- Australia

- /

- Oil and Gas

- /

- ASX:HHR

Uncovering Penny Stock Opportunities On The ASX With Hartshead Resources And 2 Others

Reviewed by Simply Wall St

It was a choppy day for the Australian market, with investors showing caution ahead of the anticipated RBA interest rate decision on Tuesday, which could influence market sentiment and corporate strategies. Despite the volatility, some sectors like Utilities and Consumer Staples showed resilience. In this context, penny stocks—often misunderstood as relics of past trading days—continue to offer intriguing opportunities. These typically smaller or newer companies can provide significant growth potential when backed by strong financials. Let's explore several penny stocks that stand out for their financial strength and potential for long-term gains.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$66.88M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.02 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.24 | A$342.3M | ★★★★☆☆ |

| GTN (ASX:GTN) | A$0.55 | A$104.08M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$338.66M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$95.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.84 | A$103.72M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hartshead Resources (ASX:HHR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hartshead Resources NL is involved in the exploration and development of oil and gas properties in the United Kingdom, Gabon, and Madagascar, with a market capitalization of A$22.52 million.

Operations: The company generates revenue from its Oil and Gas Development and Exploration segment, amounting to A$4.68 million.

Market Cap: A$22.52M

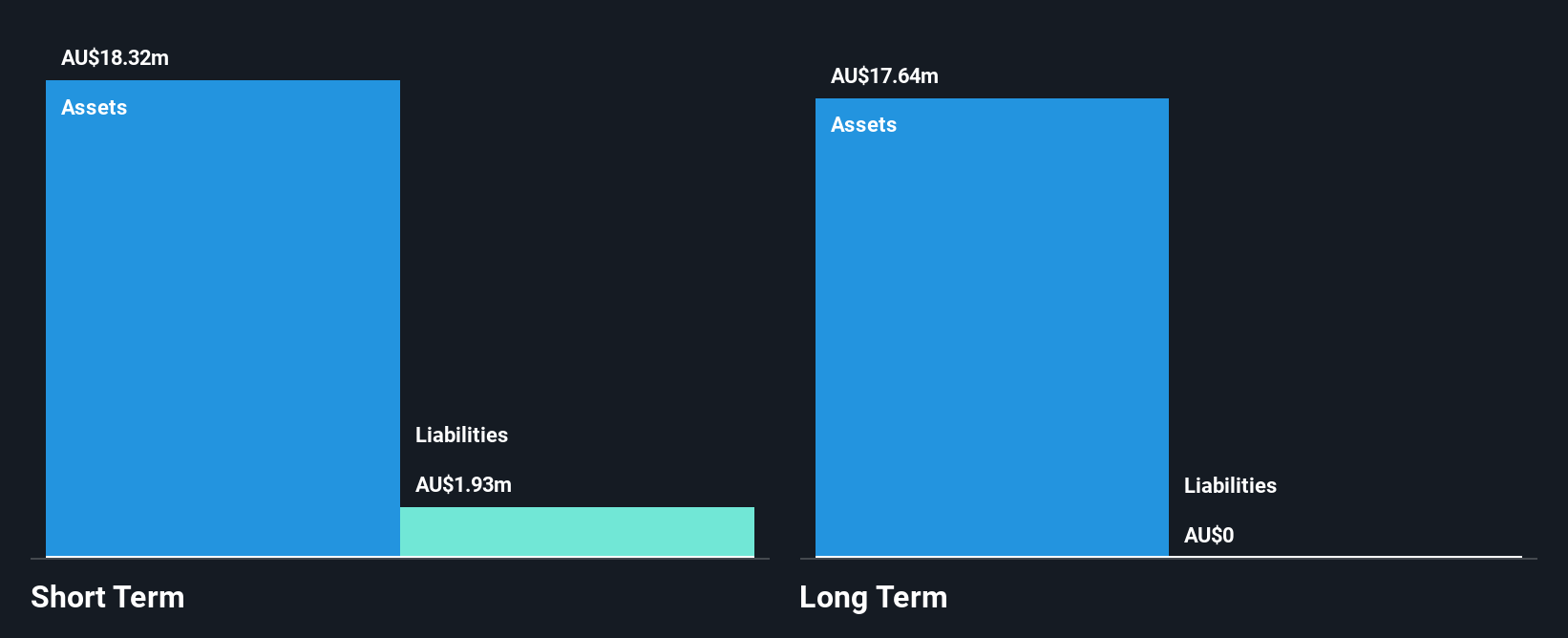

Hartshead Resources, with a market cap of A$22.52 million, is involved in oil and gas exploration but remains pre-revenue despite generating A$4.68 million from its development segment. The company has reduced losses by 44.5% annually over the past five years yet remains unprofitable with no forecasted profitability in the next three years. Its seasoned board and management team bring stability, while its debt-free status and sufficient cash runway for over three years are positive financial indicators. However, high share price volatility and lack of meaningful revenue present challenges typical of penny stocks in this sector.

- Click to explore a detailed breakdown of our findings in Hartshead Resources' financial health report.

- Learn about Hartshead Resources' historical performance here.

Marvel Gold (ASX:MVL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Marvel Gold Limited focuses on acquiring, developing, and exploring gold projects in Mali, with a market cap of A$9.50 million.

Operations: Marvel Gold Limited currently does not report any revenue segments.

Market Cap: A$9.5M

Marvel Gold Limited, with a market cap of A$9.50 million, is focused on gold exploration in Mali and remains pre-revenue, reporting just A$49K in revenue. Despite being unprofitable, the company has improved its financial position by reducing losses at 4.9% annually over five years and eliminating debt from a high ratio of 2856.4%. Marvel's short-term assets significantly exceed liabilities, yet its cash runway is under one year if current spending trends persist. The board's average tenure of 2.3 years suggests limited experience, while high share price volatility reflects typical risks associated with penny stocks in this sector.

- Unlock comprehensive insights into our analysis of Marvel Gold stock in this financial health report.

- Gain insights into Marvel Gold's historical outcomes by reviewing our past performance report.

RAS Technology Holdings (ASX:RTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RAS Technology Holdings Limited offers data, content, SaaS solutions, and digital media services to the racing and wagering industries across Australia, the UK, the US, and other international markets with a market cap of A$34.55 million.

Operations: The company generates revenue from its Entertainment Software segment, which amounts to A$16.18 million.

Market Cap: A$34.55M

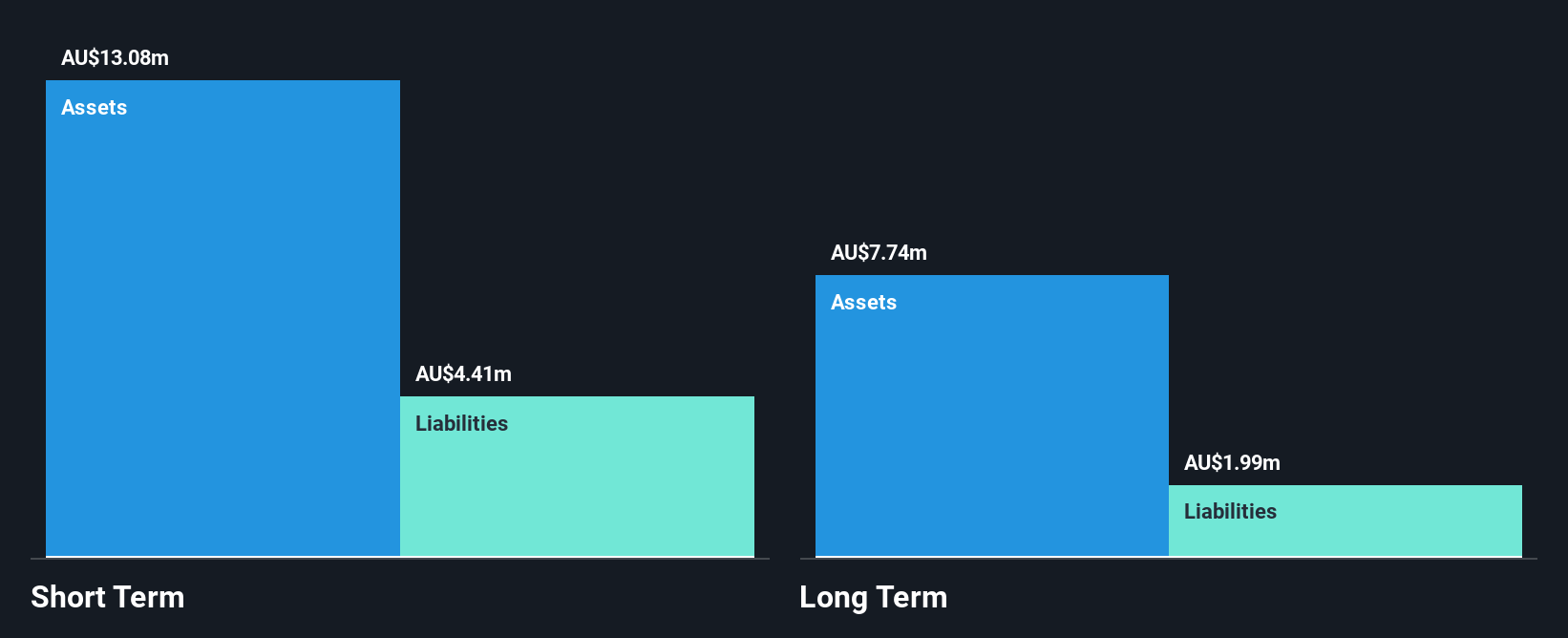

RAS Technology Holdings, with a market cap of A$34.55 million, operates in the racing and wagering industries across multiple markets. The company generates A$16.18 million in revenue from its Entertainment Software segment but remains unprofitable, with losses increasing at 30.8% annually over five years. Despite this, RAS is debt-free and has a cash runway exceeding three years based on current free cash flow levels. Its short-term assets cover both short- and long-term liabilities comfortably, while the board's average tenure of 3.7 years indicates experience amidst stable weekly volatility in share price movements.

- Jump into the full analysis health report here for a deeper understanding of RAS Technology Holdings.

- Explore RAS Technology Holdings' analyst forecasts in our growth report.

Turning Ideas Into Actions

- Jump into our full catalog of 1,032 ASX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hartshead Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HHR

Hartshead Resources

Engages in the exploration and development of oil and gas properties in the United Kingdom.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026