- Australia

- /

- Energy Services

- /

- ASX:MCE

Fewer Investors Than Expected Jumping On Matrix Composites & Engineering Ltd (ASX:MCE)

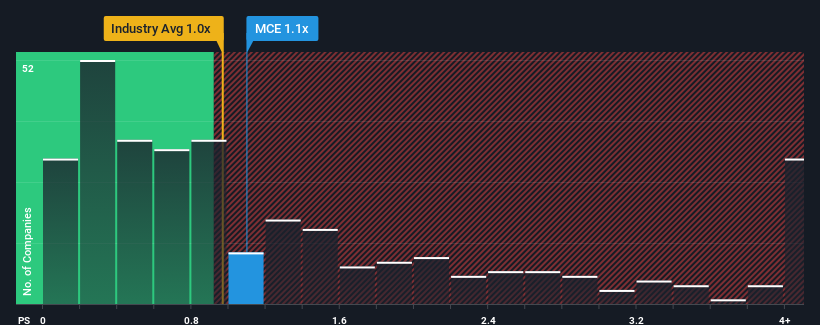

With a median price-to-sales (or "P/S") ratio of close to 1x in the Energy Services industry in Australia, you could be forgiven for feeling indifferent about Matrix Composites & Engineering Ltd's (ASX:MCE) P/S ratio of 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Matrix Composites & Engineering

What Does Matrix Composites & Engineering's Recent Performance Look Like?

Recent times have been advantageous for Matrix Composites & Engineering as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Matrix Composites & Engineering.How Is Matrix Composites & Engineering's Revenue Growth Trending?

In order to justify its P/S ratio, Matrix Composites & Engineering would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 132% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 42% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.7%, which is noticeably less attractive.

In light of this, it's curious that Matrix Composites & Engineering's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Matrix Composites & Engineering currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You always need to take note of risks, for example - Matrix Composites & Engineering has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, manufacture, and supply of engineered composite products in Australia, Brazil, the United States, the United Kingdom, Japan, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.