- Australia

- /

- Capital Markets

- /

- ASX:HUB

If You Had Bought HUB24 (ASX:HUB) Shares Five Years Ago You'd Have Made 1228%

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. For example, the HUB24 Limited (ASX:HUB) share price is up a whopping 1228% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. It's down 1.2% in the last seven days.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for HUB24

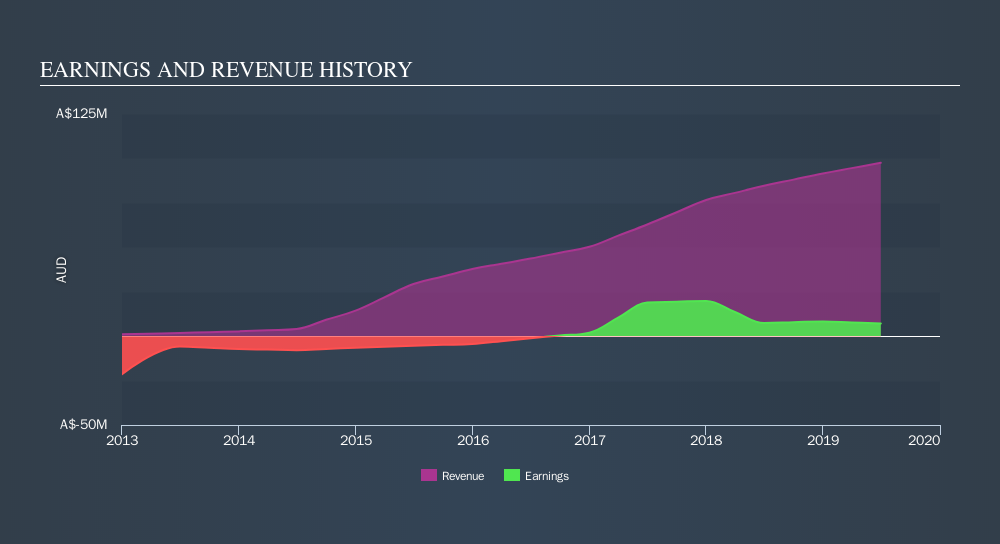

Given that HUB24 only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years HUB24 saw its revenue grow at 35% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 68%(per year) over the same period. Despite the strong run, top performers like HUB24 have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

The company's revenue and earnings (over time) are depicted in the image below.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling HUB24 stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for HUB24 the TSR over the last 5 years was 1236%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

HUB24 provided a TSR of 8.9% over the last twelve months. But that was short of the market average. On the bright side, the longer term returns (running at about 68% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:HUB

HUB24

A financial services company, provides integrated platform, technology, and data solutions to wealth industry in Australia.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives