- Australia

- /

- Oil and Gas

- /

- ASX:BYE

Byron Energy (ASX:BYE) stock falls 10% in past week as five-year earnings and shareholder returns continue downward trend

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Anyone who held Byron Energy Limited (ASX:BYE) for five years would be nursing their metaphorical wounds since the share price dropped 75% in that time. Furthermore, it's down 27% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for Byron Energy isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Byron Energy

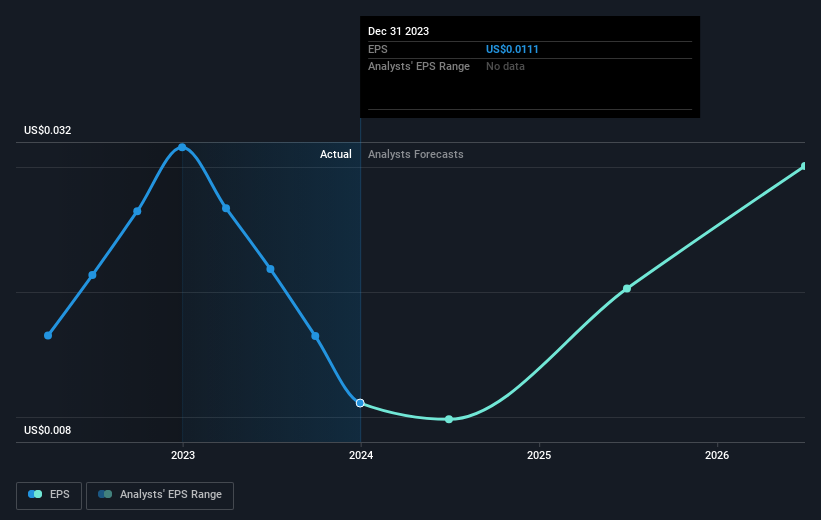

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Byron Energy's share price and EPS declined; the latter at a rate of 11% per year. This reduction in EPS is less than the 24% annual reduction in the share price. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 4.76.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Byron Energy has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Byron Energy shareholders are down 1.2% for the year, but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 12% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Byron Energy that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Byron Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BYE

Byron Energy

Engages in the exploration, development, and production of oil and gas properties.

Low and fair value.

Similar Companies

Market Insights

Community Narratives