- Australia

- /

- Metals and Mining

- /

- ASX:CAY

ASX Penny Stocks To Consider In May 2025

Reviewed by Simply Wall St

The Australian market has shown mixed performance, with the ASX200 closing up slightly at 8,409 points, driven by gains in the Energy and IT sectors. Despite some fluctuations across various sectors, investors continue to seek opportunities that can offer both stability and potential growth. Though penny stocks might seem like a term from yesteryear, they remain relevant for those looking to invest in smaller or newer companies with solid financials and promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.865 | A$1.12B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.535 | A$72.41M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.54 | A$167.97M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.14 | A$719.39M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.81 | A$657.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.74 | A$460.07M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 996 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Canyon Resources (ASX:CAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canyon Resources Limited, with a market cap of A$384 million, is involved in the exploration and development of mineral properties in West Africa.

Operations: Canyon Resources Limited does not report separate revenue segments.

Market Cap: A$383.99M

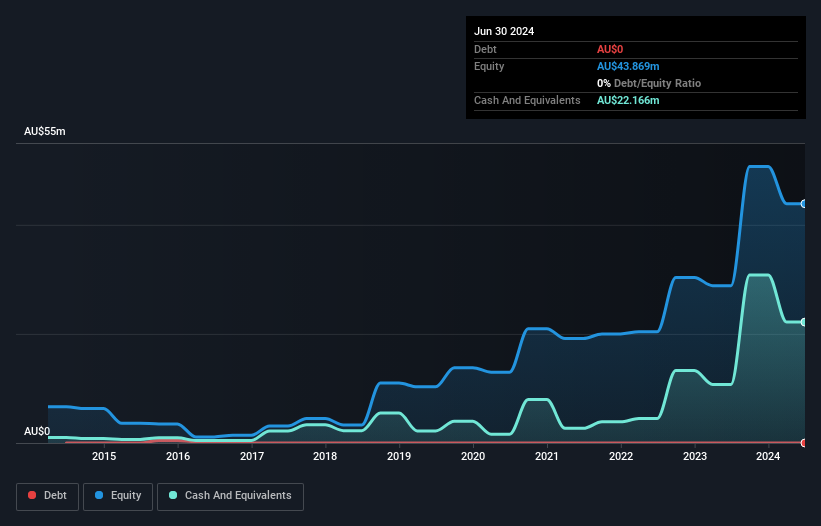

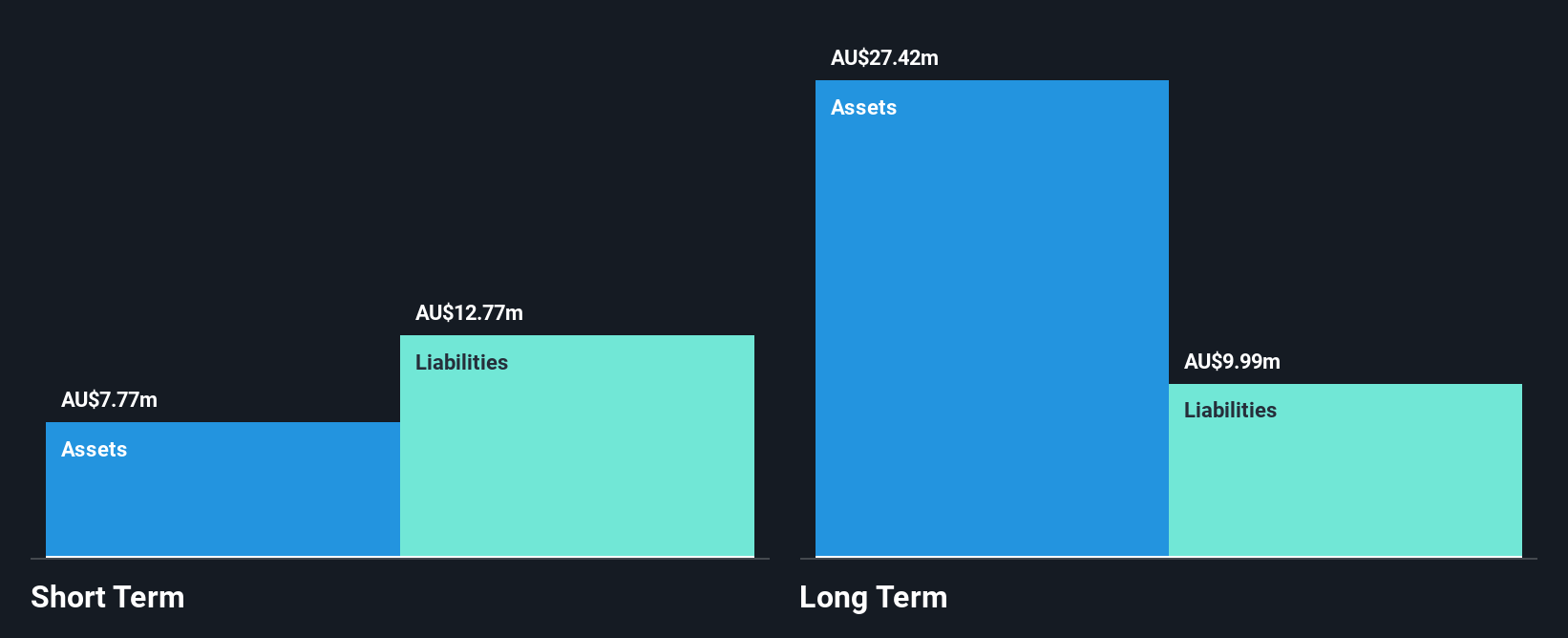

Canyon Resources Limited, with a market cap of A$384 million, is pre-revenue and currently unprofitable. Its share price has been highly volatile over the past three months. The company has no debt and its short-term assets of A$15.8 million exceed its short-term liabilities of A$1.2 million, but it has less than a year of cash runway based on current free cash flow trends. Despite these challenges, Canyon was recently added to the S&P/ASX Emerging Companies Index and All Ordinaries Index, indicating some recognition within the investment community despite reporting an increased net loss for the recent half-year period.

- Unlock comprehensive insights into our analysis of Canyon Resources stock in this financial health report.

- Review our growth performance report to gain insights into Canyon Resources' future.

EDU Holdings (ASX:EDU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EDU Holdings Limited, with a market cap of A$42.15 million, operates through its subsidiaries to provide tertiary education services in Australia.

Operations: The company's revenue is derived from its subsidiaries, with Ikon Institute of Australia contributing A$28.05 million and Australian Learning Group Pty Limited generating A$14.13 million.

Market Cap: A$42.15M

EDU Holdings Limited, with a market cap of A$42.15 million, has recently achieved profitability and is trading significantly below its estimated fair value. The company's earnings have grown consistently over the past five years, supported by reduced debt levels and strong interest coverage. Despite this financial strength, EDU's share price remains highly volatile. Recent announcements include a substantial share buyback program aimed at reducing administrative costs and providing liquidity to shareholders before delisting. This buyback will be funded through existing cash reserves and a new debt facility, reflecting strategic financial management amidst planned corporate changes.

- Take a closer look at EDU Holdings' potential here in our financial health report.

- Understand EDU Holdings' track record by examining our performance history report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market cap of A$0.46 billion.

Operations: Tyro's revenue is primarily generated from its Payments segment, which accounts for A$464.66 million, complemented by Banking at A$14.88 million.

Market Cap: A$463.97M

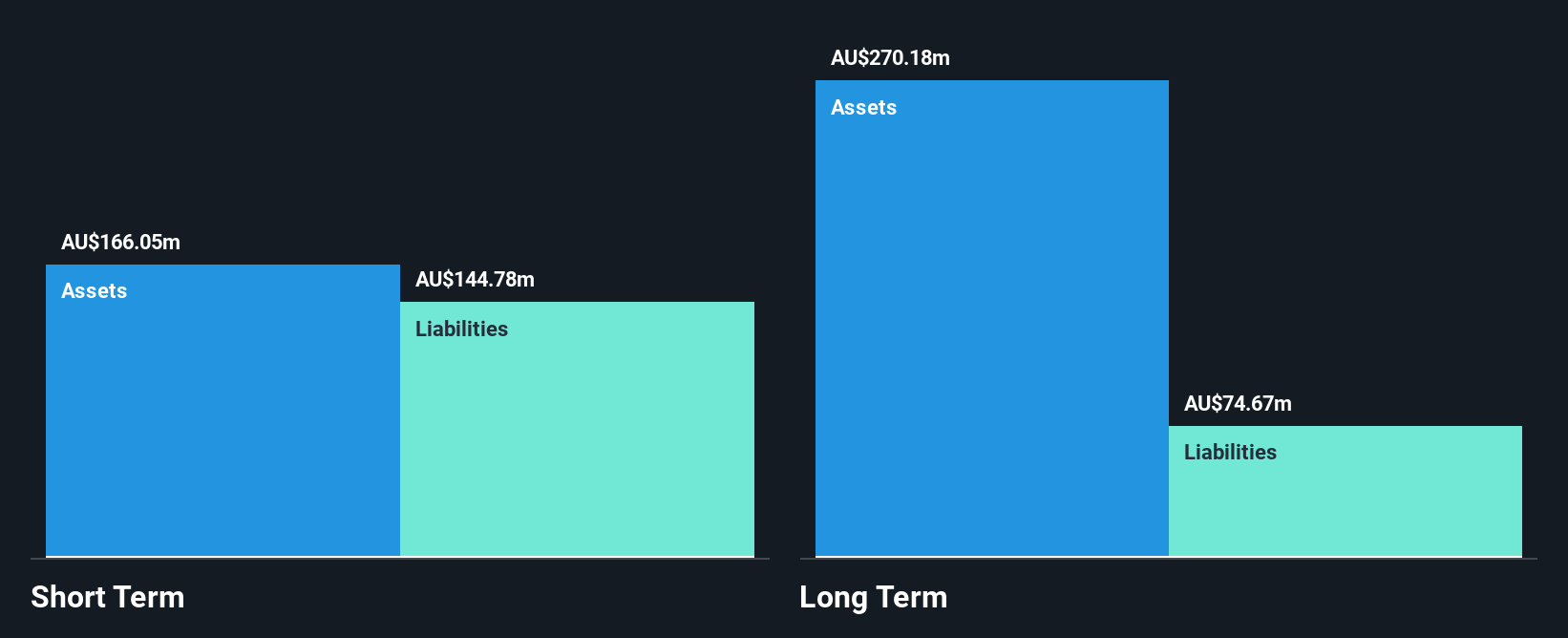

Tyro Payments Limited, with a market cap of A$0.46 billion, stands out in the penny stock arena due to its robust financial health and growth trajectory. The company is debt-free and has not diluted shareholders over the past year. Tyro's earnings have grown by 206.7% in the past year, significantly outpacing industry averages, although future earnings are expected to decline slightly by 2.6% annually over three years. With a price-to-earnings ratio of 15.1x below the Australian market average, Tyro presents potential value for investors despite its low return on equity of 14.2%.

- Click here to discover the nuances of Tyro Payments with our detailed analytical financial health report.

- Examine Tyro Payments' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Unlock our comprehensive list of 996 ASX Penny Stocks by clicking here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAY

Canyon Resources

Engages in the expedition and development of mineral properties in West Africa.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives