- Australia

- /

- Energy Services

- /

- ASX:MCE

Easy Come, Easy Go: How Matrix Composites & Engineering (ASX:MCE) Shareholders Got Unlucky And Saw 71% Of Their Cash Evaporate

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Matrix Composites & Engineering Ltd (ASX:MCE) share price is a whole 71% lower. That's not a lot of fun for true believers. But it's up 6.1% in the last week.

View our latest analysis for Matrix Composites & Engineering

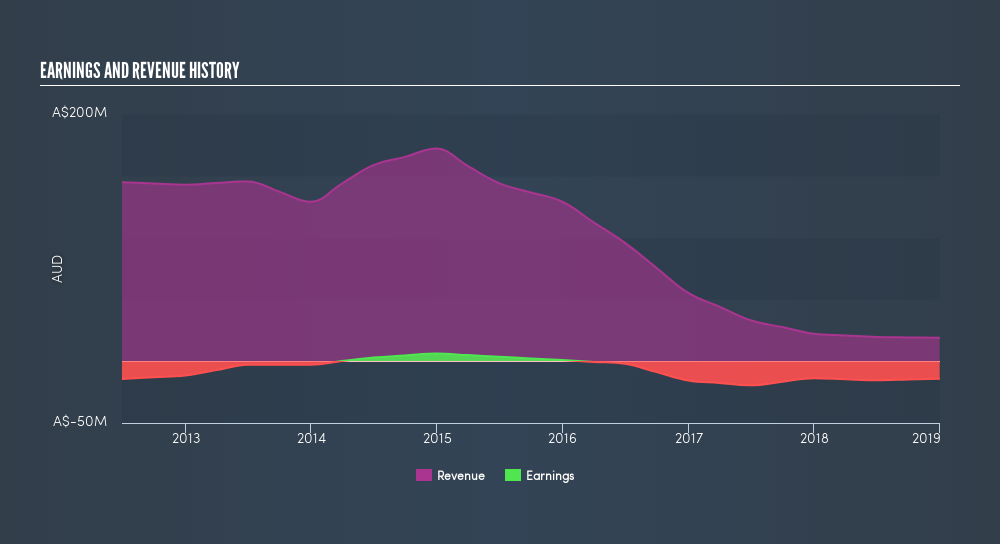

Because Matrix Composites & Engineering is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Matrix Composites & Engineering reduced its trailing twelve month revenue by 39% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 22% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Matrix Composites & Engineering stock, you should check out this freereport showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 11% in the last year, Matrix Composites & Engineering shareholders lost 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 21% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Matrix Composites & Engineering is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, engineering, and manufacturing of engineered polymer products for the energy, mining and resource, and defence industries.

Good value with acceptable track record.

Market Insights

Community Narratives