- Australia

- /

- Consumer Finance

- /

- ASX:HMY

3 ASX Penny Stocks With Under A$2B Market Cap

Reviewed by Simply Wall St

The ASX200 is poised to open slightly lower today, despite a strong performance on Wall Street driven by impressive Big Tech earnings. In the context of current market dynamics, investors may find value in smaller companies that possess solid financial foundations and growth potential. While 'penny stocks' is an older term, it still captures the essence of investing in smaller or newer companies that can offer both affordability and opportunity for growth.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.715 | A$138.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.88 | A$1.06B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.37 | A$64.63M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.62 | A$403.96M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$115.38M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.31 | A$2.63B | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$155.64M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.94 | A$652.16M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.71 | A$1.24B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 990 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

BKI Investment (ASX:BKI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BKI Investment Company Limited is a publicly owned investment manager with a market capitalization of A$1.36 billion.

Operations: The company generates revenue of A$68.44 million from the securities industry segment.

Market Cap: A$1.36B

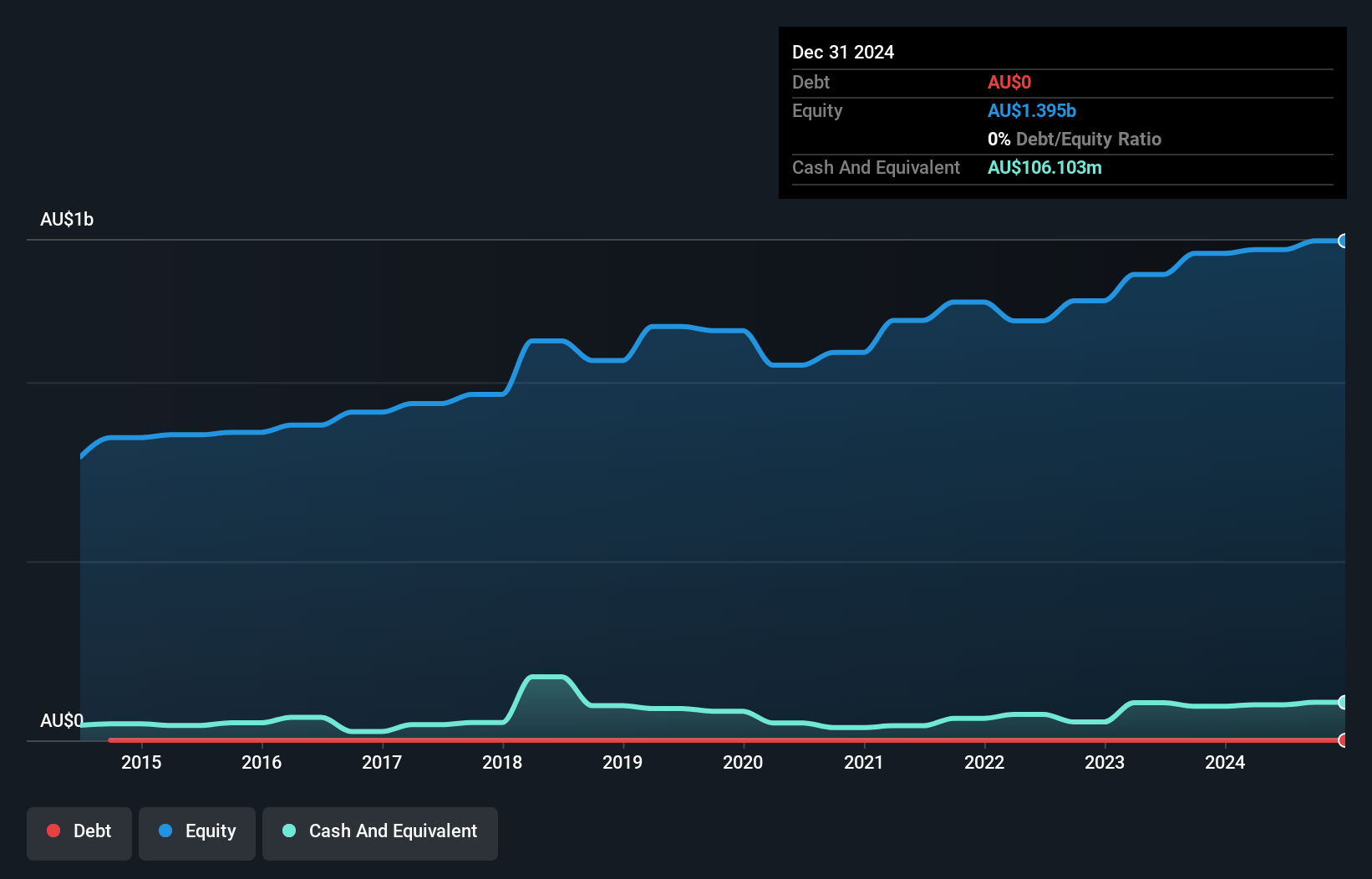

BKI Investment, with a market capitalization of A$1.36 billion, has shown stable financials despite some challenges. The company is debt-free, eliminating concerns over interest coverage and debt management. However, its dividend yield of 4.67% is not well covered by earnings or free cash flows, raising sustainability questions. BKI's Return on Equity is low at 4.4%, and it experienced negative earnings growth (-9.7%) over the past year compared to industry averages. While insider selling was significant recently, the board remains highly experienced with an average tenure of 21.6 years, providing stability in governance amidst these concerns.

- Click here to discover the nuances of BKI Investment with our detailed analytical financial health report.

- Explore historical data to track BKI Investment's performance over time in our past results report.

Harmoney (ASX:HMY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Harmoney Corp Limited operates as an online lender offering secured and unsecured personal loans in Australia and New Zealand, with a market cap of A$67.30 million.

Operations: The company generates revenue through its Financial Services - Consumer segment, which amounted to A$37.09 million.

Market Cap: A$67.3M

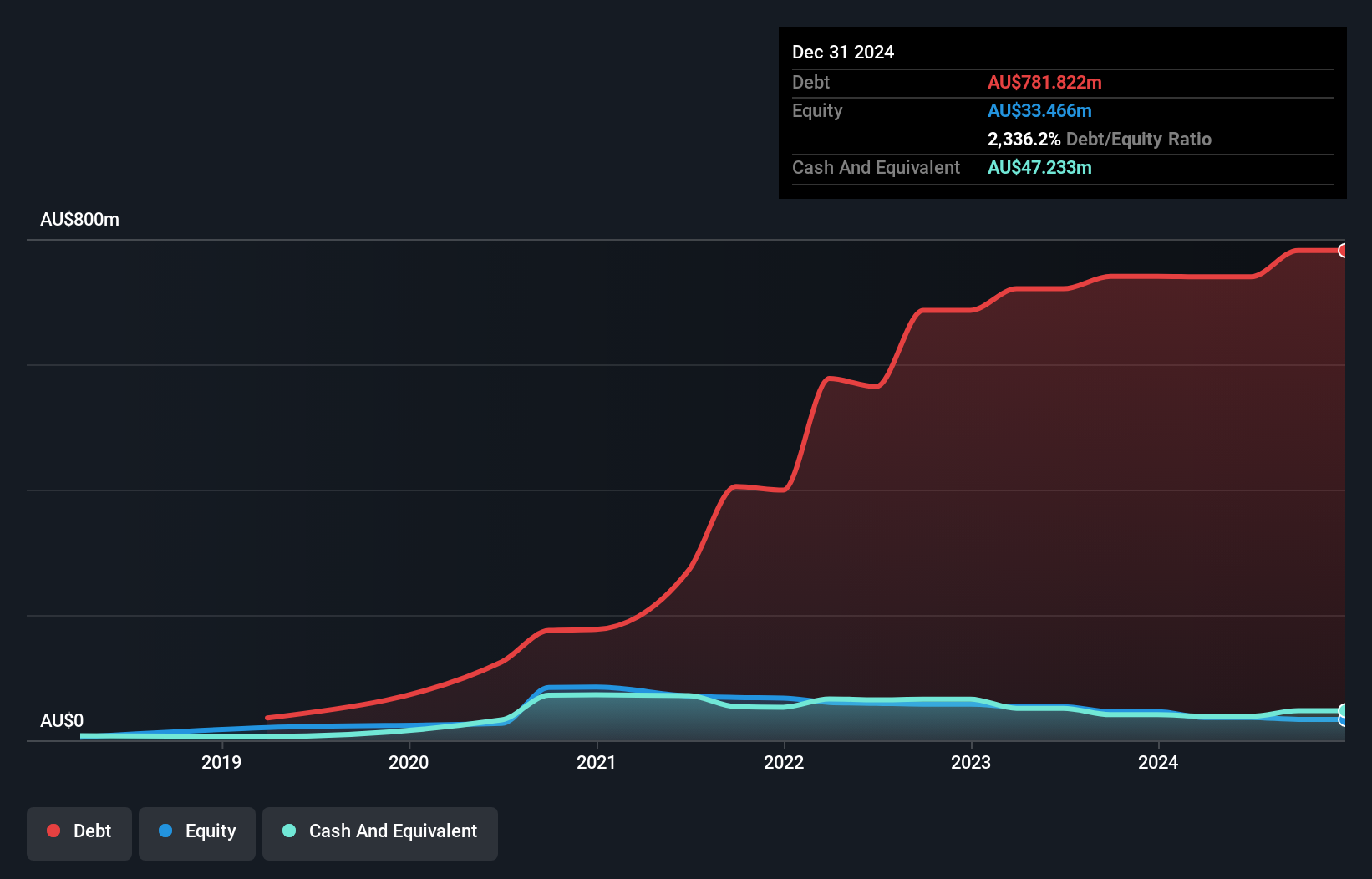

Harmoney Corp Limited, with a market cap of A$67.30 million, recently announced a share buyback program to repurchase up to 5% of its issued shares by April 2026. Despite being unprofitable, the company has improved its financial position, reporting A$64.44 million in revenue for the half year ending December 2024 and achieving net income of A$2.01 million. Harmoney's board and management are experienced, but challenges remain with high debt levels and significant volatility in share price. The company's cash runway is robust due to positive free cash flow, supporting potential future growth opportunities.

- Unlock comprehensive insights into our analysis of Harmoney stock in this financial health report.

- Examine Harmoney's earnings growth report to understand how analysts expect it to perform.

Qualitas (ASX:QAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qualitas (ASX:QAL) is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt restructuring, third-party capital raisings, and consulting services, with a market cap of A$730.71 million.

Operations: The company generates revenue through its Direct Lending segment, which contributes A$23.03 million, and its Funds Management segment, with A$21.46 million.

Market Cap: A$730.71M

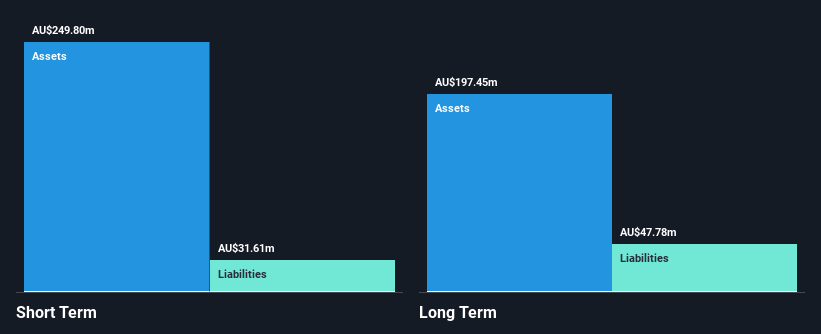

Qualitas, with a market cap of A$730.71 million, has shown robust earnings growth of 23.5% over the past year, although its Return on Equity remains low at 8.1%. The company's revenue streams are well-diversified across Direct Lending and Funds Management segments, contributing A$23.03 million and A$21.46 million respectively. Recent board changes include the appointment of Bruce MacDiarmid as an independent non-executive director, bringing significant expertise from investment banking sectors. Despite negative operating cash flow impacting debt coverage, Qualitas maintains strong liquidity with short-term assets exceeding liabilities and more cash than total debt on hand.

- Dive into the specifics of Qualitas here with our thorough balance sheet health report.

- Gain insights into Qualitas' future direction by reviewing our growth report.

Next Steps

- Unlock our comprehensive list of 990 ASX Penny Stocks by clicking here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmoney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMY

Harmoney

Provides secured and unsecured personal loans through online in Australia and New Zealand.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives