- Australia

- /

- Oil and Gas

- /

- ASX:BOE

Accent Group And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market has recently faced challenges, including a significant ASX outage that disrupted trading and affected numerous companies, leading to a mixed performance across sectors. Despite these hurdles, opportunities for investors remain, particularly in the realm of penny stocks—a term that may seem outdated but still holds relevance. These smaller or newer companies can offer substantial growth potential when backed by strong financials. In this article, we explore three promising penny stocks on the ASX that combine balance sheet strength with potential for outsized gains.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.595 | A$75.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$433.41M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.47 | A$256.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.87M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.93 | A$3.34B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.40 | A$133.31M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 407 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Accent Group (ASX:AX1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market cap of A$604.19 million.

Operations: The company generates revenue primarily through its Retail segment, which accounts for A$1.30 billion, and its Wholesale segment, contributing A$459.71 million.

Market Cap: A$604.19M

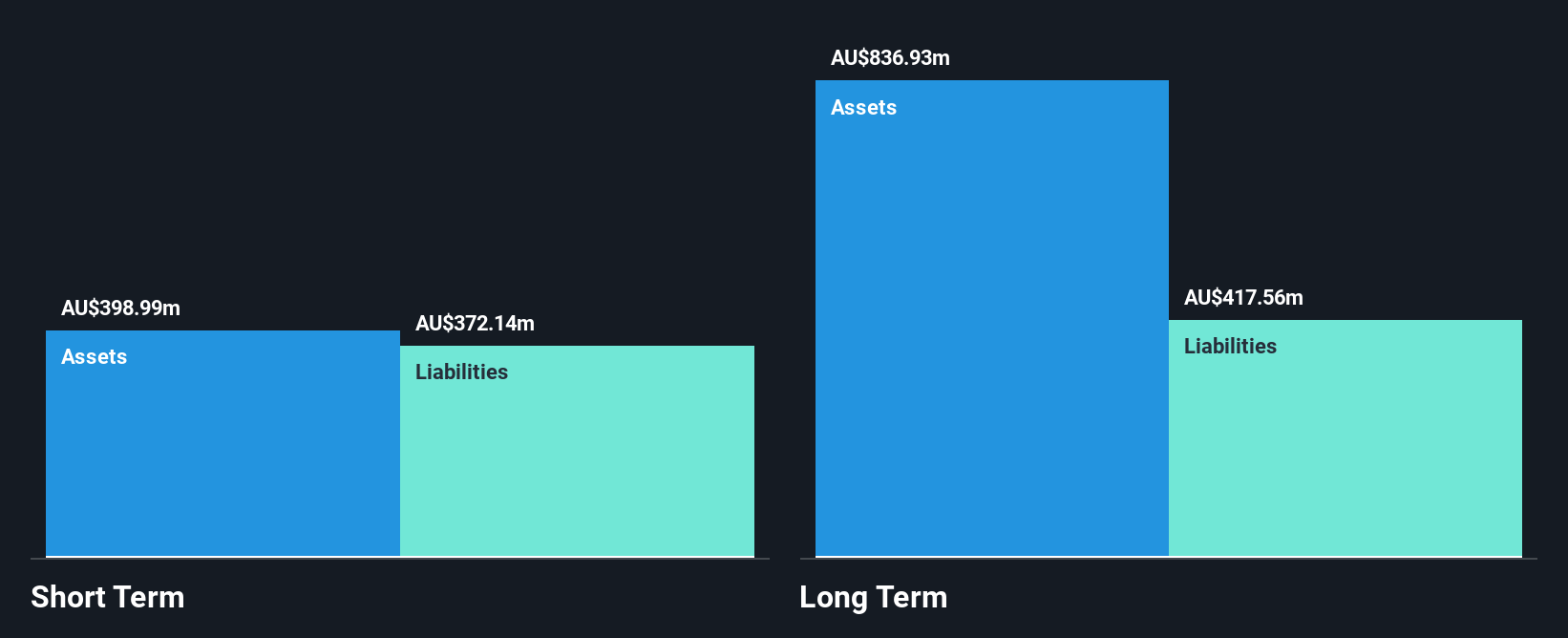

Accent Group Limited, with a market cap of A$604.19 million, operates primarily through its Retail and Wholesale segments, generating A$1.30 billion and A$459.71 million respectively. Recent guidance indicates expected EBIT for 2026 between A$85 million to A$95 million despite nonrecurring losses from MySale closures. The company has expanded its strategic partnership with Bamboo Rose to enhance planning capabilities using AI-driven insights for improved efficiency and growth potential. While the company's debt is well-covered by operating cash flow, short-term assets do not fully cover long-term liabilities, indicating potential financial constraints in the future.

- Click here and access our complete financial health analysis report to understand the dynamics of Accent Group.

- Assess Accent Group's future earnings estimates with our detailed growth reports.

Boss Energy (ASX:BOE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boss Energy Limited is involved in the exploration and production of uranium deposits in Australia and the United States, with a market capitalization of A$655.58 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$655.58M

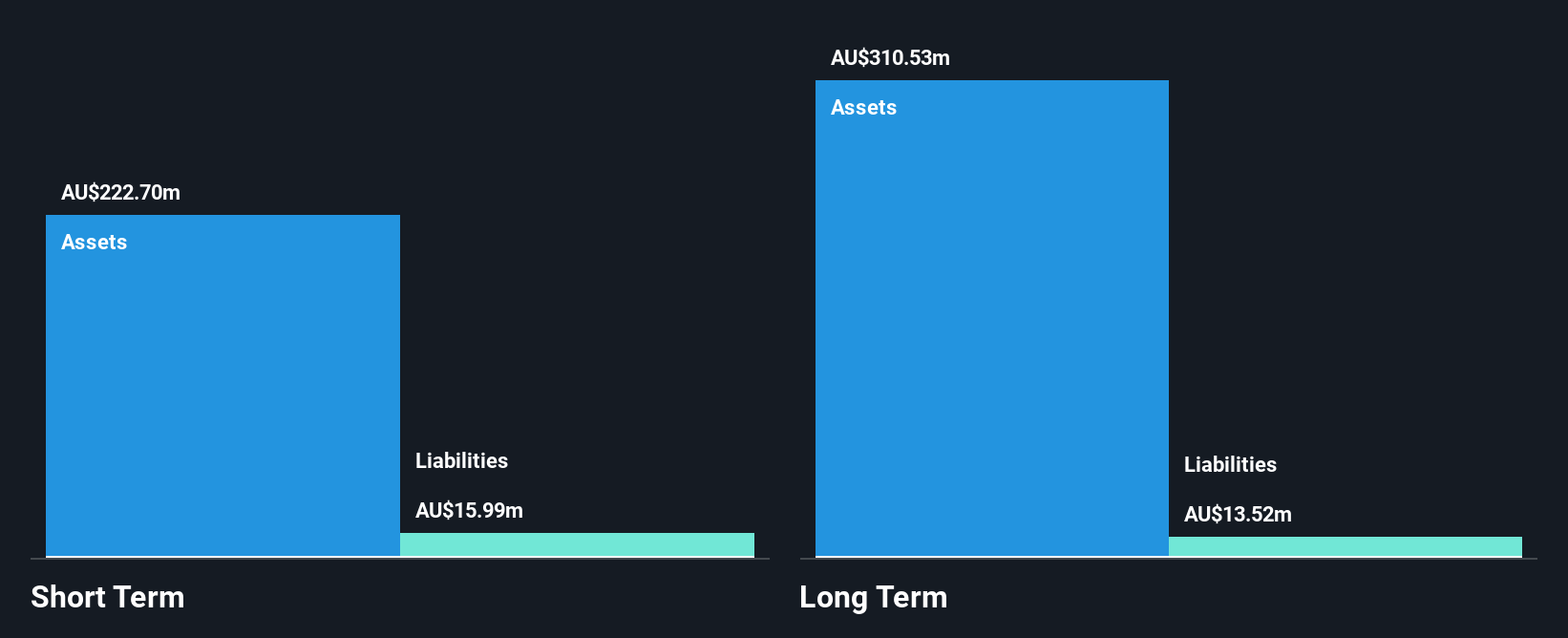

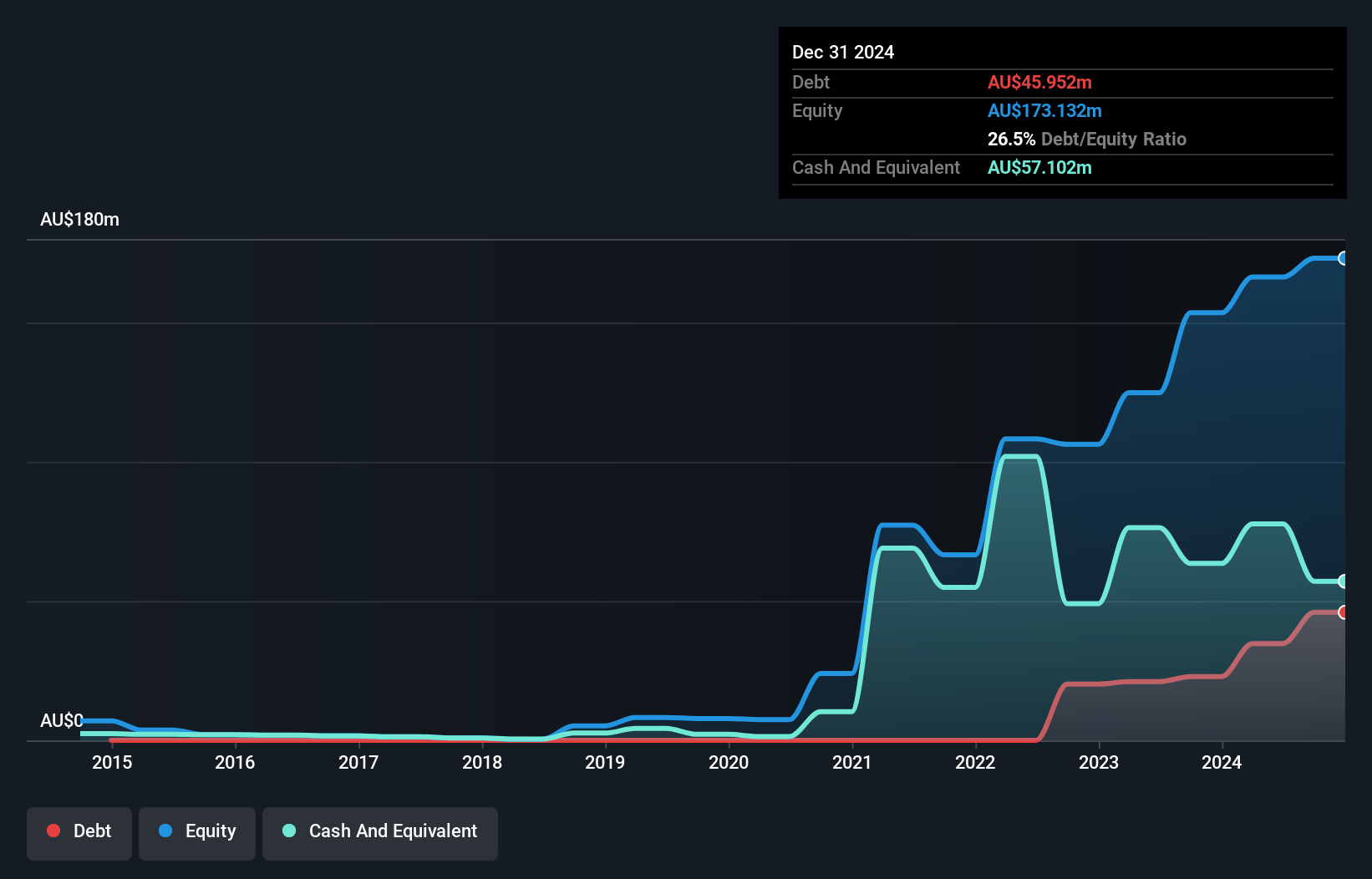

Boss Energy Limited, with a market cap of A$655.58 million, is pre-revenue and unprofitable but has reduced losses by 3.3% annually over the past five years. The company is debt-free, with short-term assets of A$202.5 million exceeding both short-term and long-term liabilities significantly. Despite a lack of seasoned management and board experience, the company's shares have not been meaningfully diluted recently. Notably, Boss Energy's stock trades at a significant discount to its estimated fair value while earnings are forecasted to grow substantially at 37.5% per year according to consensus estimates.

- Click to explore a detailed breakdown of our findings in Boss Energy's financial health report.

- Gain insights into Boss Energy's future direction by reviewing our growth report.

Fenix Resources (ASX:FEX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fenix Resources Limited operates in Western Australia, offering mining, logistics, and port services with a market capitalization of A$308.96 million.

Operations: The company generates revenue of A$316.09 million from its mining operations.

Market Cap: A$308.96M

Fenix Resources, with a market cap of A$308.96 million, has shown profitability growth over the past five years despite negative earnings growth last year. The company's short-term assets exceed both its short and long-term liabilities, indicating solid financial footing. Recent hedging contracts secure cashflow margins for future production while maintaining exposure to spot prices. However, profit margins have declined from 13% to 1.7%, and Return on Equity remains low at 3%. The appointment of Fernando Pereira as COO brings extensive industry expertise, potentially enhancing operational efficiency in upcoming projects like the Weld Range Project Feasibility Study.

- Unlock comprehensive insights into our analysis of Fenix Resources stock in this financial health report.

- Examine Fenix Resources' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Access the full spectrum of 407 ASX Penny Stocks by clicking on this link.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boss Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOE

Boss Energy

Explores for and produces uranium deposits in Australia and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026