- Australia

- /

- Capital Markets

- /

- ASX:NWL

Did Netwealth Group's (ASX:NWL) Earnings Surge and Dividend Hike Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- Netwealth Group Limited announced in August 2025 that it will pay a fully franked final dividend of A$0.21 per share for the six months ended June 30, 2025, payable on September 25, 2025, following its release of full-year results.

- The company reported significant year-over-year growth, with revenue rising to A$324.44 million and net income increasing to A$116.52 million for the year ended June 30, 2025.

- We'll examine how Netwealth's strong earnings growth and dividend increase impact its investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Netwealth Group Investment Narrative Recap

Netwealth Group continues to appeal to investors who value consistent revenue and earnings expansion, supported by robust net profit growth and dividend increases. The recent announcement reinforces optimism around the company’s short-term catalyst, sustained client inflows and productivity improvements, while the risk of margin pressure from rising costs as expansion accelerates remains a factor to watch. For now, the impact of the latest dividend and earnings release reinforces, rather than materially changes, the dominant investment thesis or its key risks.

The final dividend announcement of A$0.21 per share, fully franked and up on the previous period, stands out as the most relevant recent development. This continues a trend of increasing shareholder distributions, aligning with the company’s strong earnings results and overall narrative of growth, but also highlights the importance of balancing rewards to shareholders against ongoing operational investments and rising costs.

However, investors should be aware that higher operating costs, which often accompany planned headcount and technology investment, could impact profit margins in the near term if...

Read the full narrative on Netwealth Group (it's free!)

Netwealth Group's outlook anticipates A$479.0 million in revenue and A$173.2 million in earnings by 2028. This implies a yearly revenue growth rate of 18.6% and an earnings increase of A$71.5 million from the current A$101.7 million.

Uncover how Netwealth Group's forecasts yield a A$31.99 fair value, a 12% downside to its current price.

Exploring Other Perspectives

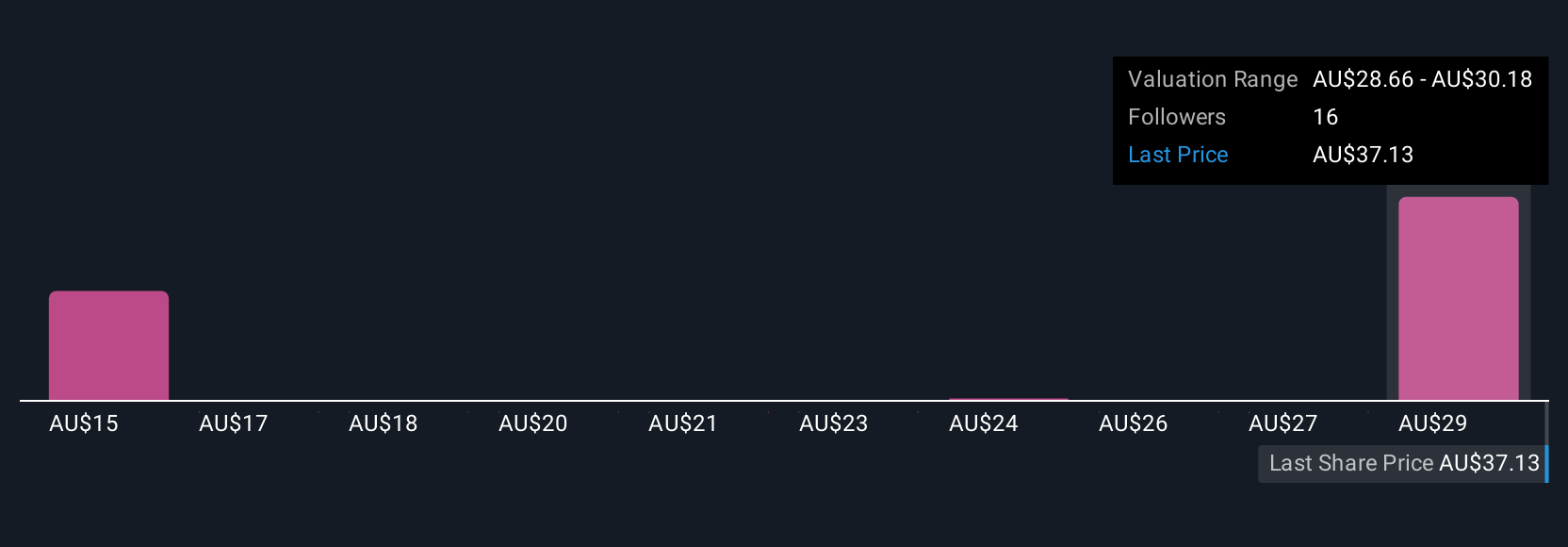

The Simply Wall St Community’s fair value estimates for Netwealth Group range widely, from A$15.31 to A$31.99 across 4 individual perspectives. While market participants recognize strong earnings growth, these differences highlight just how much opinions may diverge on what comes next, be sure to consider several viewpoints.

Explore 4 other fair value estimates on Netwealth Group - why the stock might be worth as much as A$31.99!

Build Your Own Netwealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netwealth Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netwealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netwealth Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netwealth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NWL

Netwealth Group

A financial services company, engages in the wealth management business in Australia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives