- Australia

- /

- Diversified Financial

- /

- ASX:OFX

ASX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Australian market is experiencing a slight downturn, with the ASX 200 futures indicating a 0.4% decline, largely influenced by ongoing international trade uncertainties and energy sector developments. Despite these fluctuations, penny stocks continue to offer intriguing opportunities for investors seeking exposure to smaller or less-established companies that can provide value at lower price points. While the term "penny stocks" may seem outdated, it remains relevant as an investment area where strong financials and solid fundamentals can uncover potential growth opportunities without excessive risk.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.865 | A$1.12B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.535 | A$72.41M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$114.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.54 | A$167.97M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.14 | A$719.39M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.81 | A$657.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.74 | A$460.07M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 996 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Archer Materials (ASX:AXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Archer Materials Limited is a technology company focused on developing and commercializing semiconductor devices and sensors for quantum computing and medical diagnostics in Australia, with a market cap of A$75.18 million.

Operations: The company generates revenue from its Materials Technology Research and Development segment, amounting to A$2.31 million.

Market Cap: A$75.18M

Archer Materials, with a market cap of A$75.18 million, operates as a pre-revenue technology company focusing on semiconductor devices and sensors for quantum computing and medical diagnostics. Despite its unprofitability and declining earnings over the past five years, Archer's debt-free status and sufficient cash runway of over three years provide some financial stability. Recent strategic alliances, such as the partnership with Hylid Diagnostics to develop potassium measurement products for chronic kidney disease testing, highlight potential growth avenues in the medical diagnostics sector. However, management changes may pose transitional challenges given their relatively inexperienced team.

- Jump into the full analysis health report here for a deeper understanding of Archer Materials.

- Review our historical performance report to gain insights into Archer Materials' track record.

K&S (ASX:KSC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand, with a market cap of A$474.86 million.

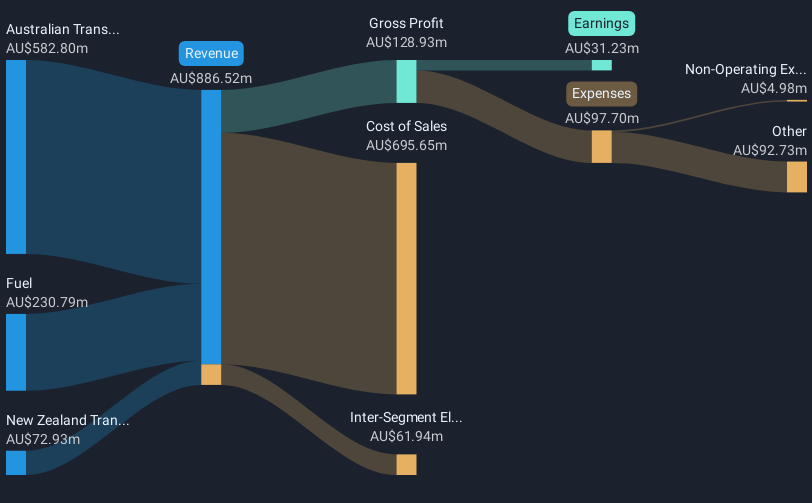

Operations: The company's revenue is derived from its Australian Transport segment at A$553.12 million, Fuel distribution at A$213.29 million, and New Zealand Transport operations contributing A$74.99 million.

Market Cap: A$474.86M

K&S Corporation Limited, with a market cap of A$474.86 million, has demonstrated consistent profitability growth over the past five years at 25.5% annually, although recent earnings growth slowed to 2.8%. Its Price-To-Earnings ratio of 15.5x is below the Australian market average, suggesting potential value. The company’s net debt to equity ratio stands at a satisfactory 12.7%, and its interest payments are well covered by EBIT (9.5x). However, short-term assets do not cover long-term liabilities (A$183.9M), and dividend sustainability is questionable due to inadequate free cash flow coverage despite high-quality earnings and stable volatility levels.

- Click here to discover the nuances of K&S with our detailed analytical financial health report.

- Evaluate K&S' historical performance by accessing our past performance report.

OFX Group (ASX:OFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OFX Group Limited offers international payments and foreign exchange services across the Asia Pacific, North America, Europe, the Middle East, and Africa, with a market cap of A$178.34 million.

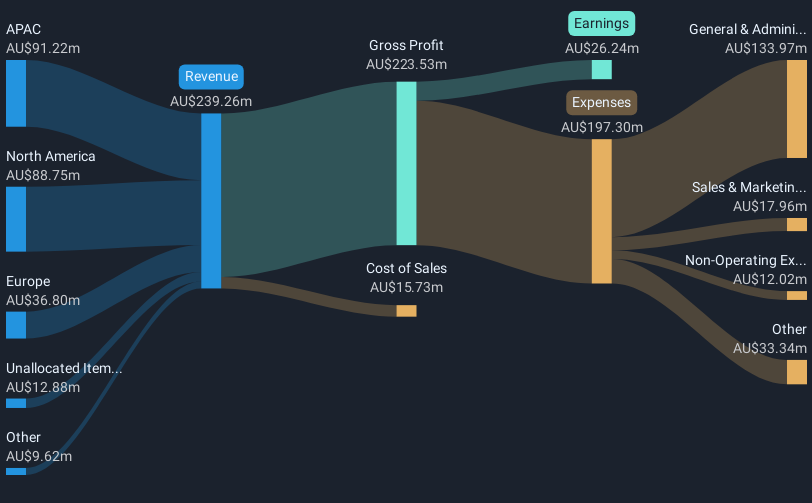

Operations: The company's revenue is derived from the Asia Pacific (A$90.31 million), North America (A$86.63 million), Europe (A$33.77 million), and Treasury operations (A$11.23 million).

Market Cap: A$178.34M

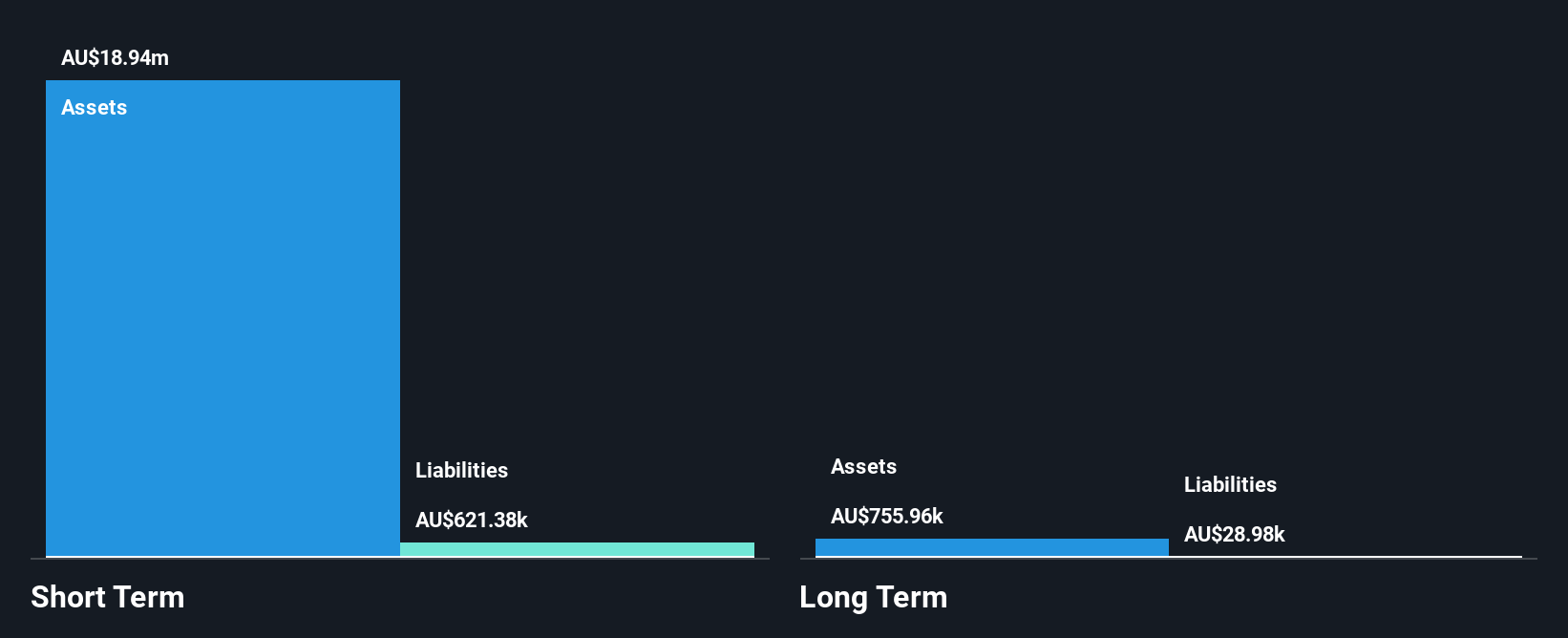

OFX Group Limited, with a market cap of A$178.34 million, offers international payment services across various regions. The company has shown earnings growth of 12.8% annually over the past five years, but recent performance saw a decline in net income to A$24.86 million from A$31.3 million the previous year. Despite this downturn, OFX maintains more cash than total debt and its short-term assets exceed both short and long-term liabilities significantly. Trading at 73.2% below estimated fair value suggests potential upside, though share price volatility remains high and profit margins have decreased compared to last year’s figures.

- Navigate through the intricacies of OFX Group with our comprehensive balance sheet health report here.

- Assess OFX Group's future earnings estimates with our detailed growth reports.

Make It Happen

- Reveal the 996 hidden gems among our ASX Penny Stocks screener with a single click here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OFX

OFX Group

Provides international payments and foreign exchange services in the Asia Pacific, North America, Europe, the Middle East, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives