- Australia

- /

- Capital Markets

- /

- ASX:WAR

Discover ASX Penny Stocks Featuring Mayne Pharma Group And Two Others

Reviewed by Simply Wall St

The Australian market recently witnessed the ASX200 reach an all-time intra-day high, reflecting a dynamic period for investors amid predictions of potential interest rate cuts by the Reserve Bank of Australia. In such a climate, identifying stocks with strong fundamentals becomes crucial, especially when considering penny stocks. Though often seen as relics of past market eras, penny stocks continue to offer compelling opportunities for growth and value in smaller or newer companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$320.75M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$102.12M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$247.9M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$106.21M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.825 | A$108.49M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$62.65M | ★★★★★☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Mayne Pharma Group (ASX:MYX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mayne Pharma Group Limited is a specialty pharmaceutical company that manufactures and sells branded and generic pharmaceutical products across Australia, New Zealand, the United States, Canada, Europe, Asia, and other international markets with a market cap of A$373.73 million.

Operations: The company's revenue is derived from three main segments: Dermatology (A$174.86 million), Women's Health (A$142.83 million), and International markets (A$70.71 million).

Market Cap: A$373.73M

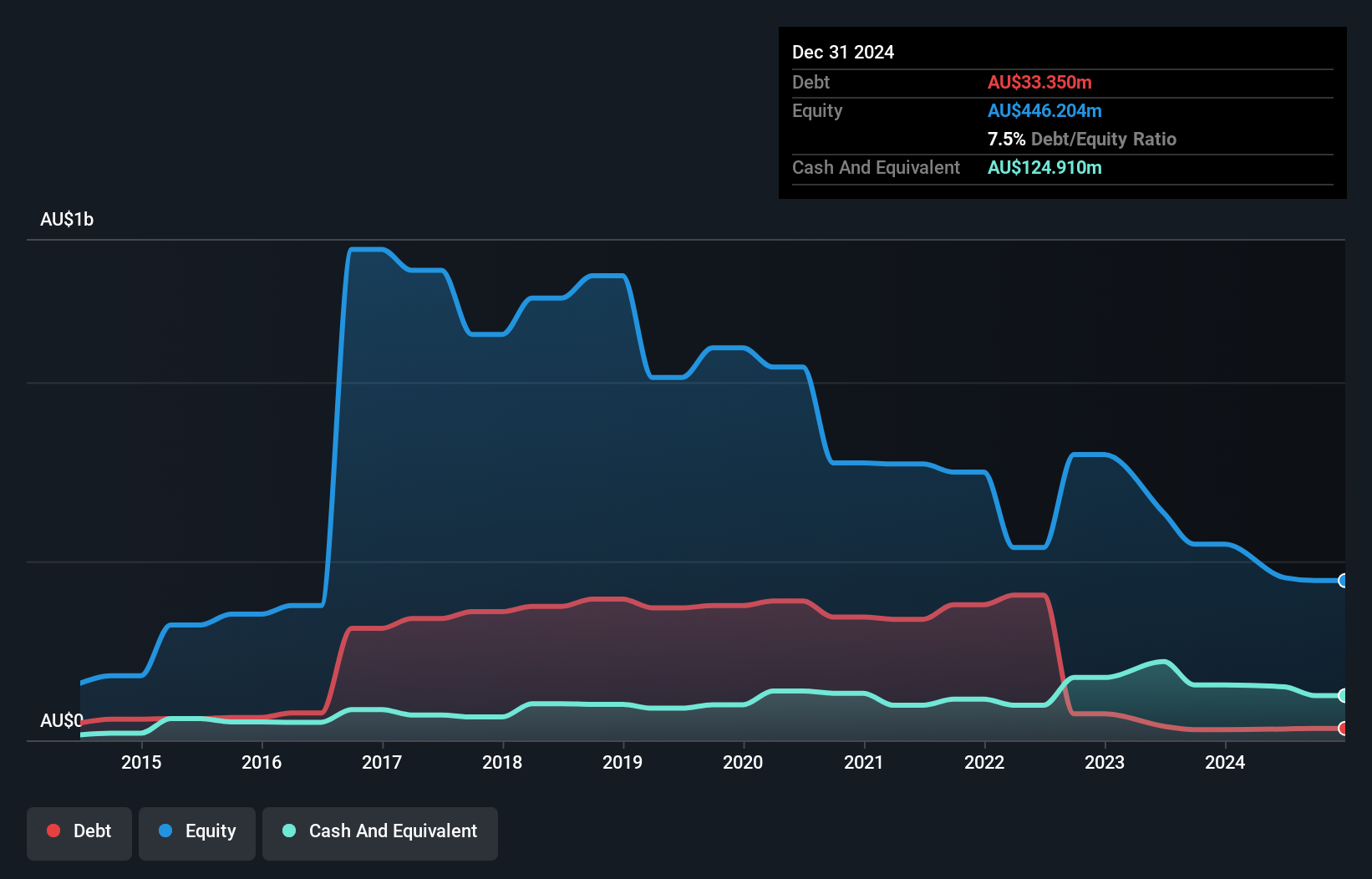

Mayne Pharma Group, with a market cap of A$373.73 million, is navigating financial challenges as it remains unprofitable despite having significant revenue from its Dermatology (A$174.86 million), Women's Health (A$142.83 million), and International markets (A$70.71 million) segments. The company has reduced its debt significantly over the past five years and maintains more cash than total debt, indicating prudent financial management. Short-term assets exceed both short- and long-term liabilities, providing some stability; however, cash runway concerns persist if free cash flow continues to decline at historical rates. Its board's inexperience may impact strategic decisions moving forward.

- Take a closer look at Mayne Pharma Group's potential here in our financial health report.

- Explore Mayne Pharma Group's analyst forecasts in our growth report.

Richmond Vanadium Technology (ASX:RVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Richmond Vanadium Technology Limited is involved in the exploration and development of mineral properties in Australia, with a market capitalization of A$38.82 million.

Operations: The company's revenue segment is focused on Mineral Exploration & Development with a Particular Focus on Vanadium Resources, generating A$0.74 million.

Market Cap: A$38.82M

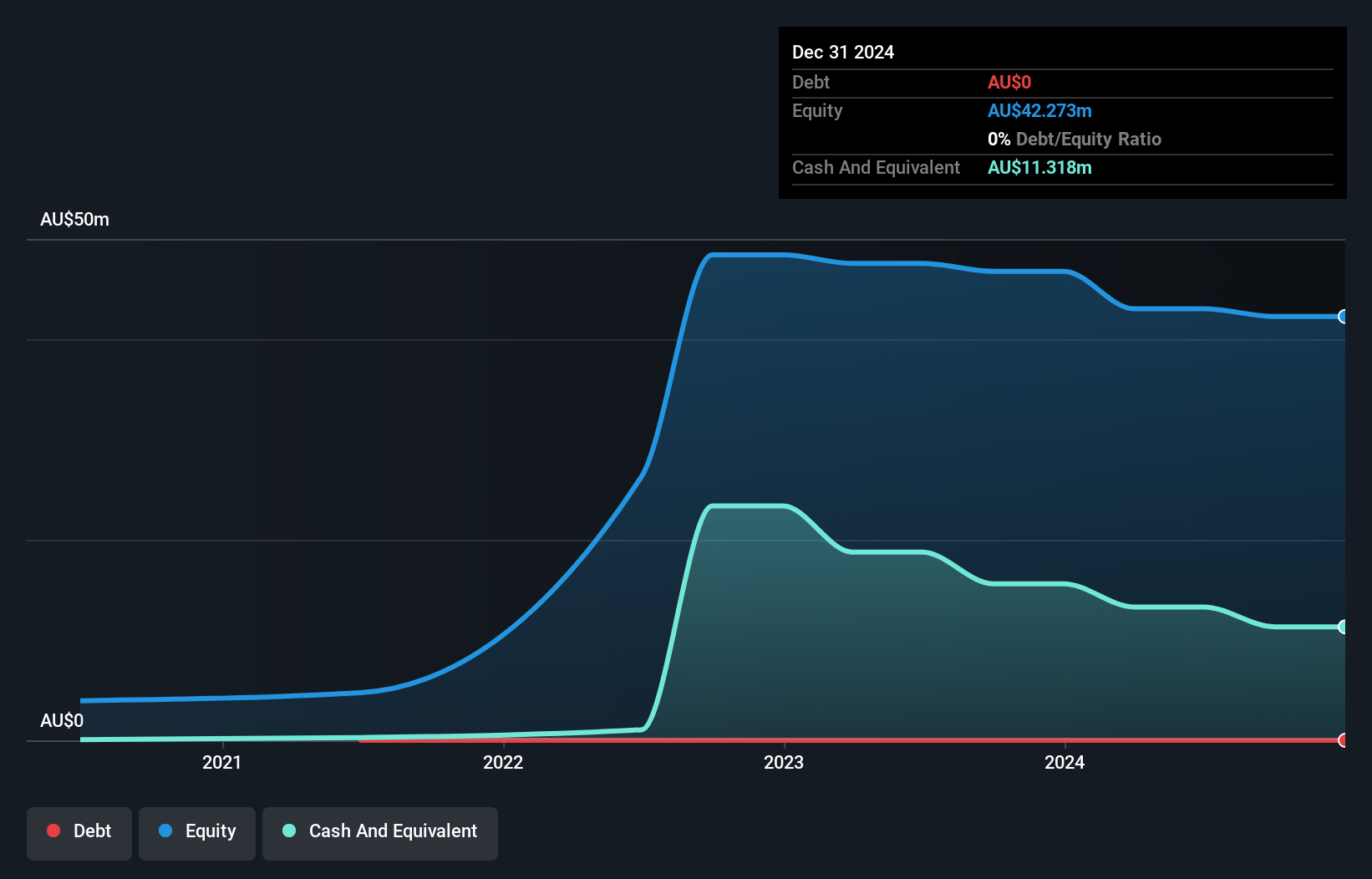

Richmond Vanadium Technology, with a market cap of A$38.82 million, is focused on vanadium exploration and development but remains pre-revenue with earnings under US$1 million. The company is debt-free and its short-term assets comfortably cover both short- and long-term liabilities. Despite having a cash runway for over two years if historical cash flow reductions persist, it faces challenges from high share price volatility and significant insider selling recently. The management team and board are relatively new, which may impact strategic direction as the company works towards profitability amidst increasing losses over the past five years.

- Navigate through the intricacies of Richmond Vanadium Technology with our comprehensive balance sheet health report here.

- Explore historical data to track Richmond Vanadium Technology's performance over time in our past results report.

WAM Strategic Value (ASX:WAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WAM Strategic Value Limited focuses on investing in discounted assets and has a market capitalization of A$203.54 million.

Operations: The company's revenue segment is solely derived from Investing Activities, amounting to A$38.34 million.

Market Cap: A$203.54M

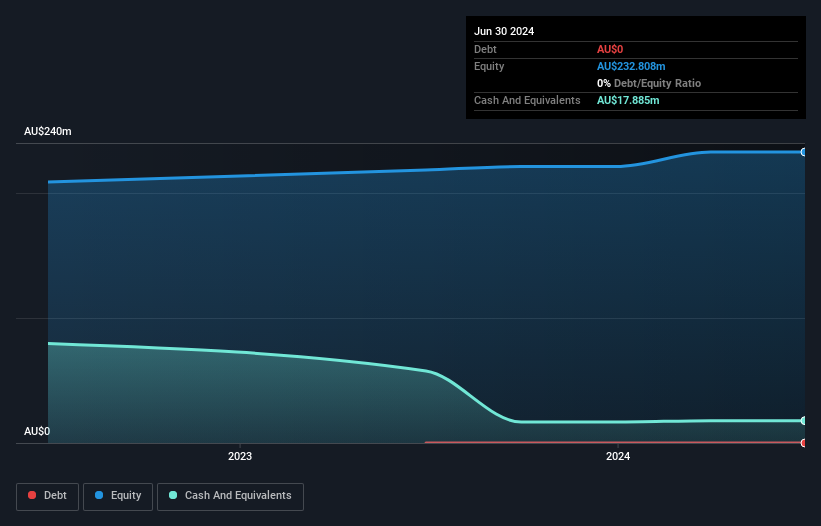

WAM Strategic Value Limited, with a market cap of A$203.54 million, focuses on investing in discounted assets and has shown earnings growth of 40.1% over the past year, surpassing industry averages. The company is debt-free, which alleviates concerns about interest coverage and long-term liabilities. However, its dividend yield of 5.31% is not well covered by free cash flows. Despite having a stable weekly volatility and no significant shareholder dilution recently, WAM's return on equity remains low at 9.5%. Its experienced board may provide stability as it navigates these financial dynamics amidst high non-cash earnings levels.

- Unlock comprehensive insights into our analysis of WAM Strategic Value stock in this financial health report.

- Gain insights into WAM Strategic Value's historical outcomes by reviewing our past performance report.

Next Steps

- Reveal the 1,027 hidden gems among our ASX Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WAM Strategic Value might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAR

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives