- Australia

- /

- Oil and Gas

- /

- ASX:NHC

New Hope (ASX:NHC): Evaluating Valuation After Fresh Production Results and Upbeat 2025 Guidance

Reviewed by Simply Wall St

New Hope (ASX:NHC) has just released its Q4 and annual production and sales results, along with fresh production guidance for the coming year. The main headline for investors is the increase in output and sales compared to last year, as well as a clear signal of confidence from management shown by a completed share buyback. In an industry known for operational surprises, these updates are notable for the transparency they bring to the company’s trajectory and goals.

This news follows a year of modest but positive movement for New Hope’s share price, which has climbed roughly 4% overall despite a difficult start to the year. The stock has gained momentum in the past three months, rising 17%. Earlier, updates about steady revenues and some pressure on net income growth had softened momentum, so this latest data provides a fresh perspective for investor expectations. With the buyback now completed and production volumes rising, there is renewed discussion regarding how the stock should be valued.

The key question now is whether markets are underappreciating this forward-looking growth, or if the recent uptick has already factored the new outlook into the price.

Most Popular Narrative: 6% Overvalued

According to the community narrative, New Hope is currently trading slightly above its fair value, based on analysts’ expectations for future earnings and profit margins.

Continued operational ramp-up and expansion at Bengalla and New Acland mines, along with improvements in coal yield and stable cost control, position the company to increase production scale and reduce unit costs. This benefits overall profitability and EBITDA margins. The ramp-up of the Maxwell Mine, with meaningful coking coal production and eventual dividend flows, is expected to contribute materially to group cash flows and earnings over the next 12-24 months.

Want to uncover the story behind this valuation? One analyst-building narrative claims a production surge and large-scale operational changes could reshape New Hope’s future cash flows. The suspense lies in how key profitability assumptions and elusive industry benchmarks shape the ultimate fair value. How do these elements stack up? Dive in and weigh the numbers behind this bold valuation thesis.

Result: Fair Value of $4.16 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued logistics constraints or a further drop in coal prices could quickly undermine these positive expectations for New Hope’s growth and margins.

Find out about the key risks to this New Hope narrative.Another View: What Does the DCF Say?

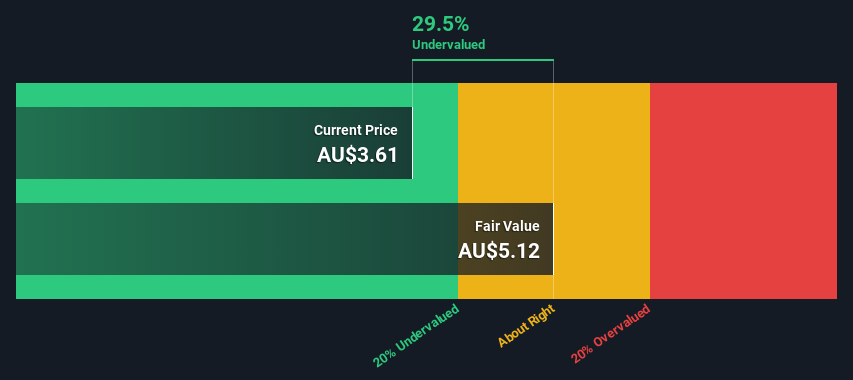

Looking from a different angle, our DCF model takes into account future cash flows and presents a much more optimistic outlook. It suggests the market could be underestimating New Hope’s real value. Which perspective will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own New Hope Narrative

If you see things differently or prefer hands-on research, you can shape your own view and build a personal valuation in just minutes. do it your way.

A great starting point for your New Hope research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why stop with just one stock when there’s a world of opportunities right at your fingertips? Let me show you a smarter way to cut through market noise. The Simply Wall Street Screener helps you zero in on the stocks that match your strategy, allowing you to stay ahead of market moves that others might miss.

- Capture reliable income streams by reviewing dividend stocks with yields over 3%. Use dividend stocks with yields > 3% to see which companies are sharing profits with shareholders.

- Tap into high-growth medical trends by finding companies that are shaping the future of medicine with artificial intelligence. Explore healthcare AI stocks to identify potential leaders in healthcare innovation.

- Spot market bargains by looking for undervalued stocks based on strong cash flows. Start your search with undervalued stocks based on cash flows and discover value opportunities that others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

New Hope

Explores for, develops, produces, and processes coal, and oil and gas properties.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives