- Australia

- /

- Energy Services

- /

- ASX:MCE

Investors Still Aren't Entirely Convinced By Matrix Composites & Engineering Ltd's (ASX:MCE) Revenues Despite 26% Price Jump

Matrix Composites & Engineering Ltd (ASX:MCE) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 51%.

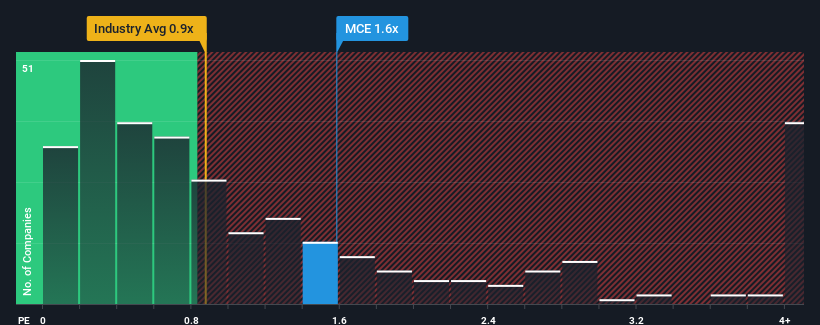

Although its price has surged higher, it's still not a stretch to say that Matrix Composites & Engineering's price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the Energy Services industry in Australia, where the median P/S ratio is around 2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Matrix Composites & Engineering

What Does Matrix Composites & Engineering's P/S Mean For Shareholders?

Recent times have been advantageous for Matrix Composites & Engineering as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Matrix Composites & Engineering.How Is Matrix Composites & Engineering's Revenue Growth Trending?

Matrix Composites & Engineering's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 65% last year. The strong recent performance means it was also able to grow revenue by 72% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 26% per year during the coming three years according to the sole analyst following the company. With the industry only predicted to deliver 9.0% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Matrix Composites & Engineering's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Matrix Composites & Engineering's P/S?

Matrix Composites & Engineering's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Matrix Composites & Engineering's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Matrix Composites & Engineering (of which 2 shouldn't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, manufacture, and supply of engineered composite products in Australia, Brazil, the United States, the United Kingdom, Japan, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026