- Australia

- /

- Oil and Gas

- /

- ASX:PV1

The Global Energy Ventures (ASX:GEV) Share Price Has Gained 192%, So Why Not Pay It Some Attention?

It might be of some concern to shareholders to see the Global Energy Ventures Ltd. (ASX:GEV) share price down 10% in the last month. In contrast, the return over three years has been impressive. In fact, the share price is up a full 192% compared to three years ago. After a run like that some may not be surprised to see prices moderate. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

View our latest analysis for Global Energy Ventures

With zero revenue generated over twelve months, we don't think that Global Energy Ventures has proved its business plan yet. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Global Energy Ventures will discover or develop fossil fuel before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Global Energy Ventures has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

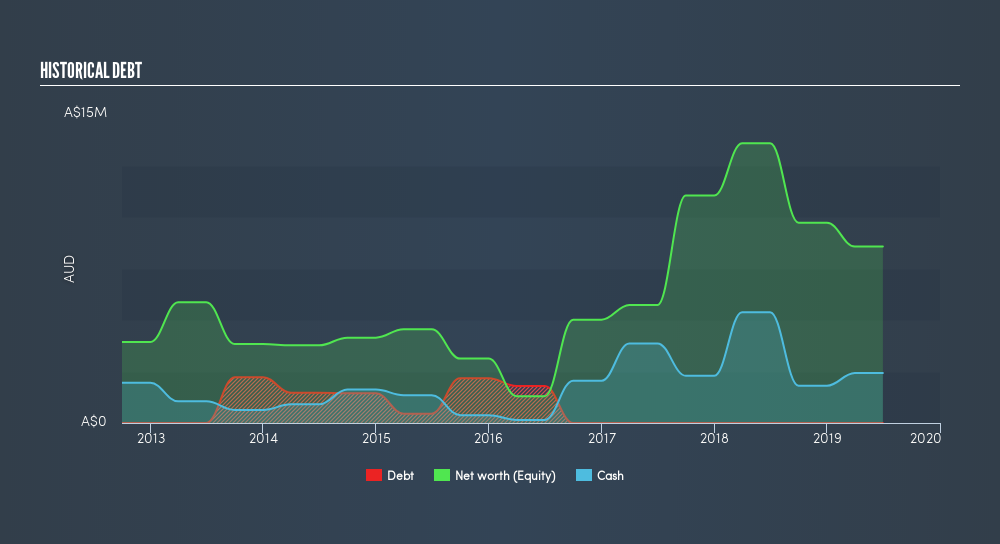

When it reported in June 2019 Global Energy Ventures had minimal cash in excess of all liabilities consider its expenditure: just AU$2.3m to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. It's a testament to the popularity of the business plan that the share price gained 43% per year, over 3 years, despite the weak balance sheet. You can click on the image below to see (in greater detail) how Global Energy Ventures's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Global Energy Ventures's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Global Energy Ventures's TSR, at 289% is higher than its share price return of 192%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in Global Energy Ventures had a tough year, with a total loss of 2.8%, against a market gain of about 8.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 8.3% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you would like to research Global Energy Ventures in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Global Energy Ventures may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:PV1

Provaris Energy

Engages in the development of hydrogen production and export projects in Australia and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives