- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Zip Co (ASX:ZIP): Valuation Check as Buy-Backs and Director Buying Signal Management Confidence

Reviewed by Simply Wall St

Zip Co (ASX:ZIP) has been back on traders’ radars after the company ramped up its share buy back and director Andrew Stevens lifted his personal stake, moves that typically hint at internal confidence.

See our latest analysis for Zip Co.

Those moves come after a bumpy stretch, with the share price at A$2.98 following a 30 day share price return of negative 20.95 percent and a three year total shareholder return above 300 percent. This suggests long term momentum remains strong even as short term sentiment cools.

If Zip’s story has you curious about what else is reshaping finance and payments, this could be a good moment to explore high growth tech and AI stocks for your next idea.

With Zip trading well below analyst targets but already boasting rapid revenue and profit growth, the key question is whether today’s price still underestimates its earnings power or whether the market has already priced in the next leg of expansion.

Most Popular Narrative Narrative: 41.5% Undervalued

With Zip Co last closing at A$2.98 against a narrative fair value near A$5.10, the spread reflects ambitious expectations for both growth and profitability.

The analysts have a consensus price target of A$4.442 for Zip Co based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.0, and the most bearish reporting a price target of just A$4.08.

Want to see what justifies such a sharp earnings ramp and richer future multiple than most consumer finance names enjoy? The narrative leans on compounding top line growth, expanding margins and a punchy valuation framework that assumes Zip can scale into a very different profit profile. Curious which specific revenue and earnings milestones this story is banking on, and how they map into that fair value per share? Explore the full set of projections driving this view.

Result: Fair Value of $5.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter regulation or higher bad debts as Zip scales into new products and geographies could quickly challenge these upbeat earnings assumptions.

Find out about the key risks to this Zip Co narrative.

Another Way to Look at Value

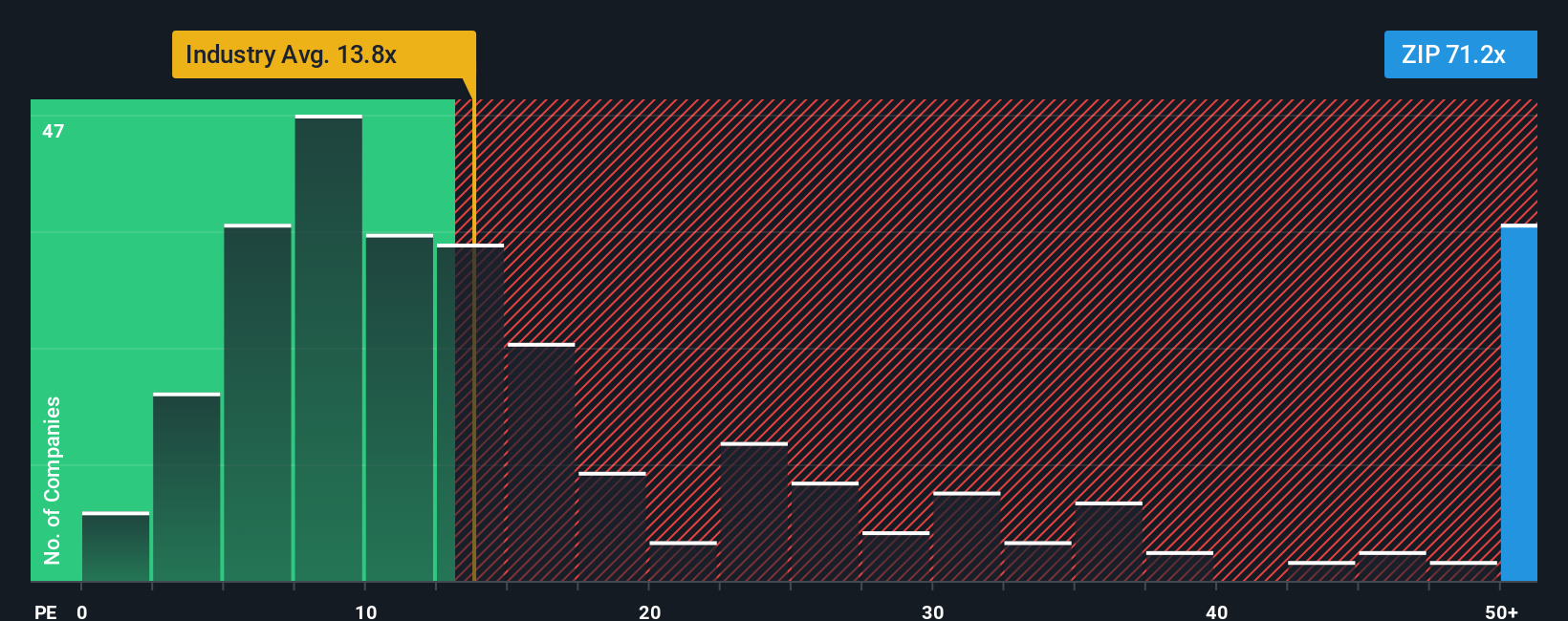

While the narrative fair value suggests Zip is meaningfully undervalued, a simple earnings lens tells a different story. Zip trades on a 47.7x price to earnings ratio versus an industry 12.2x and a fair ratio of 30x, implying the market already bakes in a lot of future perfection.

That kind of premium can reward believers if growth and margins keep compounding, but it also leaves little room for execution missteps or tougher credit cycles. Is this a case of justified enthusiasm, or are expectations running one step ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zip Co Narrative

If you would rather stress test the assumptions yourself and follow your own trail of evidence, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Zip Co research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop scouting for the next opportunity, so use the Simply Wall St Screener now to uncover stocks you could regret ignoring later.

- Capitalize on overlooked value by targeting these 912 undervalued stocks based on cash flows that pair strong cash flows with attractive entry prices before they reach the broader market’s radar.

- Explore the next wave of innovation by focusing on these 26 AI penny stocks that are positioned to benefit from demand for automation, data analytics and intelligent software.

- Seek potential income streams by zeroing in on these 15 dividend stocks with yields > 3% that combine regular payouts with the financial strength to support them through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026