncertain market conditions. When evaluating dividend stocks in such an environment, it's crucial to consider factors like consistent earnings performance, strong balance sheets, and the ability to sustain payouts even during economic downturns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.38% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.15% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.58% | ★★★★★☆ |

| Auswide Bank (ASX:ABA) | 9.84% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.32% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.01% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.04% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.60% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.51% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.20% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

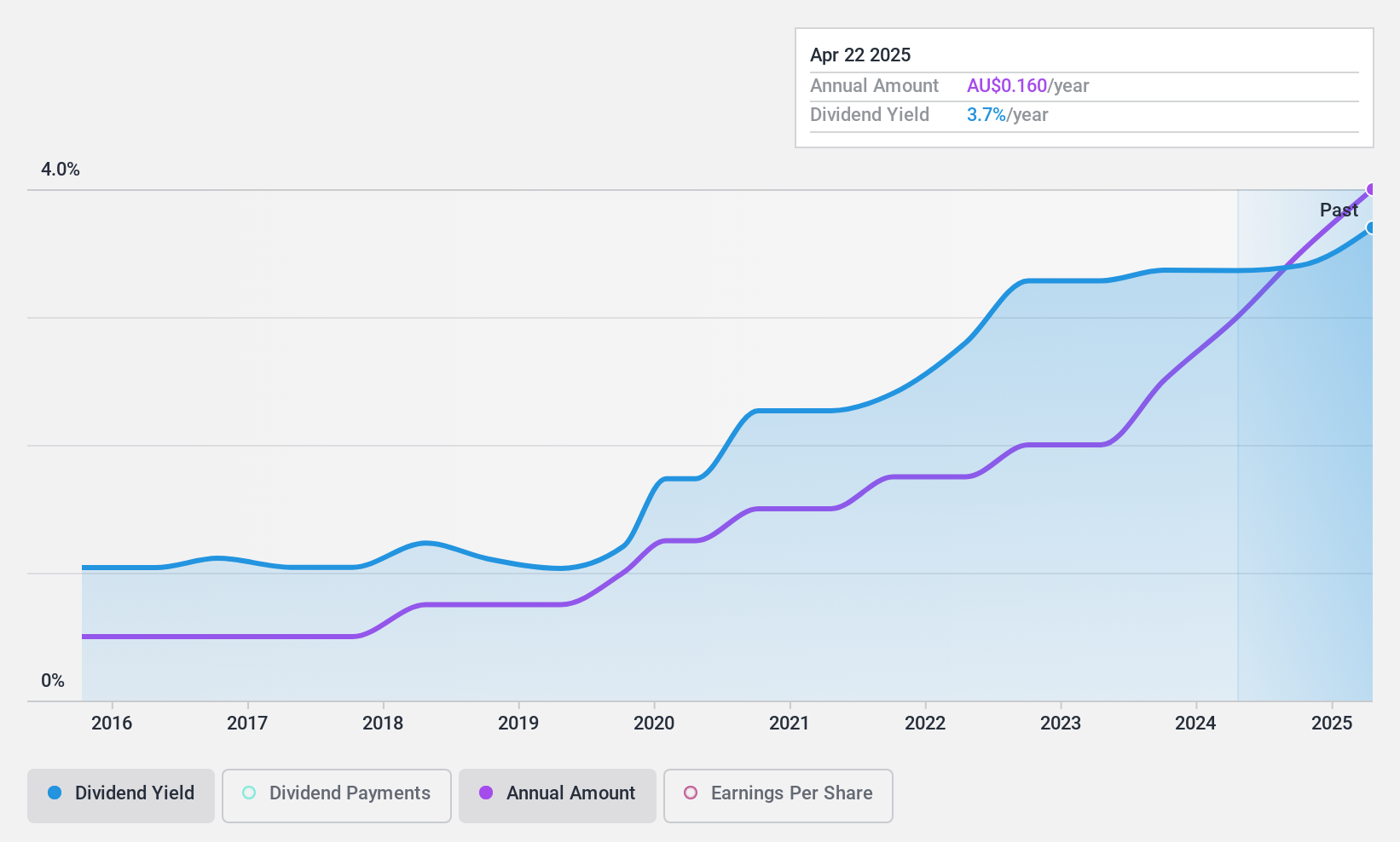

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.25 billion.

Operations: MFF Capital Investments Limited generates revenue primarily through equity investments, amounting to A$659.96 million.

Dividend Yield: 3.6%

MFF Capital Investments pays a reliable dividend of 3.6%, which is well-covered by both earnings (payout ratio: 16.8%) and cash flows (cash payout ratio: 24.1%). Its dividends have been stable and growing over the past decade, although its yield is lower than the top quartile in Australia. Recently, MFF announced a final dividend of A$0.07 per share for H2 FY2024, alongside strong earnings growth with net income rising to A$447.36 million from A$323.58 million last year.

- Click here and access our complete dividend analysis report to understand the dynamics of MFF Capital Investments.

- The valuation report we've compiled suggests that MFF Capital Investments' current price could be quite moderate.

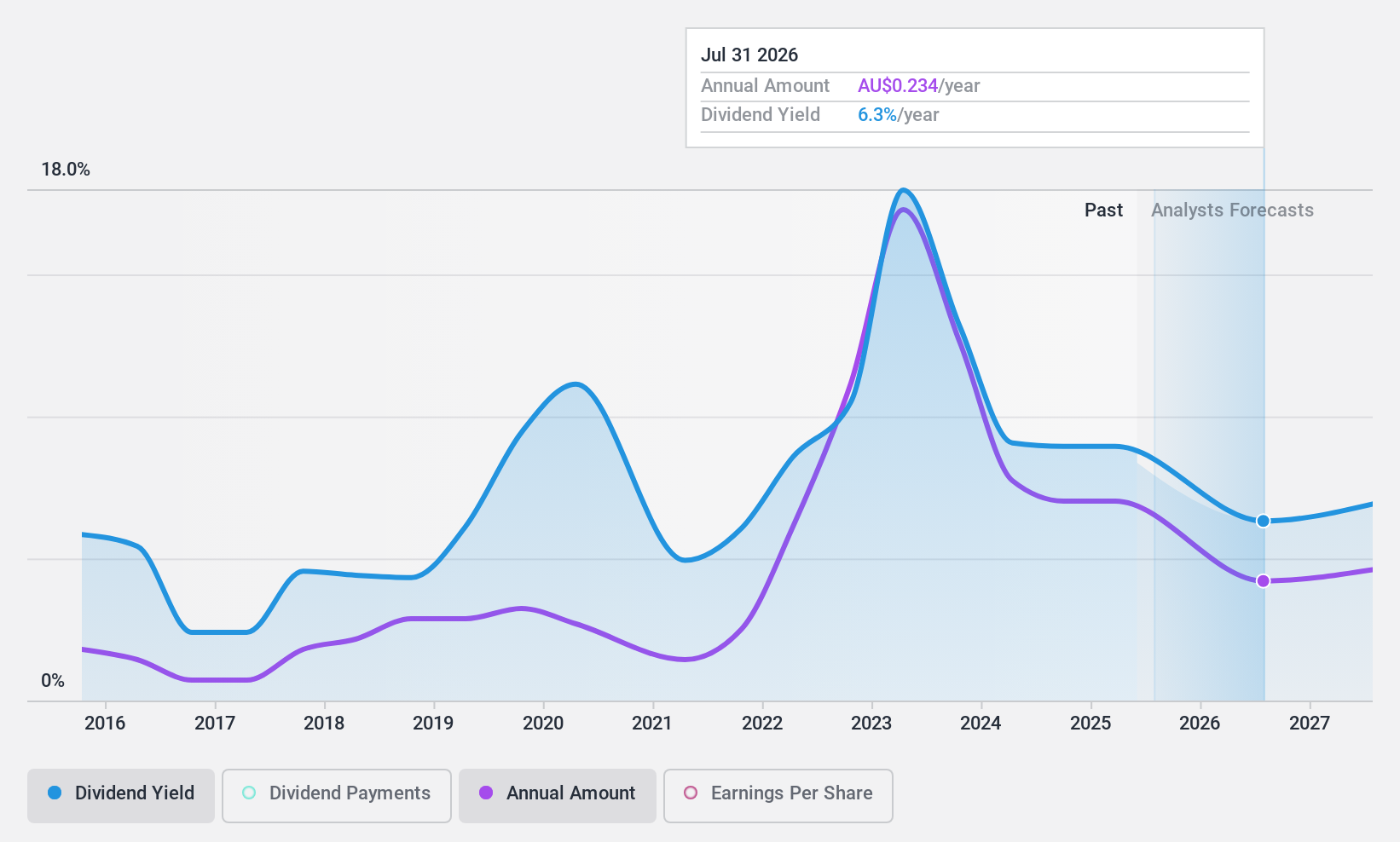

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited explores, develops, produces, and processes coal as well as oil and gas properties with a market cap of A$4.17 billion.

Operations: New Hope Corporation Limited's revenue primarily comes from its Coal Mining NSW segment, which generated A$1.88 billion, and its Coal Mining QLD (including Treasury and Investments) segment, which brought in A$48.15 million.

Dividend Yield: 8.7%

New Hope Corporation offers a high dividend yield of 8.72%, placing it in the top 25% of Australian dividend payers. However, its dividends are not well covered by free cash flows, with a high cash payout ratio of 90.2%. Recent changes include the resignation of Director Todd Barlow and the appointment of Brent Smith, which may impact future governance. Additionally, New Hope completed a A$300 million fixed-income offering to bolster its financial position amidst volatile earnings forecasts.

- Delve into the full analysis dividend report here for a deeper understanding of New Hope.

- The analysis detailed in our New Hope valuation report hints at an deflated share price compared to its estimated value.

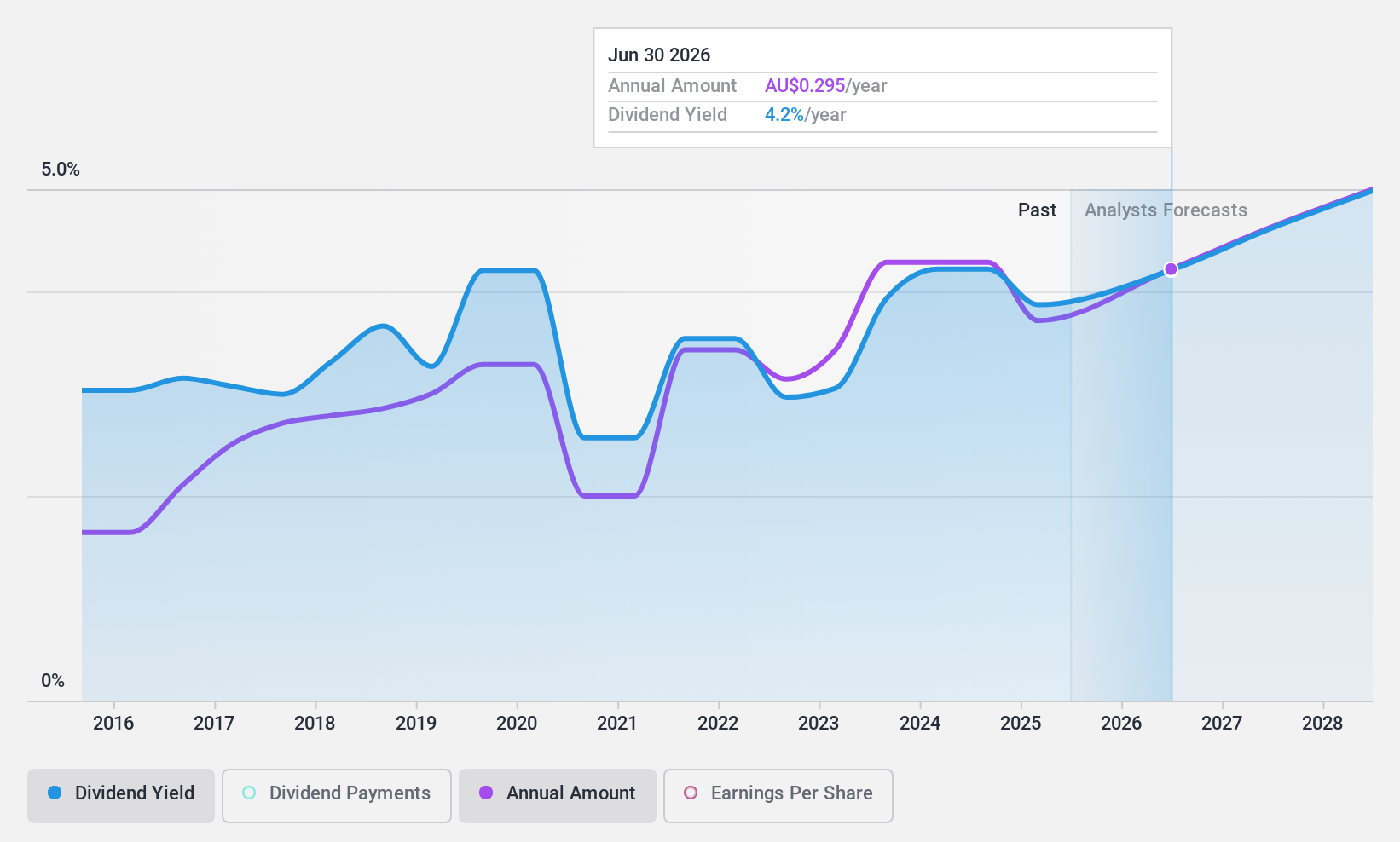

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited, with a market cap of A$3.61 billion, underwrites and distributes private health insurance to residents, international students, and visitors in Australia and New Zealand.

Operations: nib holdings limited generates revenue from several segments including Australian Residents Health Insurance (A$2.55 billion), New Zealand Insurance (A$351.90 million), International (Inbound) Health Insurance (A$173.20 million), NIB Travel (A$109.10 million), and Nib Thrive (A$38 million).

Dividend Yield: 4%

nib holdings trades at 44.9% below its estimated fair value and has grown earnings by 9.7% annually over the past five years. Its dividend payments have increased over the past decade, though they have been volatile. The current payout ratios are sustainable, with earnings coverage at 67.5% and cash flow coverage at 57.9%. Recent changes include CEO Mark Fitzgibbon's retirement and Ed Close's appointment as the new CEO, effective before year-end 2024.

- Navigate through the intricacies of nib holdings with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, nib holdings' share price might be too pessimistic.

Key Takeaways

- Reveal the 31 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

New Hope

Explores for, develops, produces, and processes coal, and oil and gas properties.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives