- Australia

- /

- Capital Markets

- /

- ASX:HMC

3 Undervalued Small Caps In Global With Insider Buying To Consider

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced challenges, with the Russell 2000 Index dropping 1.83% amid cautious sentiment and interest rate concerns. Despite these headwinds, opportunities may exist for discerning investors who can identify companies with solid fundamentals and potential for growth in undervalued segments of the market.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Centurion | 4.0x | 3.4x | 37.11% | ★★★★★★ |

| Eurocell | 15.5x | 0.3x | 42.74% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.94% | ★★★★★☆ |

| Senior | 21.9x | 0.7x | 33.49% | ★★★★★☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.58% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.8x | 0.4x | -442.61% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 19.48% | ★★★☆☆☆ |

| Chinasoft International | 23.1x | 0.7x | -1266.63% | ★★★☆☆☆ |

| CVS Group | 43.3x | 1.2x | 30.76% | ★★★☆☆☆ |

| Linc | NA | NA | 0.35% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

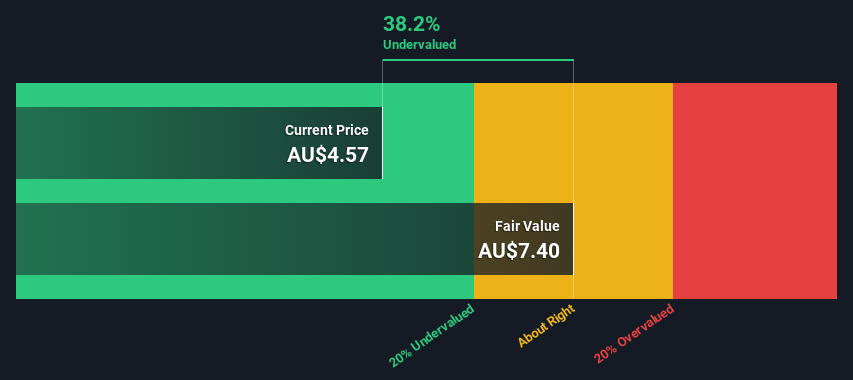

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMC Capital is an investment management firm operating in digital, real estate, private credit, and private equity sectors with a market cap of A$1.35 billion.

Operations: HMC Capital generates revenue from digital, real estate, private credit, and private equity segments. The company has shown a gross profit margin of 100% in recent periods. Operating expenses have been significant, with general and administrative expenses being a notable component.

PE: 9.0x

HMC Capital, a smaller company in the investment landscape, demonstrates potential for growth with earnings projected to rise by 6.07% annually. Despite relying entirely on external borrowing, which poses higher risk, insider confidence is evident as Mario Verrocchi increased their shareholding by 262%, investing A$20.3 million. Recent events include an AGM scheduled for November 19, 2025, addressing key financial and governance matters. As it navigates these dynamics, HMC's future prospects remain intriguing amidst industry challenges.

- Navigate through the intricacies of HMC Capital with our comprehensive valuation report here.

Evaluate HMC Capital's historical performance by accessing our past performance report.

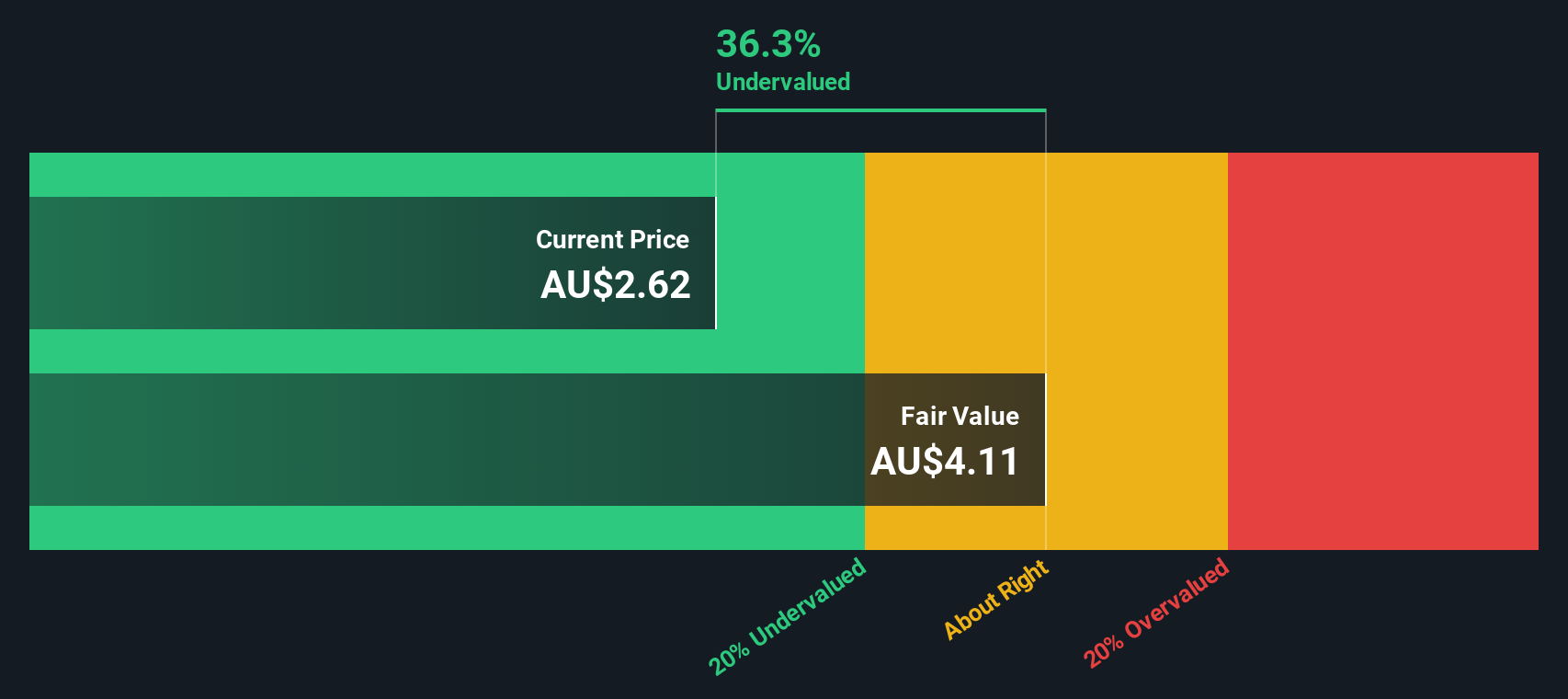

Waypoint REIT (ASX:WPR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Waypoint REIT is a real estate investment trust focused on owning and managing fuel and convenience retail investment properties, with a market capitalization of A$2.89 billion.

Operations: The company generates revenue primarily from its fuel and convenience retail investment properties, with a gross profit margin reaching 100% in recent periods. Operating expenses have been minimal, while non-operating expenses have significantly impacted net income margins, which varied widely from -0.48% to 2.49%.

PE: 9.7x

Waypoint REIT, a smaller company in the property sector, shows potential despite some challenges. Its earnings are expected to decline by 5.4% annually over the next three years, but recent insider confidence through share purchases suggests belief in its future value. The company reported A$81.9 million in sales for H1 2025 and increased net income to A$137.1 million from A$93.3 million the previous year, indicating operational improvements amidst a challenging financial landscape reliant on external borrowing.

- Dive into the specifics of Waypoint REIT here with our thorough valuation report.

Gain insights into Waypoint REIT's historical performance by reviewing our past performance report.

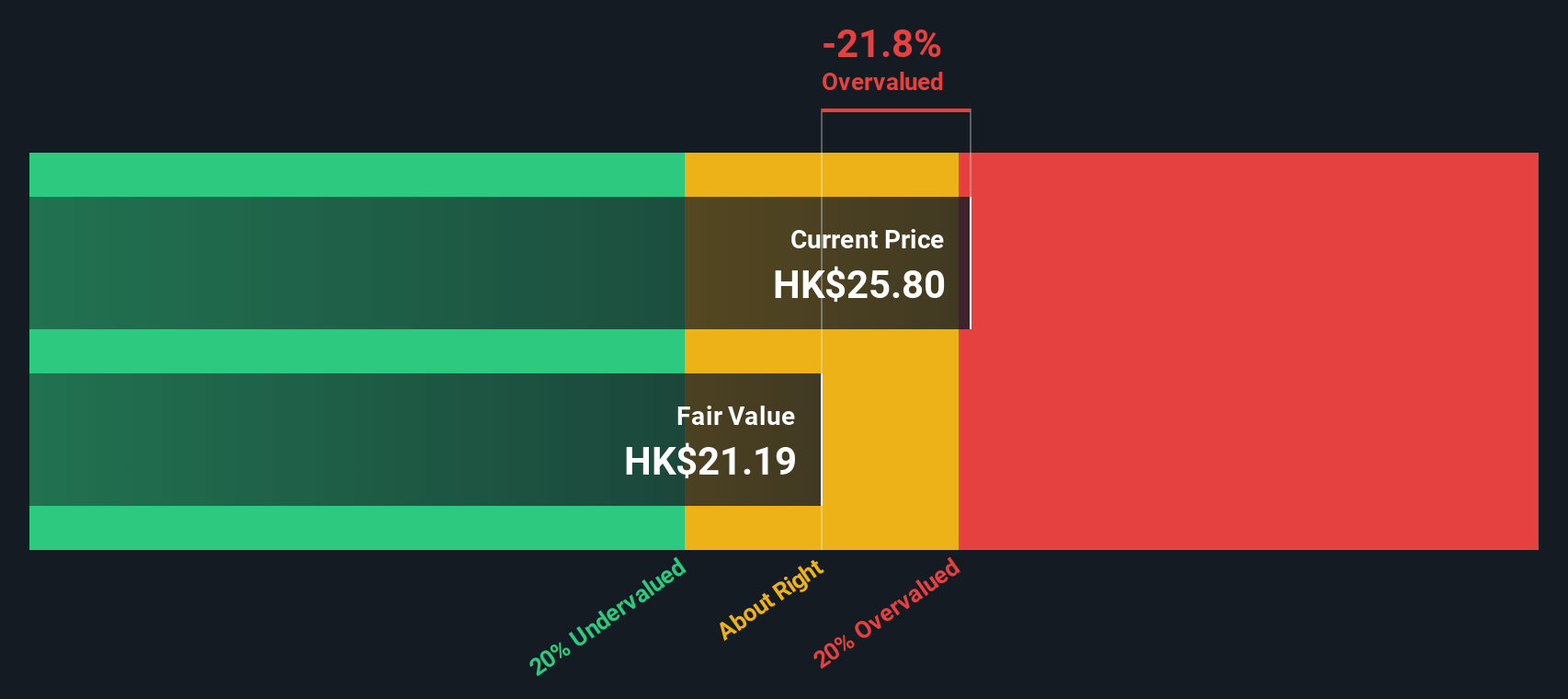

Luk Fook Holdings (International) (SEHK:590)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Luk Fook Holdings (International) operates as a jewelry retailer and wholesaler with a focus on markets in Hong Kong, Macau, Mainland China, and overseas, and has a market capitalization of HK$10.78 billion.

Operations: The company's revenue streams are primarily derived from retailing in Hong Kong, Macau, and overseas markets. The gross profit margin has shown variability over the periods, with a peak of 33.11% as of March 2025. Operating expenses have consistently impacted profitability, with sales and marketing being a significant component.

PE: 13.3x

Luk Fook Holdings (International) has shown insider confidence with Founder Wai Sheung Wong purchasing 635,000 shares for HK$9.2 million, reflecting a 5% increase in their holdings. Recent sales results for Q2 2025 indicate growth in retailing revenue and same-store sales by 15% and 10%, respectively, compared to the previous quarter. The company faces higher risk due to reliance on external borrowing but anticipates earnings growth of nearly 18% annually, suggesting potential value despite its small market presence.

Key Takeaways

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 136 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HMC Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMC

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives