- Sweden

- /

- Industrials

- /

- OM:NOLA B

Insider Action On 3 Undervalued Small Caps In Global Market

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience, with small-cap indices like the Russell 2000 and S&P MidCap 400 outperforming their large-cap counterparts amid easing U.S. inflation and strong business activity indicators. In this environment, identifying promising small-cap stocks often involves looking for companies with solid fundamentals that can capitalize on economic trends and navigate market volatility effectively.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.5x | 1.0x | 22.49% | ★★★★★★ |

| Morguard North American Residential Real Estate Investment Trust | 5.0x | 1.7x | 26.48% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 19.27% | ★★★★☆☆ |

| Nickel Asia | 20.4x | 2.1x | 44.82% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.53% | ★★★★☆☆ |

| Sagicor Financial | 6.9x | 0.4x | -69.29% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.42% | ★★★★☆☆ |

| Bumitama Agri | 11.6x | 1.7x | 43.25% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -426.97% | ★★★☆☆☆ |

| Chinasoft International | 24.6x | 0.8x | -1373.12% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

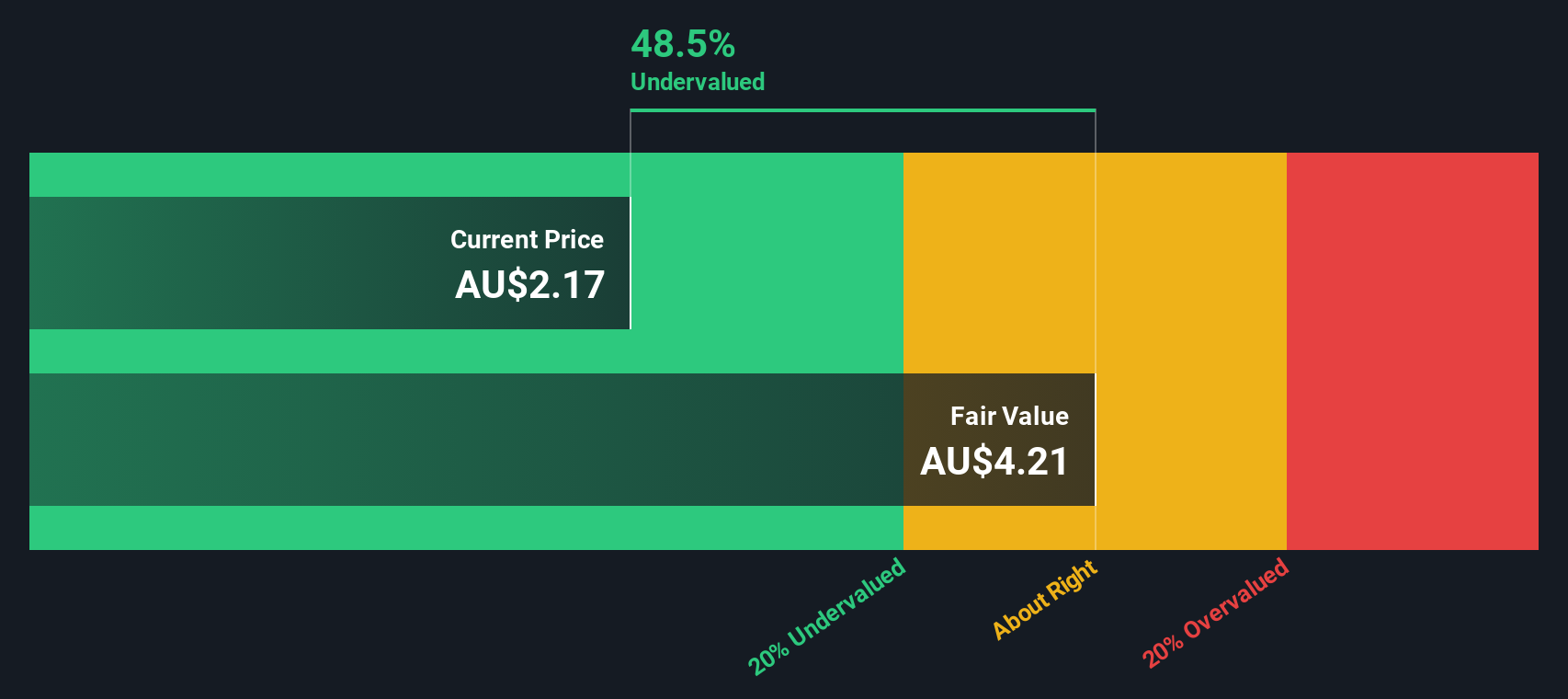

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments is an asset management company primarily operating through its Lighthouse segment, with a market cap of approximately A$0.35 billion.

Operations: Navigator Global Investments generates revenue primarily from its Lighthouse segment, with recent figures showing a gross profit margin of 42.66%. The company experiences operating expenses and non-operating expenses that influence its net income, which has seen fluctuations over time.

PE: 6.7x

Navigator Global Investments, a diversified alternative asset management firm, has seen insider confidence with Lindsay Megan Wright acquiring 100,000 shares for A$209,107 in August 2025. Despite earnings forecasted to decline by 8.3% annually over the next three years, revenue is expected to grow at a rate of 13.79% per year. The recent full-year results show revenue increased to US$365.79 million from US$276.28 million last year, alongside net income growth from US$66.31 million to US$119.36 million—an impressive leap reflecting operational strength amidst higher-risk funding reliance on external borrowing rather than customer deposits.

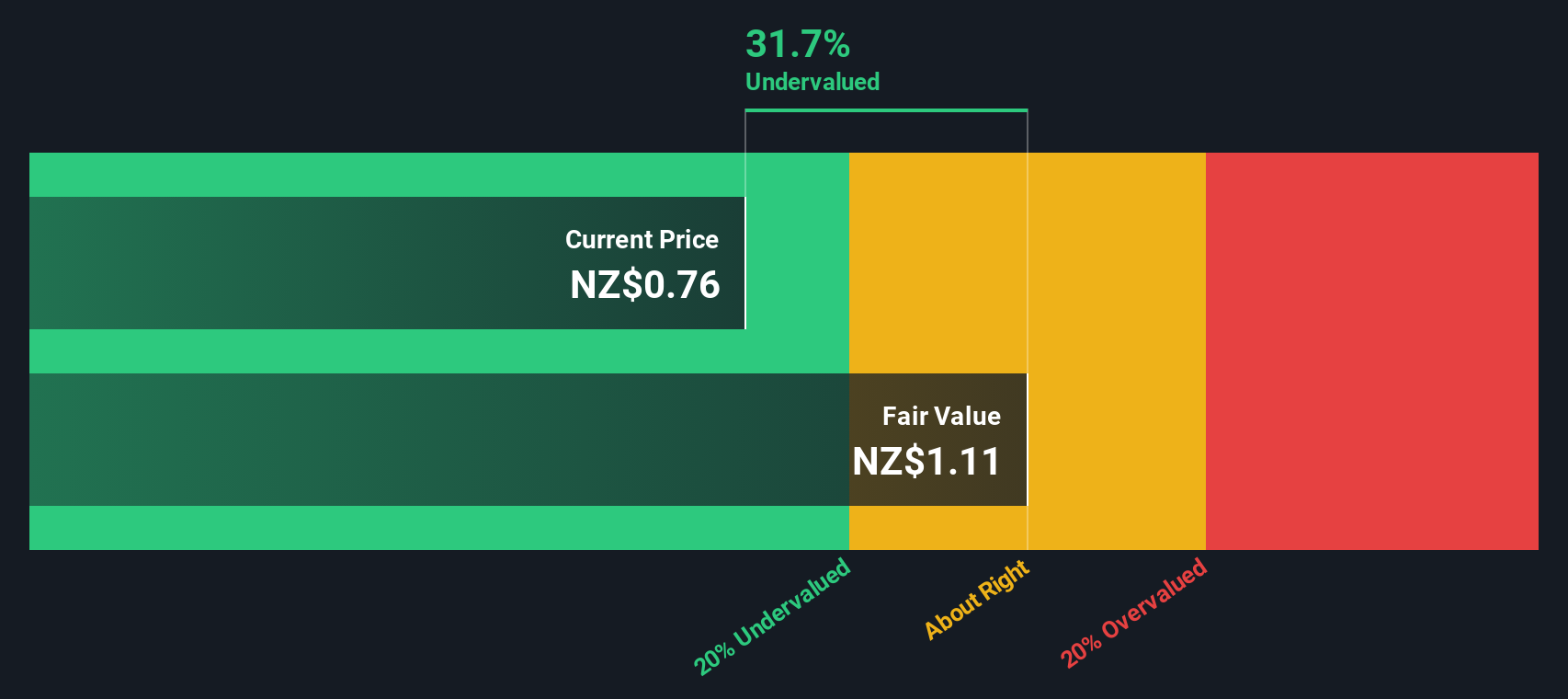

SkyCity Entertainment Group (NZSE:SKC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SkyCity Entertainment Group operates as a prominent entertainment and gaming company with key operations in Auckland and Adelaide, boasting a market capitalization of approximately NZ$2.38 billion.

Operations: The company's primary revenue streams are from SKYCITY Auckland and SKYCITY Adelaide, contributing significantly to its overall earnings. The gross profit margin has shown fluctuations, reaching 57.74% in recent periods. Operating expenses, including depreciation and amortization, remain a substantial portion of the cost structure. Non-operating expenses have varied widely over time, impacting net income results significantly.

PE: 27.5x

SkyCity Entertainment Group, a company in the gaming and hospitality sector, has seen insider confidence with Jason Walbridge acquiring 200,000 shares for NZ$139,978. Despite recent volatility and being dropped from key indices in September 2025, SkyCity is actively restructuring by selling Auckland assets worth over NZ$250 million to reduce debt. The firm reported a net income of NZ$29 million for FY25 after a previous year's loss. Plans include raising an additional NZ$240 million through equity offerings amidst economic challenges impacting visitor spending.

- Delve into the full analysis valuation report here for a deeper understanding of SkyCity Entertainment Group.

Learn about SkyCity Entertainment Group's historical performance.

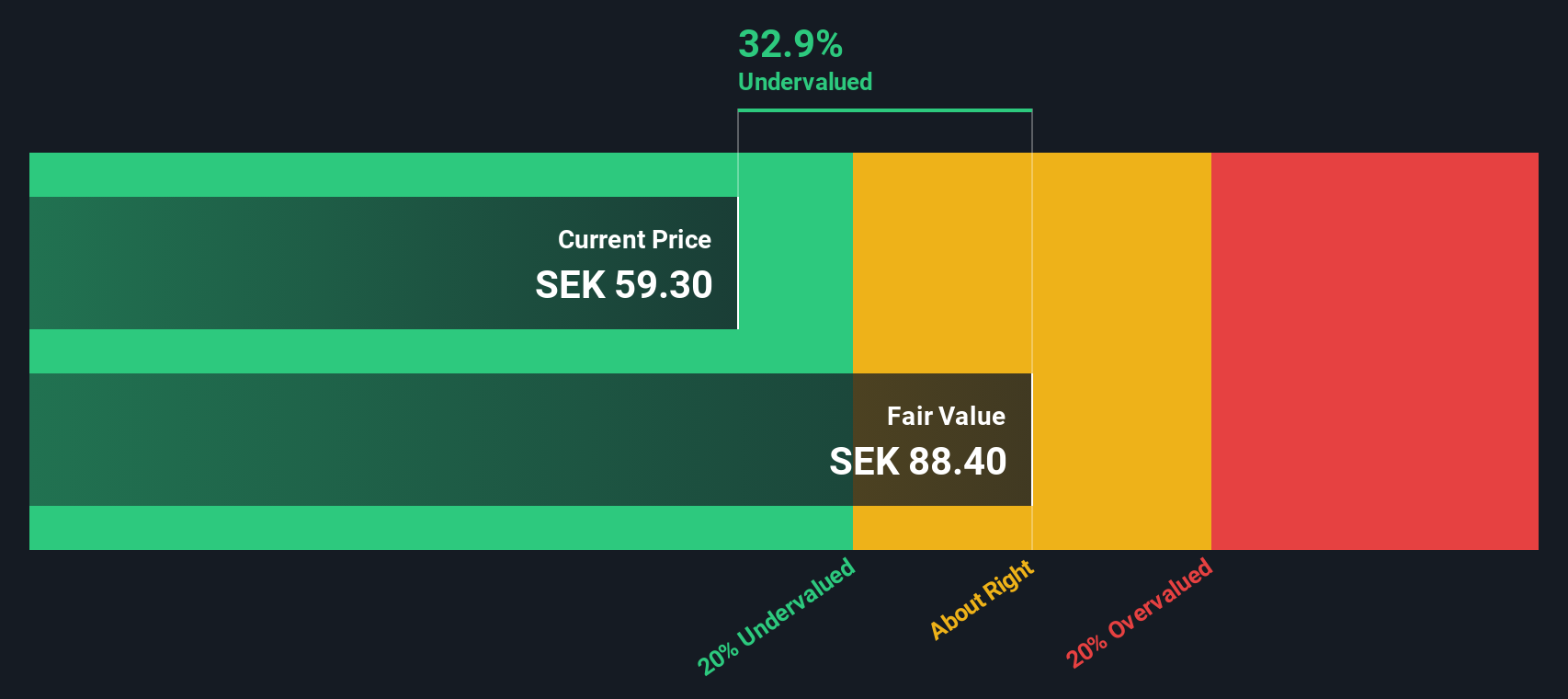

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nolato is a Swedish company specializing in the development and production of polymer product systems for medical, automotive, and consumer electronics industries with a market cap of approximately SEK 8.76 billion.

Operations: Medical Solutions and Engineered Solutions are the primary revenue streams, generating SEK 5.42 billion and SEK 4.17 billion respectively. The net profit margin has shown variability, reaching a low of 4.56% in late 2023 before improving to 8.24% by September 2025.

PE: 21.8x

Nolato, a smaller company in the market, has demonstrated insider confidence with recent share purchases. They reported third-quarter sales of SEK 2,342 million and net income of SEK 215 million, up from SEK 164 million last year. Earnings per share increased to SEK 0.8 from SEK 0.61. Despite relying entirely on external borrowing for funding, Nolato's earnings are projected to grow by 12.75% annually, suggesting potential for future growth amidst its current valuation challenges.

- Dive into the specifics of Nolato here with our thorough valuation report.

Gain insights into Nolato's past trends and performance with our Past report.

Turning Ideas Into Actions

- Investigate our full lineup of 120 Undervalued Global Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products in Europe, Asia, North America, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives