- Australia

- /

- Capital Markets

- /

- ASX:MQG

Macquarie Group (ASX:MQG) Will Pay A Smaller Dividend Than Last Year

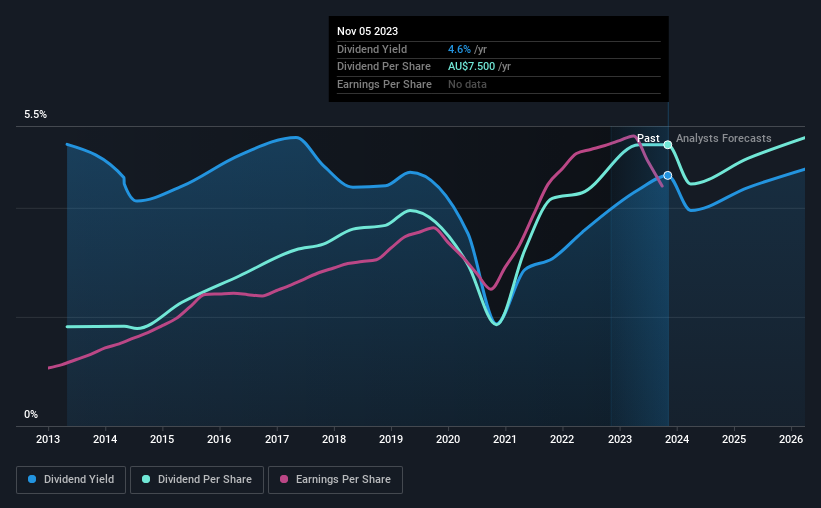

Macquarie Group Limited's (ASX:MQG) dividend is being reduced by 15% to A$2.55 per share on 19th of December, in comparison to last year's comparable payment of A$3.00. However, the dividend yield of 4.6% still remains in a typical range for the industry.

View our latest analysis for Macquarie Group

Macquarie Group's Earnings Will Easily Cover The Distributions

Solid dividend yields are great, but they only really help us if the payment is sustainable.

Macquarie Group has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Based on Macquarie Group's last earnings report, the payout ratio is at a decent 63%, meaning that the company is able to pay out its dividend with a bit of room to spare.

Over the next 3 years, EPS is forecast to expand by 16.4%. Analysts forecast the future payout ratio could be 63% over the same time horizon, which is a number we think the company can maintain.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2013, the dividend has gone from A$2.65 total annually to A$7.50. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. Macquarie Group has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

We Could See Macquarie Group's Dividend Growing

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's encouraging to see that Macquarie Group has been growing its earnings per share at 7.8% a year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

In Summary

Even though the dividend was cut this year, we think Macquarie Group has the ability to make consistent payments in the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for Macquarie Group that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MQG

Macquarie Group

Provides diversified financial services in Australia, New Zealand the Americas, Europe, the Middle East, Africa, and Asia.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success