- Australia

- /

- Energy Services

- /

- ASX:MRM

There's No Escaping MMA Offshore Limited's (ASX:MRM) Muted Earnings Despite A 26% Share Price Rise

MMA Offshore Limited (ASX:MRM) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 139% in the last year.

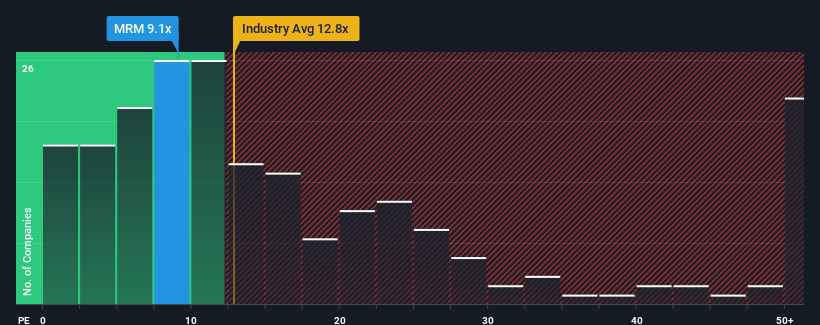

Even after such a large jump in price, MMA Offshore's price-to-earnings (or "P/E") ratio of 9.1x might still make it look like a strong buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 20x and even P/E's above 35x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings that are retreating more than the market's of late, MMA Offshore has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for MMA Offshore

What Are Growth Metrics Telling Us About The Low P/E?

MMA Offshore's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 6.2% each year as estimated by the six analysts watching the company. That's not great when the rest of the market is expected to grow by 17% each year.

With this information, we are not surprised that MMA Offshore is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Shares in MMA Offshore are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that MMA Offshore maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for MMA Offshore (of which 1 can't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MRM

MMA Offshore

Provides vessels, and marine and subsea services to the offshore energy, renewables, and wider maritime industries in Australia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives