- Australia

- /

- Diversified Financial

- /

- ASX:FND

Even With A 50% Surge, Cautious Investors Are Not Rewarding Findi Limited's (ASX:FND) Performance Completely

Findi Limited (ASX:FND) shares have continued their recent momentum with a 50% gain in the last month alone. The last month tops off a massive increase of 158% in the last year.

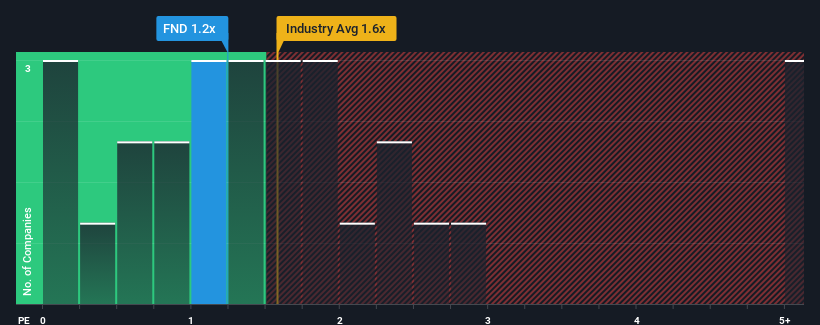

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Findi's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Diversified Financial industry in Australia is also close to 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Findi

How Findi Has Been Performing

Recent times have been quite advantageous for Findi as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Findi will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Findi will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Findi?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Findi's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 110% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 42% shows it's a great look while it lasts.

In light of this, it's peculiar that Findi's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Findi's P/S?

Findi appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As mentioned previously, Findi currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Having said that, be aware Findi is showing 6 warning signs in our investment analysis, and 3 of those are a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

Low risk and slightly overvalued.

Market Insights

Community Narratives