- Australia

- /

- Capital Markets

- /

- ASX:MFF

How Investors May Respond To MFF Capital Investments (ASX:MFF) Leadership Appointments and Strong Full-Year Results

Reviewed by Simply Wall St

- On August 13, 2025, MFF Capital Investments Limited reported a full-year revenue of A$632.85 million and net income of A$431.97 million, announced an interim dividend of A$0.09 per share, and appointed Kirsten Morton as Chief Financial Officer and Matthew Githens as Chief Risk Officer.

- The addition of two experienced executives from leading financial institutions signals a substantial focus on enhanced financial stewardship and risk management practices at the company.

- With the appointment of a new CFO, we'll examine how this leadership change may influence MFF Capital Investments' investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is MFF Capital Investments' Investment Narrative?

At its core, the MFF Capital Investments story still hinges on the belief in disciplined portfolio management, reliable dividend streams, and value returning to shareholders. The most recent results showed a slight decline in both revenue and net income year over year, but the company’s decision to lift its dividend could signal ongoing confidence in its cash flows. The arrival of an experienced Chief Financial Officer and a specialist Chief Risk Officer appears well timed, especially since MFF’s management team tenure had been flagged as a concern for its lack of experience. These hires could help address some of the short-term risks around financial oversight and risk processes, making them potential catalysts for improved sentiment. With the share price holding firm, for now, the direct impact of the leadership shake-up may take time to fully play out, but it looks set to sharpen the company’s focus on governance and risk controls.

However, any persistent decline in earnings is something investors should keep on their radar.

Exploring Other Perspectives

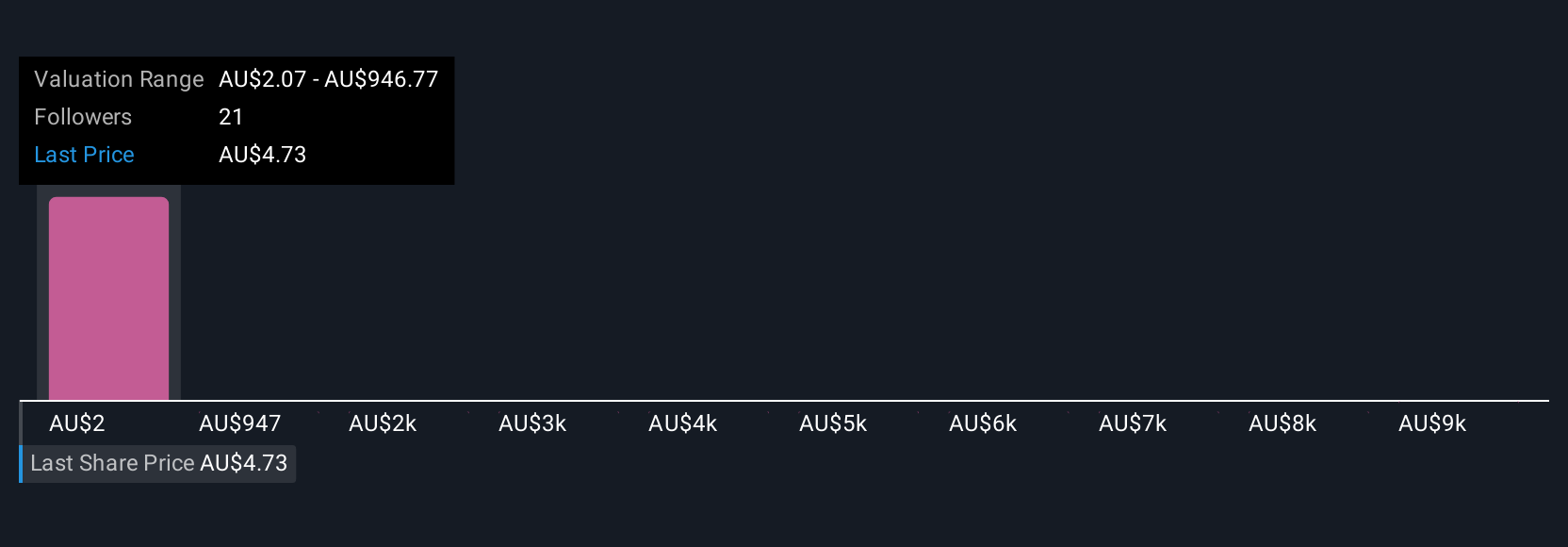

Explore 8 other fair value estimates on MFF Capital Investments - why the stock might be a potential multi-bagger!

Build Your Own MFF Capital Investments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MFF Capital Investments research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free MFF Capital Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MFF Capital Investments' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives