- Australia

- /

- Oil and Gas

- /

- ASX:KAR

Karoon Energy (ASX:KAR): Assessing Valuation Following Leadership Transition with New CEO Carri Lockhart

Reviewed by Simply Wall St

Karoon Energy (ASX:KAR) has just announced Ms Carri Lockhart as its new Chief Executive Officer and Managing Director. This marks a key leadership change that could influence the company’s next phase of strategy and performance.

See our latest analysis for Karoon Energy.

Karoon Energy’s latest executive shake-up comes as investors refocus on momentum in the share price. With a strong 1-day return of 4.43% and a 1-year total shareholder return of nearly 29%, recent gains suggest the market is warming to the company’s growth outlook, even after a tougher three-year stretch.

If the leadership change at Karoon piqued your curiosity, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With recent leadership changes and share price gains, a key question emerges: is Karoon Energy trading at a discount, or has the market already factored in all its future growth prospects?

Most Popular Narrative: 9.3% Overvalued

Compared to its last close of A$1.65, the most widely followed narrative on Karoon Energy—according to kapirey—suggests the company’s fair value sits at A$1.51. This frames the current price as ahead of underlying value and brings the company’s future strategy into focus.

Karoon Energy is fundamentally strong with solid financials, a diversified asset base, and a clear strategy for growth and shareholder returns. However, operational execution and commodity price stability will be key to sustaining performance. The FPSO acquisition and development of contingent resources could unlock significant long-term value.

Curious what numbers drive that premium price? The narrative’s projection leans on ambitious targets for production and cost efficiency, plus assumptions about operating margins. The real surprise is how a single strategic acquisition could shift value estimates. Unlock the full story and see what return trajectory might justify buying at today’s levels.

Result: Fair Value of $1.51 (OVERVAULED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational reliability hiccups or unexpected commodity price shifts could quickly alter Karoon Energy’s perceived value and test the current optimism.

Find out about the key risks to this Karoon Energy narrative.

Another View: Market Ratios Signal Cheapness

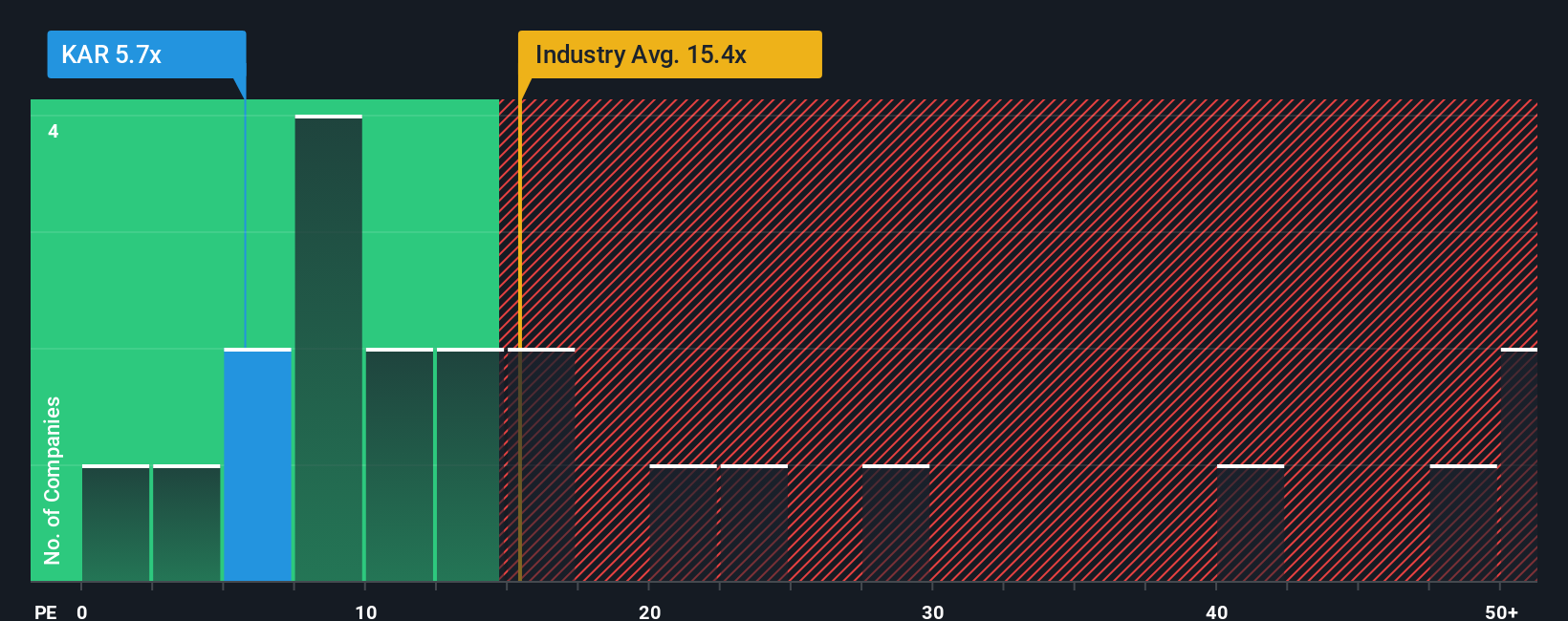

Looking beyond the fair value estimate, market ratios provide a different perspective. Karoon Energy’s price/earnings ratio stands at just 5.8x, far below the industry average of 15.4x and the peer group’s 27x. It is also under the fair ratio of 9.6x. This sizable gap hints at a potential valuation opportunity, but is the discount justified or a sign of hidden risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Karoon Energy Narrative

If you see things differently or want to dive into the details yourself, it takes just a few minutes to craft your own perspective. Do it your way

A great starting point for your Karoon Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at Karoon Energy. Some of today’s biggest opportunities are just a click away. Unlock your next smart move and stay ahead of the market curve.

- Capture growth in fast-moving tech by tapping into breakthroughs with these 25 AI penny stocks shaping tomorrow's biggest trends.

- Start your search for potential bargains by targeting these 865 undervalued stocks based on cash flows that may deliver sizable returns thanks to attractive price points.

- Secure stable income and shield your portfolio by considering these 14 dividend stocks with yields > 3% offering yields over 3% for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karoon Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KAR

Karoon Energy

Operates as an oil and gas exploration and production company in Brazil, the United States, and Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives