In the current Australian market landscape, investors are navigating high local inflation, a pause from the Reserve Bank of Australia, and record gold prices amidst geopolitical tensions and economic uncertainties. With these dynamics in mind, identifying promising small-cap stocks requires a keen eye for companies that can thrive amid volatility and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Carlton Investments | 0.02% | 9.10% | 8.68% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Omni Bridgeway (ASX:OBL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Omni Bridgeway Limited operates as a provider of dispute and litigation finance services across multiple regions including Australia, the United States, Canada, Latin America, Asia, New Zealand, Europe, the Middle East, and Africa with a market capitalization of A$468.70 million.

Operations: Omni Bridgeway generates revenue primarily from funding and providing services related to legal dispute resolution, amounting to A$87.77 million.

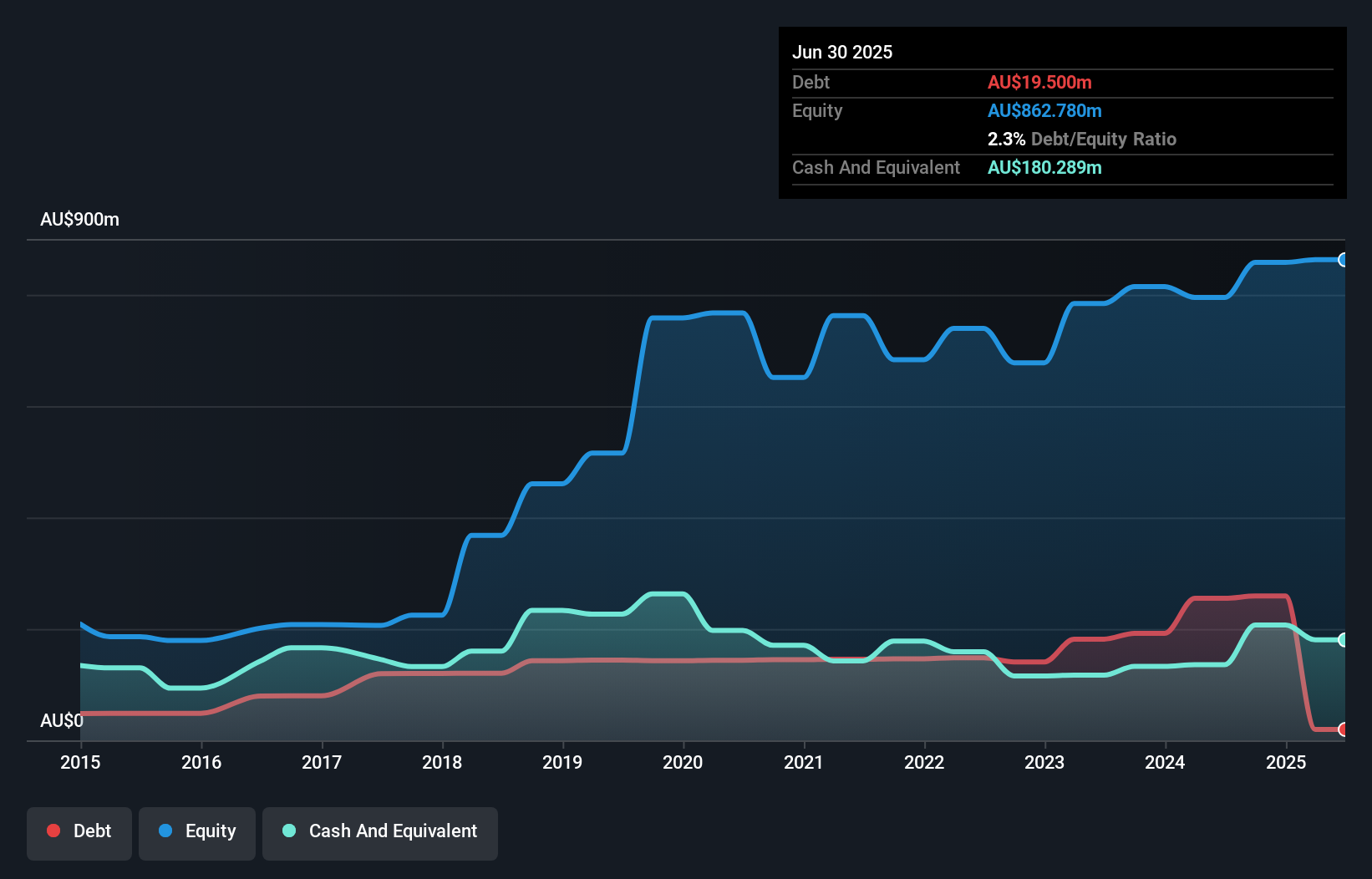

Omni Bridgeway, a notable player in Australia's financial landscape, has recently turned profitable with net income reaching A$349.8 million from a previous loss of A$87.52 million. Despite sales dipping to A$54.99 million from the prior year's A$71.05 million, revenue surged to A$651.22 million compared to last year's A$184.4 million, showcasing significant growth potential in its operations. The company's debt-to-equity ratio impressively dropped from 18.7% to 2.3% over five years and it boasts more cash than total debt, indicating robust financial health despite earnings forecasts suggesting future declines averaging 148% annually over three years.

- Take a closer look at Omni Bridgeway's potential here in our health report.

Explore historical data to track Omni Bridgeway's performance over time in our Past section.

Ridley (ASX:RIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Ridley Corporation Limited operates in the animal nutrition sector, providing solutions across Australia, the United States, New Zealand, and Thailand with a market capitalization of approximately A$1.13 billion.

Operations: Ridley generates revenue primarily from its Bulk Stockfeeds segment, contributing A$909.17 million, and the Packaged/Ingredients segment, adding A$425.83 million. The company's financials are impacted by inter-segment sales adjustments of -A$32.38 million.

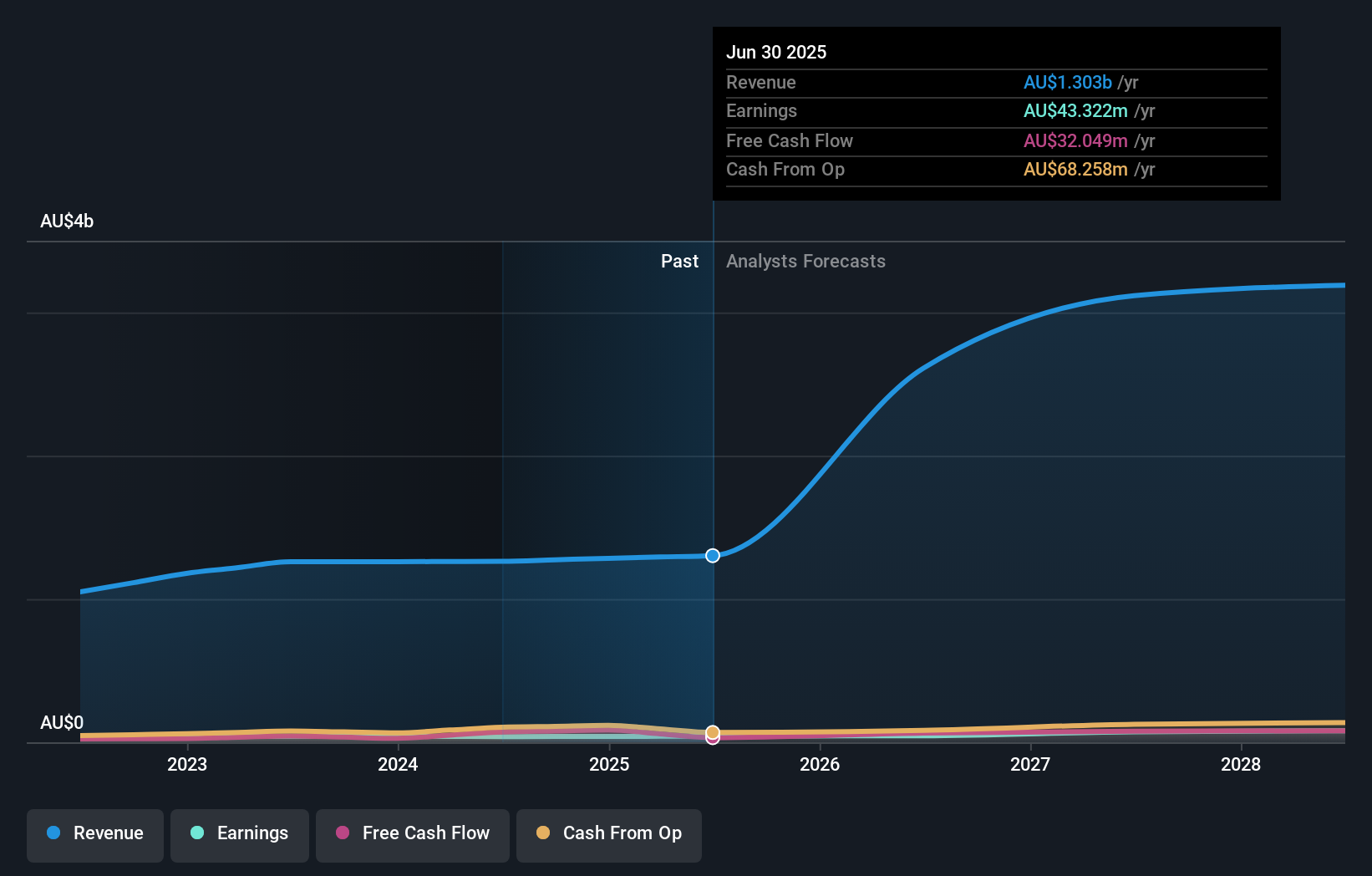

Ridley, a small yet promising player in Australia, is making strategic moves with its diversification into fertilizer distribution and premium pet food. The acquisition of Incitec Pivot Fertilisers is set to bolster supply chain resilience, aligning with domestic food security goals. Despite challenges like price pressures and operational constraints, Ridley's earnings grew by A$43.32 million this year from A$39.85 million last year, reflecting a steady upward trend. Trading at 59% below estimated fair value, Ridley presents an attractive proposition for investors looking for growth potential in the agribusiness sector amidst evolving market dynamics.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services across various sectors in Australia and has a market capitalization of approximately A$1.17 billion.

Operations: Tasmea generates revenue primarily from Electrical Services (A$212.71 million), followed by Mechanical Services (A$144.87 million) and Civil Services (A$103.07 million). The Water & Fluid segment contributes A$87.06 million to the total revenue.

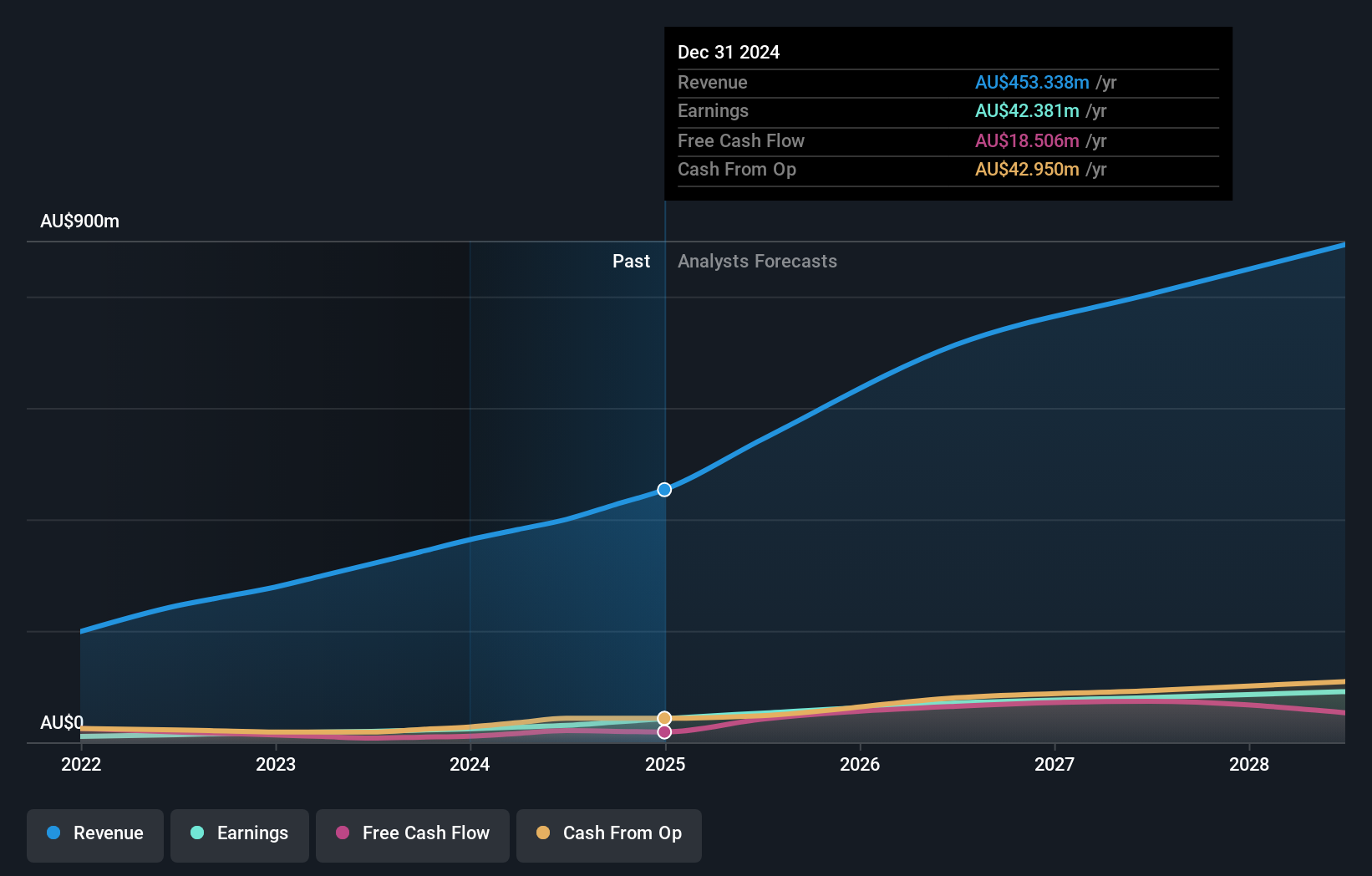

Tasmea, a promising player in its field, reported impressive earnings growth of 74.9% over the past year, surpassing industry averages. The company's net income increased to A$53.07 million from A$30.35 million the previous year, showcasing robust financial health despite a high net debt to equity ratio of 59.8%. Tasmea's debt management is noteworthy with a reduction in its debt to equity ratio from 110.9% to 70.8% over five years and interest payments are well covered by EBIT at 10.5x coverage. Recently added to the S&P Global BMI Index and completing an A$43 million follow-on equity offering, Tasmea seems poised for continued growth with forecasted annual earnings growth of 9%.

- Click here to discover the nuances of Tasmea with our detailed analytical health report.

Gain insights into Tasmea's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 53 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RIC

Ridley

Engages in the provision of animal nutrition solutions in Australia the United States, New Zealand, and Thailand.

Flawless balance sheet and good value.

Market Insights

Community Narratives