- Australia

- /

- Capital Markets

- /

- ASX:AEF

ASX Growth Leaders With High Insider Ownership

Reviewed by Simply Wall St

As the Australian market takes a breather following a year of record highs, investors are keenly observing how sectors like Staples and Utilities fare amid broader market fluctuations. In this environment, growth companies with high insider ownership can offer unique insights and potential stability, as insiders often have a vested interest in the long-term success of their firms.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 15% | 91.2% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 22.3% | 79.8% |

| Gratifii (ASX:GTI) | 17.8% | 114.0% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Emerald Resources (ASX:EMR) | 18.1% | 26.2% |

| Echo IQ (ASX:EIQ) | 18% | 50.8% |

| Adveritas (ASX:AV1) | 18.1% | 96.8% |

| Acrux (ASX:ACR) | 15.5% | 121.1% |

Underneath we present a selection of stocks filtered out by our screen.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★★

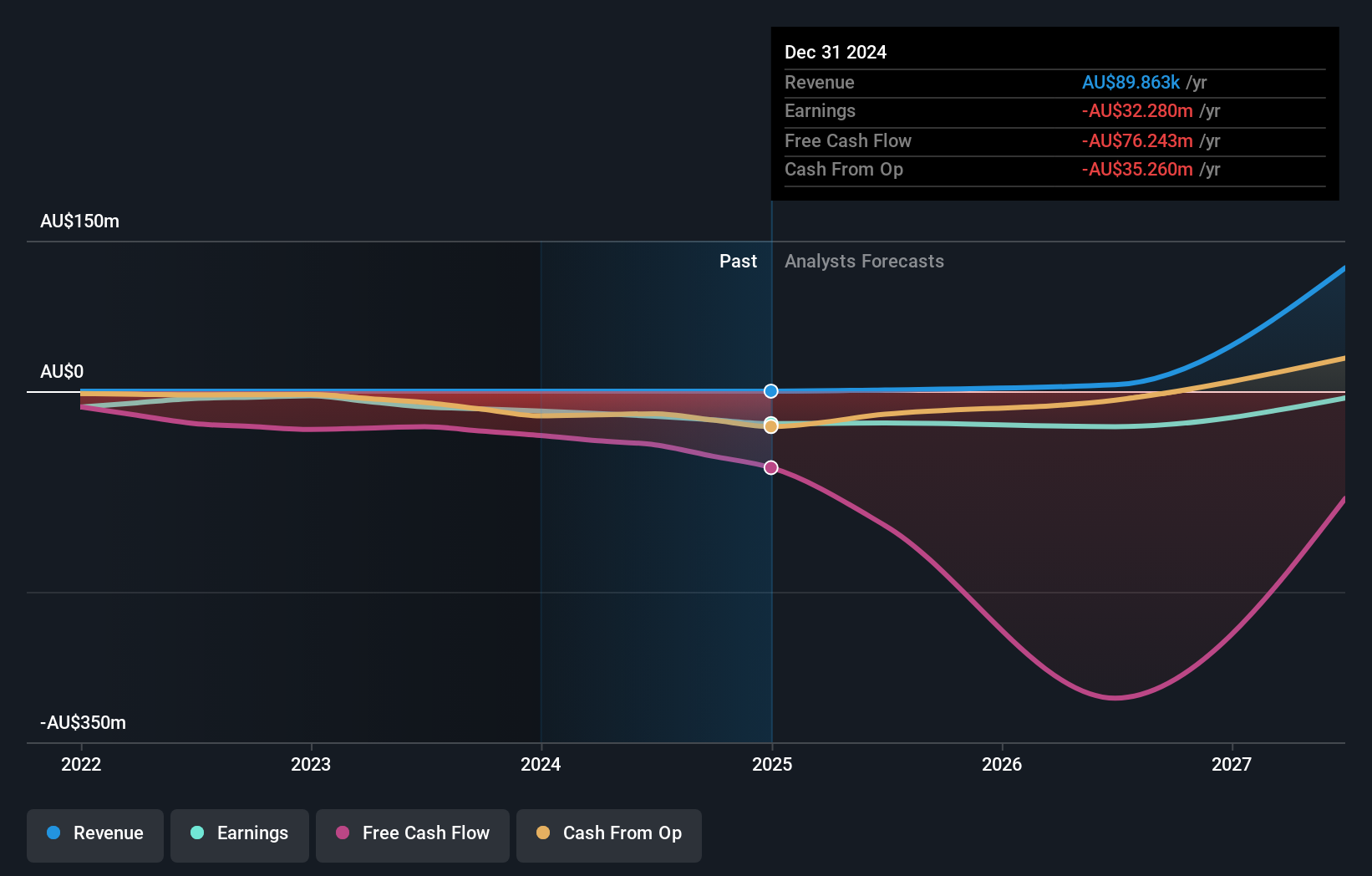

Overview: Alpha HPA Limited is a specialty material and technology company focused on the HPA First and Alpha Sapphire Projects in Queensland, with a market cap of A$1.06 billion.

Operations: The company's revenue segments include A$0.26 million from the HPA First Project and A$0.06 million from the Alpha Sapphire Project.

Insider Ownership: 11.1%

Revenue Growth Forecast: 85.1% p.a.

Alpha HPA shows significant potential for growth, with revenue forecasted to increase at a rate of 85.1% annually, surpassing the Australian market average. Despite current revenues being less than US$1 million (A$318K) and a net loss of A$32.56 million for FY2025, profitability is anticipated within three years. The company is expected to achieve a high return on equity of 35.6%, indicating strong future performance prospects despite limited cash runway and no recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Alpha HPA.

- The analysis detailed in our Alpha HPA valuation report hints at an inflated share price compared to its estimated value.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★★☆

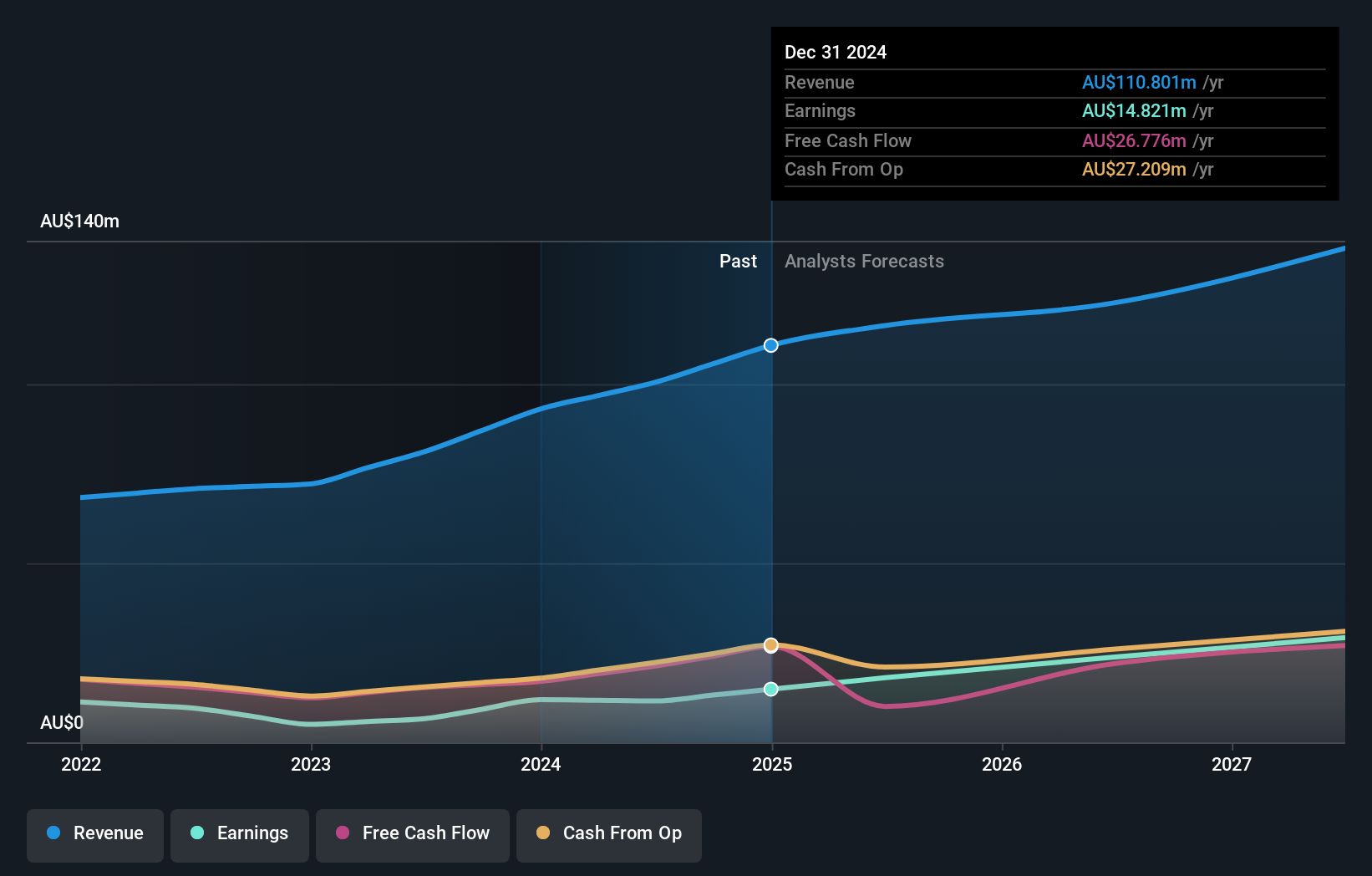

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$866.53 million.

Operations: The company generates revenue primarily through its funds management segment, which accounts for A$119.38 million.

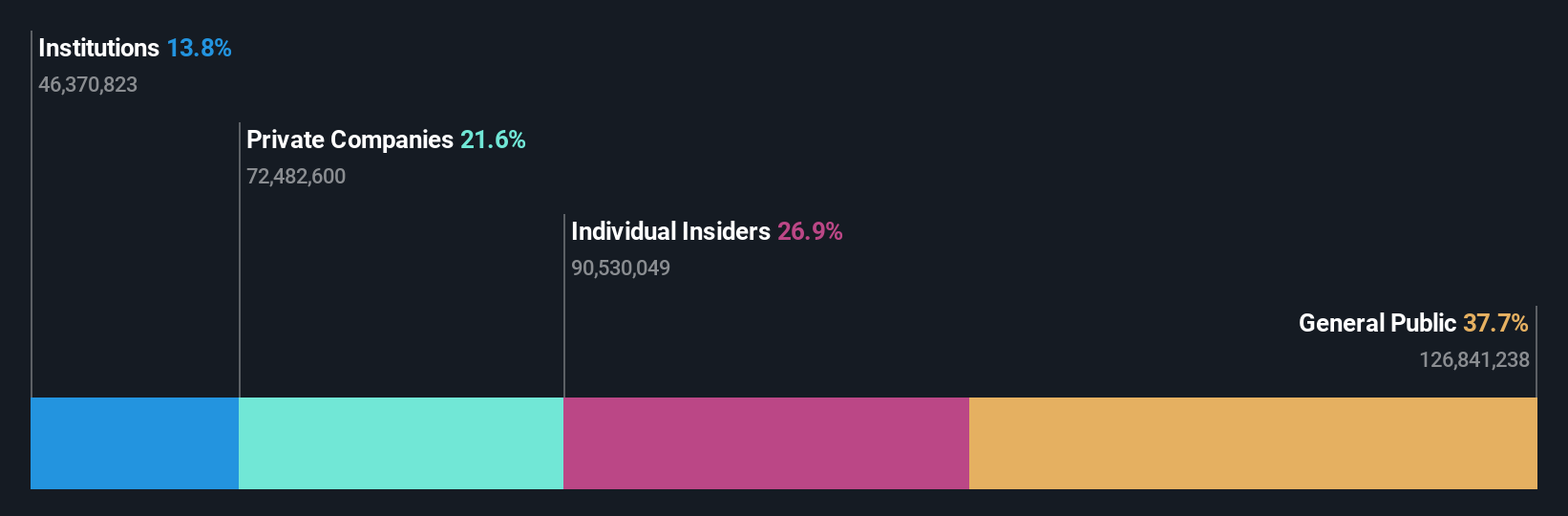

Insider Ownership: 21.8%

Revenue Growth Forecast: 10.6% p.a.

Australian Ethical Investment is poised for growth, with earnings forecasted to grow significantly at 20.45% annually, outpacing the Australian market. Recent earnings results show robust performance with sales increasing to A$119.38 million and net income rising to A$20.2 million year-on-year. The company’s return on equity is expected to be very high at 59.2% in three years, indicating strong potential despite no recent insider trading activity reported over the last three months.

- Click to explore a detailed breakdown of our findings in Australian Ethical Investment's earnings growth report.

- According our valuation report, there's an indication that Australian Ethical Investment's share price might be on the expensive side.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$946.22 million.

Operations: The company generates revenue primarily through the provision of investment management services, amounting to A$245.45 million.

Insider Ownership: 26.1%

Revenue Growth Forecast: 14.9% p.a.

Regal Partners shows potential for growth with earnings forecasted to increase significantly at 32.2% annually, surpassing the Australian market's growth rate. Despite a recent decline in revenue and net income, the company trades at a good value compared to peers and is 30.9% below its estimated fair value. Insider activity reveals more shares bought than sold recently, although profit margins have decreased from last year, and dividends remain inadequately covered by earnings.

- Get an in-depth perspective on Regal Partners' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Regal Partners' share price might be too pessimistic.

Summing It All Up

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 106 companies by clicking here.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives