- Australia

- /

- Capital Markets

- /

- ASX:GQG

We Ran A Stock Scan For Earnings Growth And GQG Partners (ASX:GQG) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like GQG Partners (ASX:GQG), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for GQG Partners

GQG Partners' Improving Profits

In the last three years GQG Partners' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. GQG Partners' EPS shot up from US$0.096 to US$0.15; a result that's bound to keep shareholders happy. That's a commendable gain of 53%.

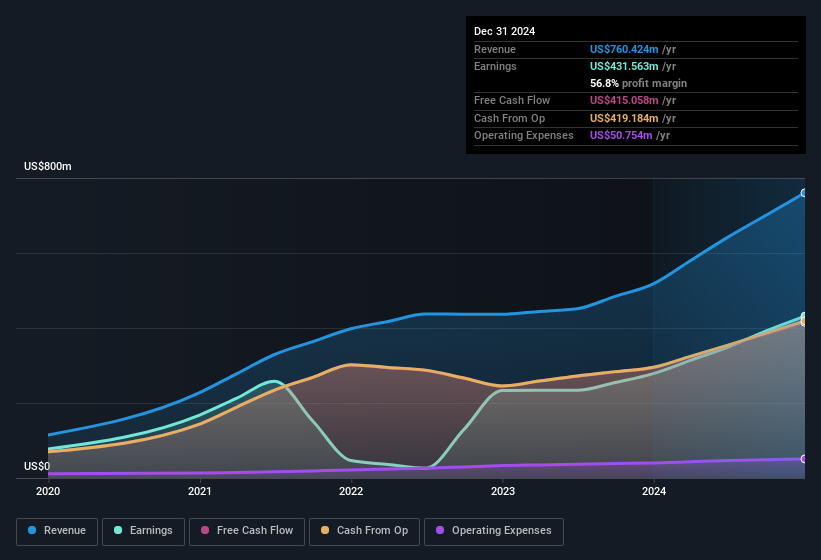

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for GQG Partners remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 47% to US$760m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for GQG Partners.

Are GQG Partners Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for GQG Partners, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Founder Rajiv Jain paid AU$503k, for stock at AU$2.28 per share. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for GQG Partners will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 74% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. And their holding is extremely valuable at the current share price, totalling US$5.3b. That level of investment from insiders is nothing to sneeze at.

Does GQG Partners Deserve A Spot On Your Watchlist?

For growth investors, GQG Partners' raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. These things considered, this is one stock worth watching. Now, you could try to make up your mind on GQG Partners by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Keen growth investors love to see insider activity. Thankfully, GQG Partners isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GQG

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives