- Australia

- /

- Electrical

- /

- ASX:SKS

ASX Penny Stocks: Lindsay Australia And 2 Other Promising Picks

Reviewed by Simply Wall St

As the Australian market anticipates a modest rise, discussions around potential economic shifts, such as the expected retail sales data and its implications for interest rates, are gaining traction. Despite their historical connotations, penny stocks continue to offer intriguing opportunities for investors willing to explore smaller or newer companies. When backed by robust financials, these stocks can present significant growth potential and hidden value in today's ever-evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.375 | A$107.47M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.46 | A$116.05M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.785 | A$471.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.66 | A$862.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.74 | A$234.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.54 | A$167.97M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 476 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Lindsay Australia (ASX:LAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindsay Australia Limited operates as a provider of integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia with a market cap of A$234.75 million.

Operations: The company's revenue is primarily derived from its Transport segment, which contributes A$573.35 million, followed by the Rural segment at A$160.92 million and Hunters at A$100.09 million, with Corporate adding A$5.15 million.

Market Cap: A$234.75M

Lindsay Australia Limited, with a market cap of A$234.75 million, shows mixed potential as a penny stock. The company benefits from strong revenue streams in its Transport and Rural segments, totaling over A$734 million. Despite being undervalued by 42.6% compared to its fair value estimate and having high-quality earnings, it faces challenges such as low return on equity (15.1%) and declining profit margins (2.9%). Recent executive changes, including Robert Miller's appointment as executive director, may enhance strategic decision-making capabilities but the company's unstable dividend track record remains a concern for investors seeking consistent returns.

- Jump into the full analysis health report here for a deeper understanding of Lindsay Australia.

- Explore Lindsay Australia's analyst forecasts in our growth report.

Omni Bridgeway (ASX:OBL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Omni Bridgeway Limited provides dispute and litigation finance services across multiple regions including Australia, the United States, and Europe, with a market capitalization of A$406.69 million.

Operations: The company generates revenue of A$132.66 million from funding and providing services related to legal dispute resolution.

Market Cap: A$406.69M

Omni Bridgeway Limited, with a market capitalization of A$406.69 million, operates in the litigation finance sector across several regions. While currently unprofitable and experiencing increased losses over the past five years, Omni Bridgeway maintains a satisfactory net debt to equity ratio of 6.1% and has sufficient cash runway for more than three years due to positive free cash flow. The company's short-term assets significantly surpass both its short- and long-term liabilities, providing financial stability amidst its challenges. Despite these hurdles, earnings are forecasted to grow substantially at 62.25% annually according to consensus analyst estimates.

- Click here and access our complete financial health analysis report to understand the dynamics of Omni Bridgeway.

- Gain insights into Omni Bridgeway's future direction by reviewing our growth report.

SKS Technologies Group (ASX:SKS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services, with a market cap of A$210.88 million.

Operations: The company generates revenue of A$198.59 million from its operations in the lighting and audio-visual markets.

Market Cap: A$210.88M

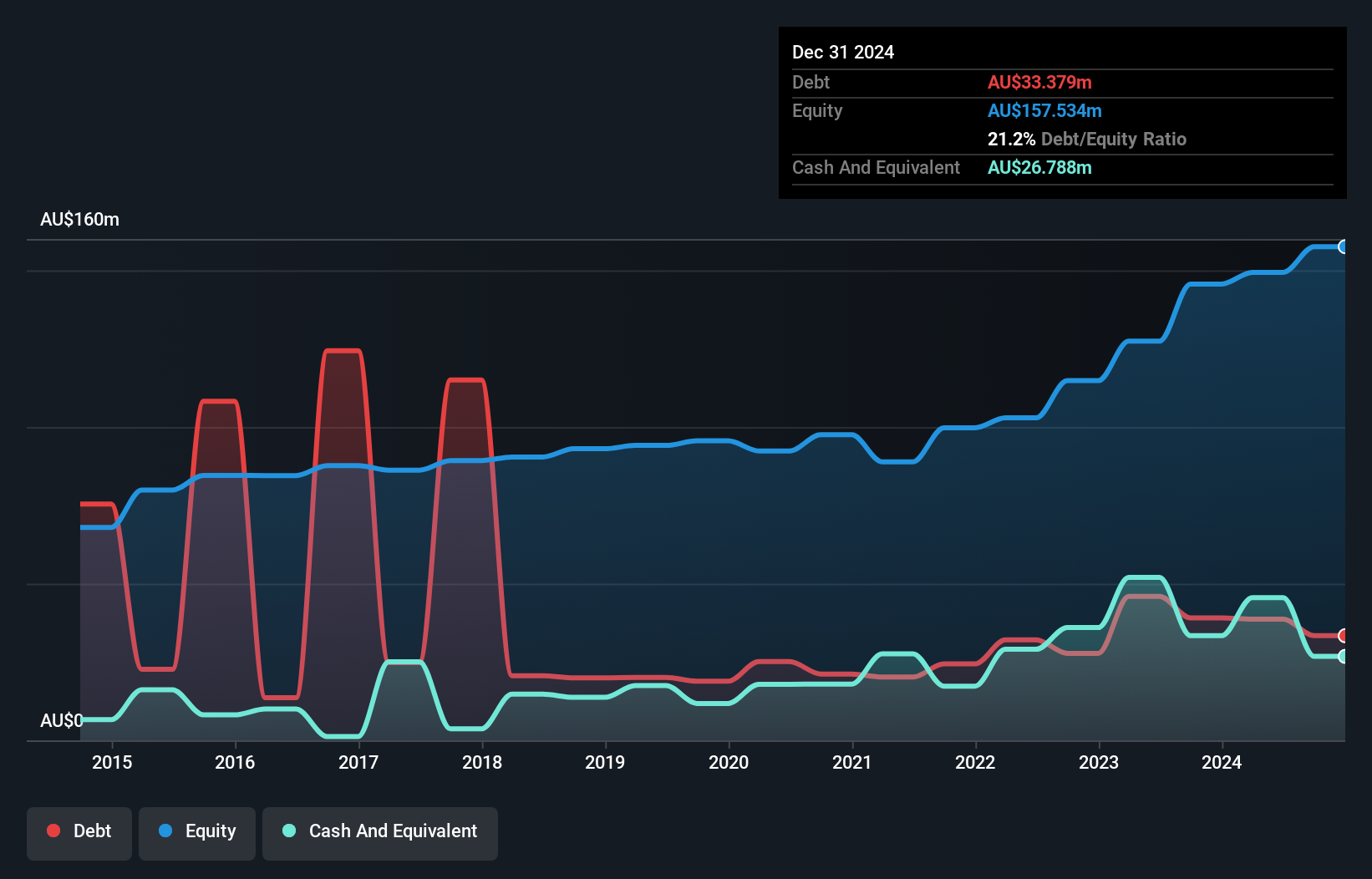

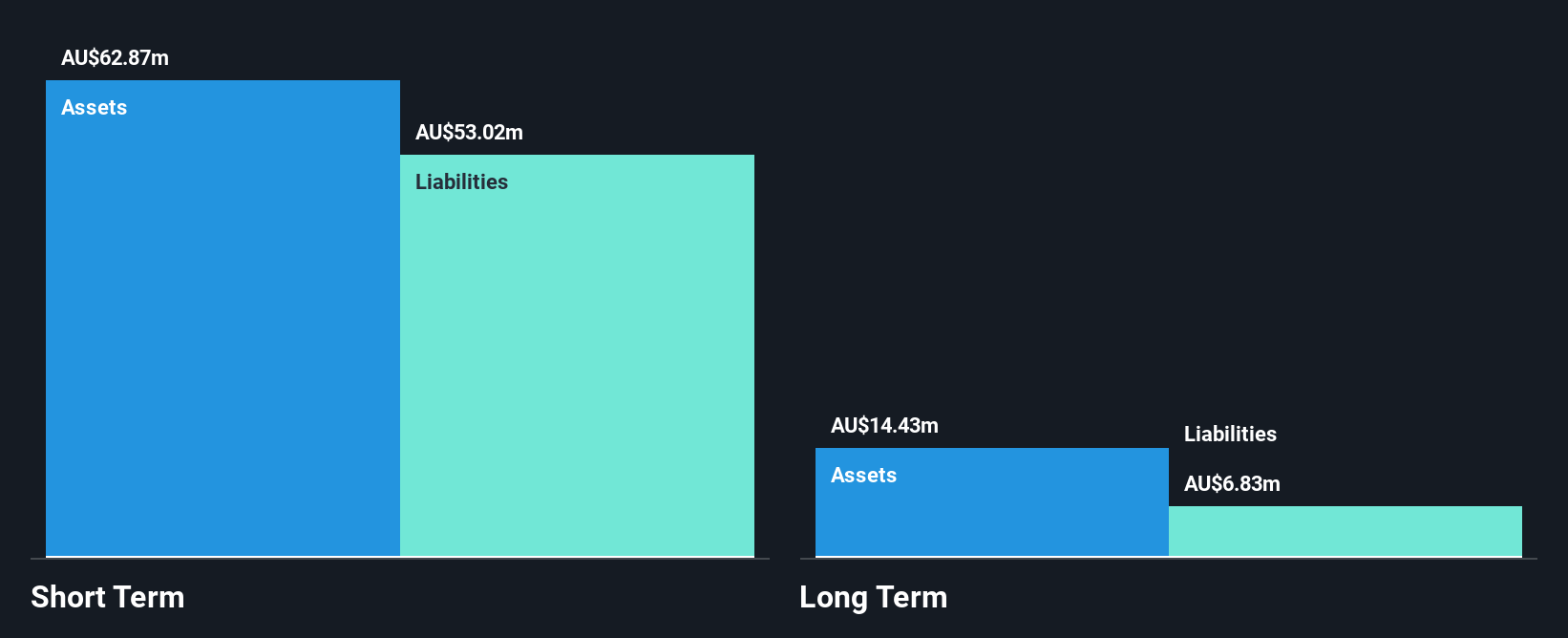

SKS Technologies Group, with a market cap of A$210.88 million, has demonstrated remarkable earnings growth of 437.6% over the past year, outpacing the electrical industry average. The company is profitable and has improved its net profit margins from 2.1% to 5.3%. SKS's strong financial position is underscored by its debt-free status and robust asset coverage for both short- and long-term liabilities. With an experienced management team and board, high-quality earnings, and trading slightly below fair value estimates, SKS presents a stable investment profile within the penny stock segment in Australia.

- Dive into the specifics of SKS Technologies Group here with our thorough balance sheet health report.

- Assess SKS Technologies Group's future earnings estimates with our detailed growth reports.

Where To Now?

- Jump into our full catalog of 476 ASX Penny Stocks here.

- Contemplating Other Strategies? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives