- Australia

- /

- Hospitality

- /

- ASX:CTD

Exploring 3 Undervalued Small Caps On ASX With Insider Action

Reviewed by Simply Wall St

The Australian market has experienced a mixed performance recently, with the ASX200 closing down 0.38% amid sector-specific fluctuations, such as a notable decline in Real Estate and gains in Materials and Information Technology. In this environment of shifting dynamics, small-cap stocks on the ASX present intriguing opportunities for investors seeking potential growth amidst broader market volatility. Identifying promising small caps often involves looking at factors like insider activity and strategic developments that could signal future potential, especially when broader economic conditions are impacting larger sectors differently.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 41.2x | 3.7x | 37.16% | ★★★★★★ |

| GWA Group | 16.3x | 1.5x | 40.69% | ★★★★★☆ |

| SHAPE Australia | 14.2x | 0.3x | 31.63% | ★★★★☆☆ |

| Dicker Data | 19.6x | 0.7x | -63.12% | ★★★★☆☆ |

| Collins Foods | 17.4x | 0.7x | 6.79% | ★★★★☆☆ |

| Hansen Technologies | 53.0x | 3.2x | 29.36% | ★★★★☆☆ |

| FINEOS Corporation Holdings | NA | 3.3x | 48.37% | ★★★★☆☆ |

| Healius | NA | 0.6x | 11.69% | ★★★★☆☆ |

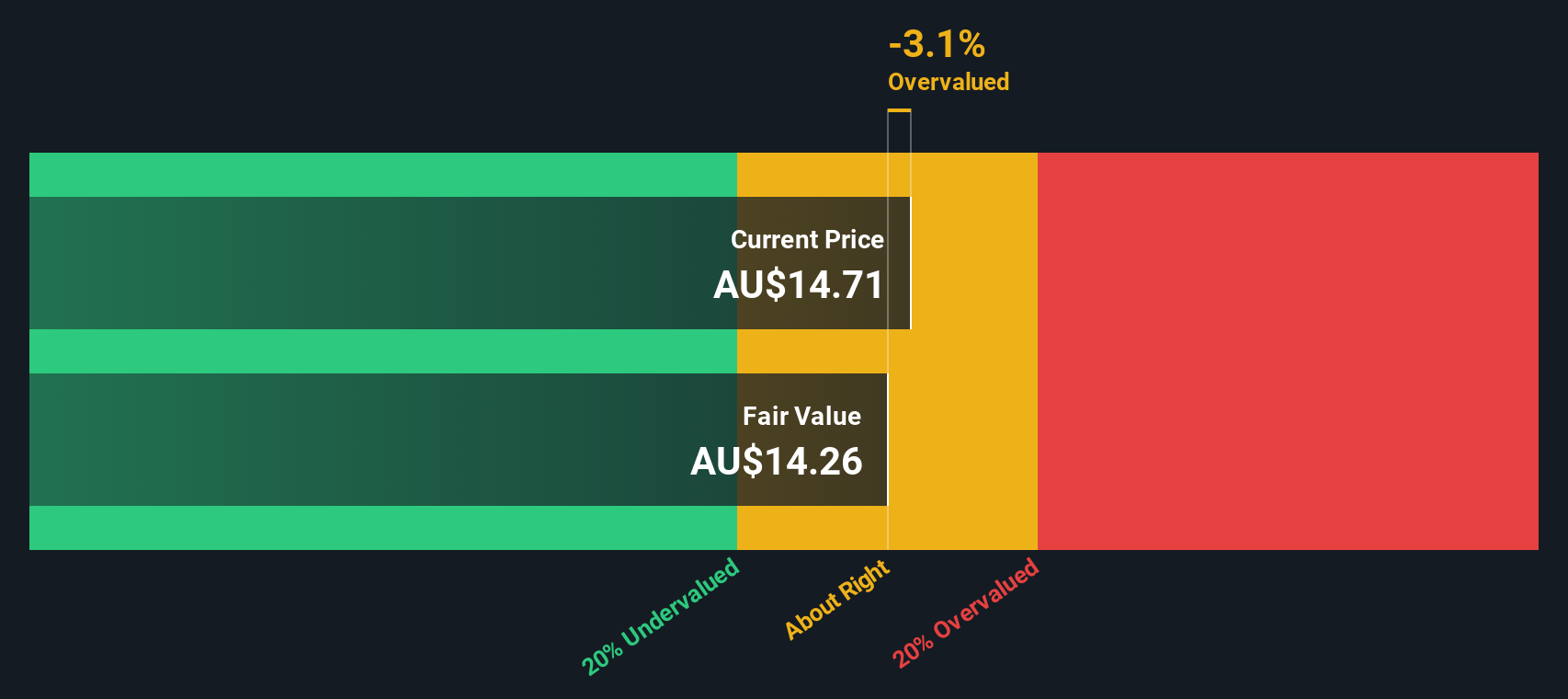

| Corporate Travel Management | 23.4x | 2.8x | 42.33% | ★★★☆☆☆ |

| Cromwell Property Group | NA | 4.5x | -15.07% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Corporate Travel Management is a global travel services company operating across Asia, Europe, North America, and Australia/New Zealand with a market capitalization of A$3.15 billion.

Operations: Corporate Travel Management generates revenue primarily through its travel services across Asia, Europe, North America, and Australia/New Zealand. The company's gross profit margin has shown an upward trend from 40.45% in December 2013 to 41.60% by December 2024. Operating expenses have increased over time, with general and administrative expenses being a significant component of these costs.

PE: 23.4x

Corporate Travel Management, a smaller player in the Australian market, has caught attention due to insider confidence demonstrated by Jamie Pherous purchasing 87,500 shares valued at approximately A$1.4 million. This move suggests potential growth prospects as earnings are forecasted to increase by 12% annually. Recent changes include Deloitte replacing PwC as auditors post-AGM on October 31, 2024. Despite relying solely on external borrowing for funding, the company's strategic initiatives may position it well for future expansion.

Data#3 (ASX:DTL)

Simply Wall St Value Rating: ★★★★☆☆

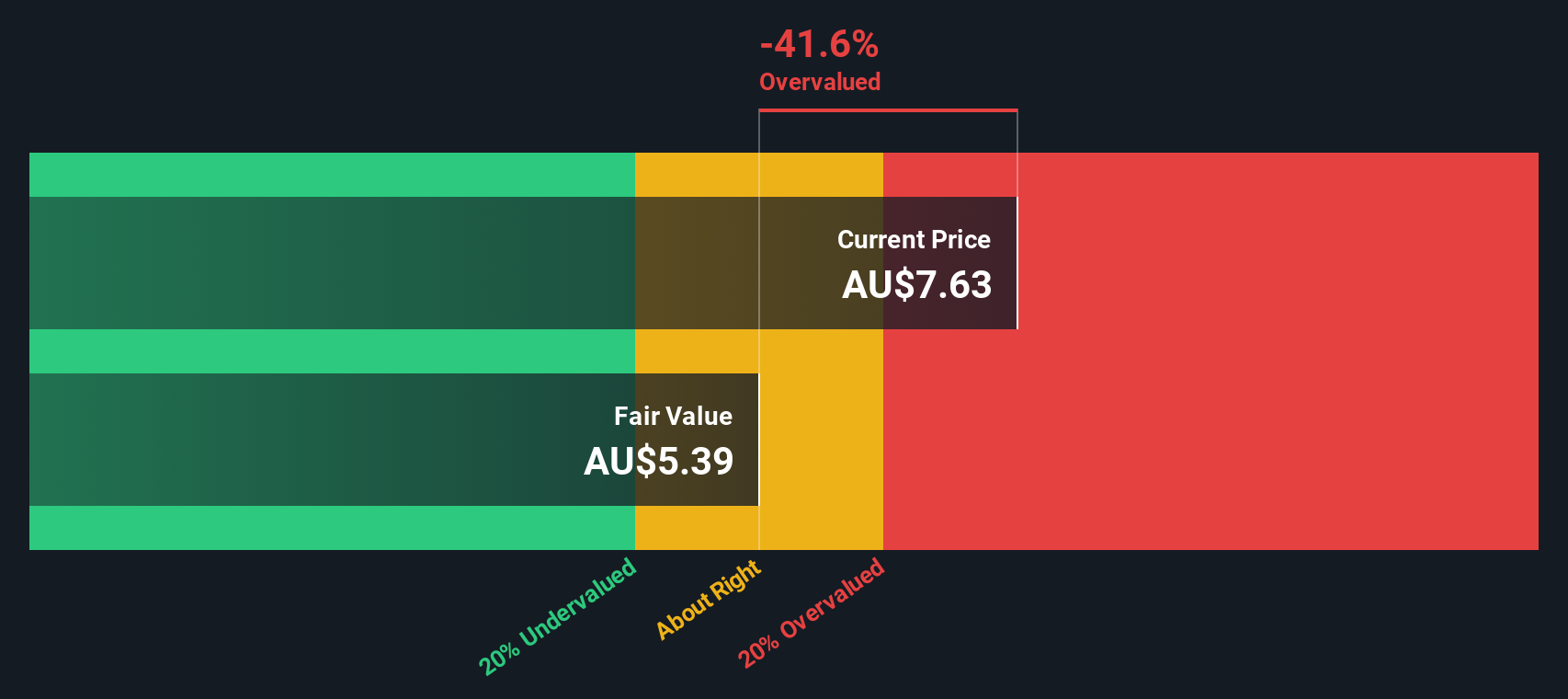

Overview: Data#3 is a value-added IT reseller and IT solutions provider with a market cap of A$1.13 billion.

Operations: The company generates revenue primarily through its role as a Value-Added IT Reseller and IT Solutions Provider. Over the observed periods, the net profit margin has shown variability, peaking at 5.38% in June 2024. The cost of goods sold (COGS) represents a significant portion of expenses, often exceeding A$700 million per period. Operating expenses are consistently around A$20 to A$26 million, with general and administrative expenses forming a notable part of this category.

PE: 26.6x

Data#3, a smaller player in the Australian market, has been drawing attention for its potential value. The company recently appointed Bronwyn Morris to its board, bringing extensive financial and governance expertise. With earnings expected to grow by 11% annually, Data#3's growth prospects appear promising despite reliance on external borrowing for funding. Insider confidence is evident from recent share purchases, indicating belief in the company's future trajectory. As it transitions auditors to PwC, strategic shifts may enhance operational efficiency moving forward.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

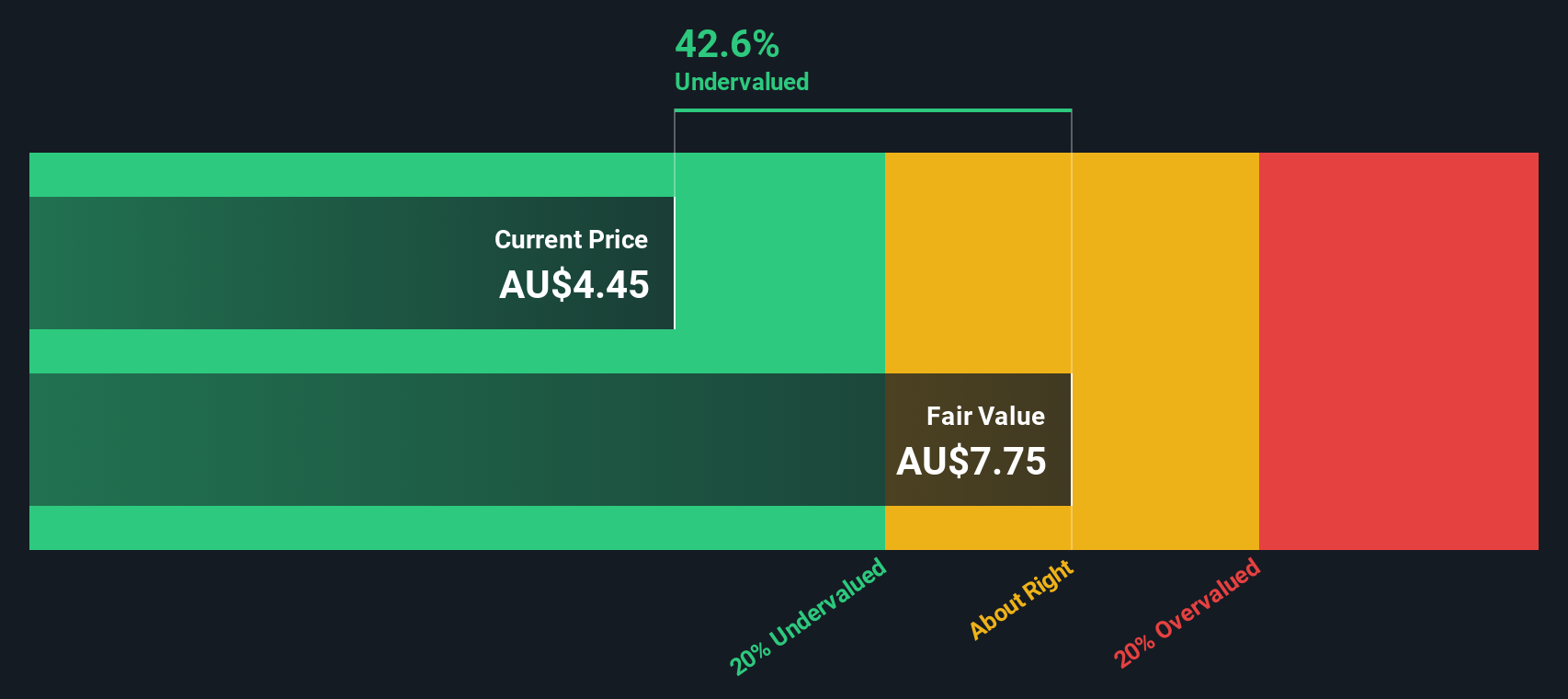

Overview: MFF Capital Investments is an investment company focused on managing a portfolio of high-quality international equities, with a market cap of approximately A$2.3 billion.

Operations: MFF Capital Investments generates revenue primarily from its equity investments, with a recent reported revenue of A$659.96 million. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold impacting its revenues. Operating expenses for the latest period were A$3.89 million, and non-operating expenses stood at A$208.72 million, contributing to a net income margin of 67.78%.

PE: 5.6x

MFF Capital Investments, a small Australian company, shows potential in the undervalued category. Christopher MacKay's insider confidence is evident with their purchase of 1,299,779 shares valued at A$5.03 million between January and September 2024. Despite relying entirely on external borrowing for funding, which poses higher risks compared to customer deposits, the company's strategic moves suggest a focus on growth and stability. The recent AGM highlighted ongoing efforts to navigate these challenges effectively.

- Click here to discover the nuances of MFF Capital Investments with our detailed analytical valuation report.

Assess MFF Capital Investments' past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 28 Undervalued ASX Small Caps With Insider Buying right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTD

Corporate Travel Management

A travel management solutions company, manages the procurement and delivery of travel services in Australia and New Zealand, North America, Asia, and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives