- Australia

- /

- Capital Markets

- /

- ASX:MQG

Shareholders Are Thrilled That The Macquarie Group (ASX:MQG) Share Price Increased 126%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term Macquarie Group Limited (ASX:MQG) shareholders would be well aware of this, since the stock is up 126% in five years. The last week saw the share price soften some 4.3%.

Check out our latest analysis for Macquarie Group

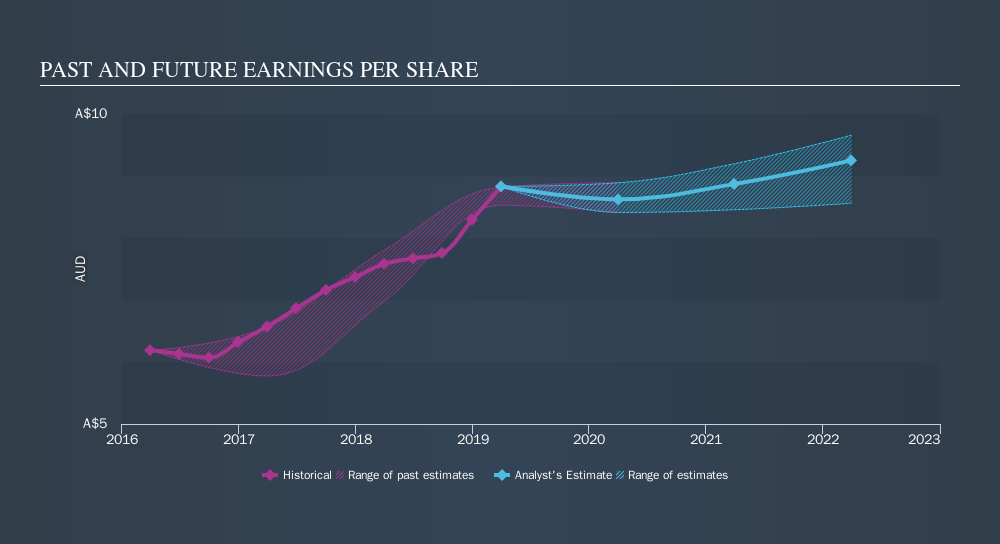

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Macquarie Group managed to grow its earnings per share at 18% a year. That makes the EPS growth particularly close to the yearly share price growth of 18%. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

The graphic below depicts how EPS has changed over time.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Macquarie Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Macquarie Group the TSR over the last 5 years was 191%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Macquarie Group shareholders gained a total return of 5.8% during the year. But that was short of the market average. On the bright side, the longer term returns (running at about 24% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives