- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Boss Energy (ASX:BOE): Exploring Valuation as Uranium Prices Rise and Key Events Approach

Reviewed by Simply Wall St

Boss Energy (ASX:BOE) is in the spotlight as uranium prices rebound and the company prepares for two big moments: an upcoming presentation at the Global Uranium Conference and its Q1 results announcement. Both events are likely to draw increased investor interest.

See our latest analysis for Boss Energy.

Uranium prices ramped up this year, but Boss Energy’s share price has swung sharply, down 25% over the past month and now off 36% year-to-date. Some volatility followed updates about management proposals and anticipation for the company’s upcoming conference appearance. Even so, investors with a long-term view will note that five-year total shareholder return sits at 226%, hinting at staying power despite a recent cycle of fading momentum.

If you’re weighing up which other companies are drawing attention as markets shift, this could be the right moment to find opportunities through fast growing stocks with high insider ownership.

With analyst price targets implying significant upside from current levels and uranium sector momentum building, the big question is whether Boss Energy’s recent sell-off represents a genuine buying opportunity or if the market has already priced in future growth.

Most Popular Narrative: 59.7% Undervalued

Boss Energy is trading significantly below the fair value set out in the most popular narrative, with that estimate sitting well above the current price. According to Robbo, a deep dive into the company’s fundamentals is reshaping perceptions about its long-term potential and positioning in the global energy transition.

Despite its somewhat cringe worthy name, ironically the kind Peter Lynch often sought in his hunt for undervaluation, Boss Energy has emerged as a key player in Australia's uranium sector. With macroeconomic trends pointing towards a global pivot away from fossil fuels over coming decades, uranium is well positioned to benefit. While renewable energy technologies such as solar and wind attract media attention, nuclear power is increasingly being recognised as a reliable low-emissions option to complement the energy mix, particularly in nations seeking energy security and grid stability.

Curious how this narrative arrives at such a bold fair value? The drivers behind the estimate include rapid headline growth and projections you might not expect for a resource company. Want the details on what really powers this ambitious valuation? Unlock the full story and uncover the numbers they’re betting on.

Result: Fair Value of $3.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes or unexpected swings in uranium prices could quickly challenge even the most optimistic long-term view for Boss Energy's outlook.

Find out about the key risks to this Boss Energy narrative.

Another View: What About Price-to-Sales?

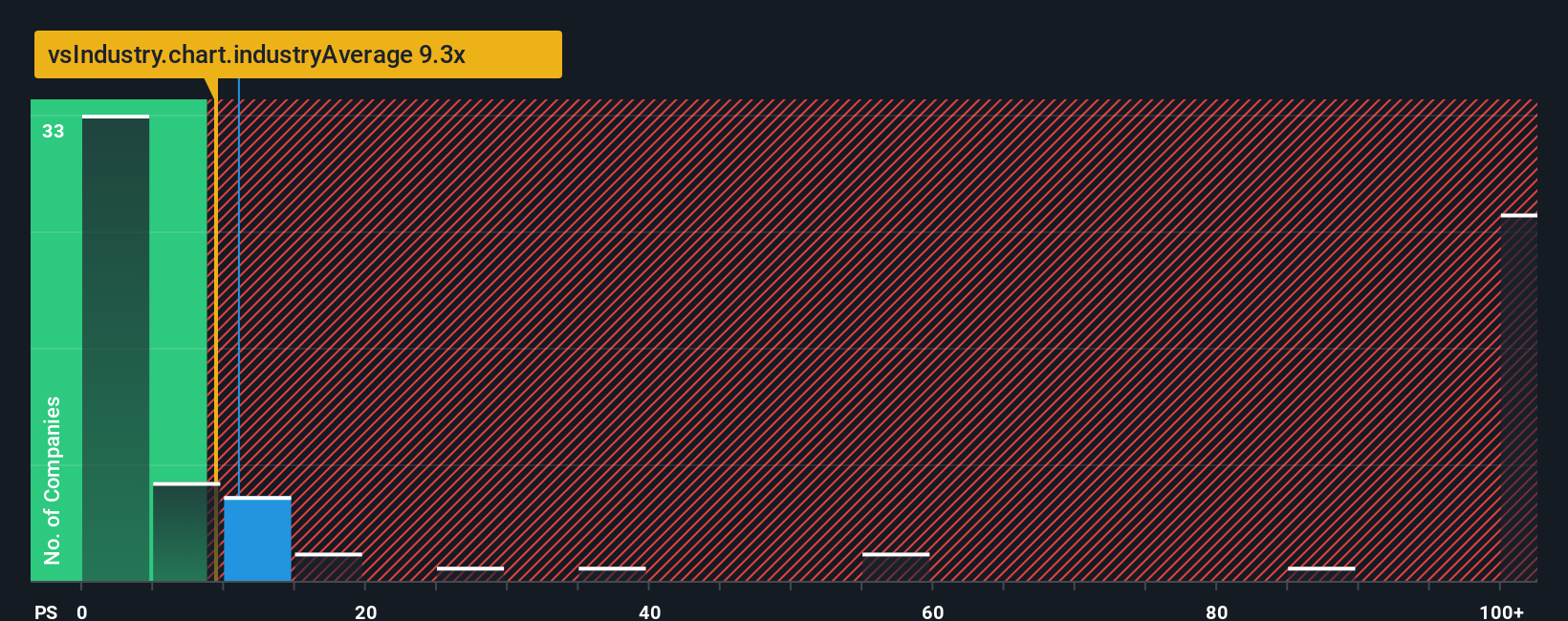

While some investors see deep value, the market is placing a high price on Boss Energy relative to its sales. Its price-to-sales ratio sits at 8.7 times, well above the fair ratio of 0.8 times, but actually below the peer average (10.2x) and industry average (9.1x). This large premium means investors expect future growth, but also face the risk that the market could shift closer to the fair ratio if lofty assumptions do not play out. Will BOE’s growth story deliver enough to justify its hefty price tag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boss Energy Narrative

If you want to dig into the numbers, question these narratives, or put your own spin on the story, you can craft your own in under three minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Boss Energy.

Looking for More Smart Investment Ideas?

Let your next move be a winning one. Expand your portfolio strategy with top picks from driven sectors that others are already watching closely.

- Track your way toward the next big market disruptor with these 26 AI penny stocks for a front-row seat to AI-powered innovation and growth.

- Secure a stream of reliable returns by targeting those with strong yields using these 21 dividend stocks with yields > 3%. See which companies stand out for stability and income.

- Catch emerging opportunities in digital finance and technology by acting on these 81 cryptocurrency and blockchain stocks, which highlights companies influencing the future of decentralized markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives