The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Findi (ASX:FND). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Findi

Findi's Improving Profits

In the last three years Findi's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. It's good to see that Findi's EPS has grown from AU$0.067 to AU$0.083 over twelve months. There's little doubt shareholders would be happy with that 24% gain.

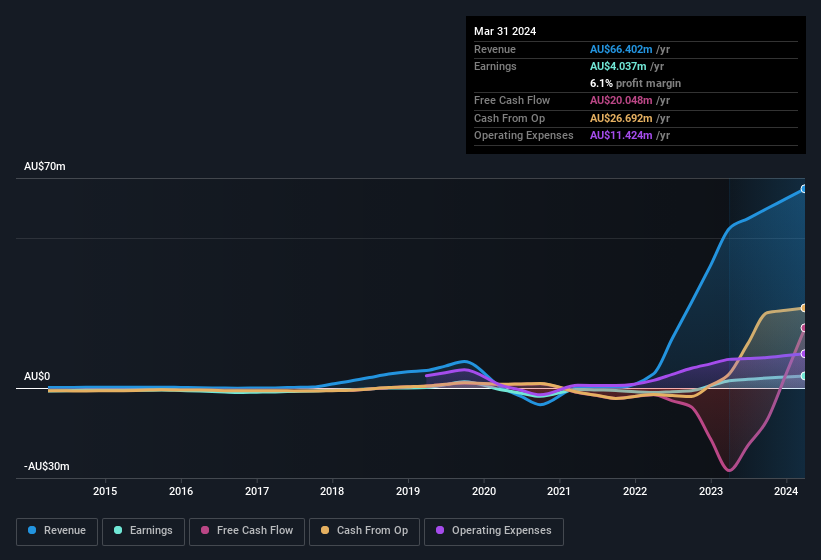

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Findi is growing revenues, and EBIT margins improved by 5.5 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Findi isn't a huge company, given its market capitalisation of AU$253m. That makes it extra important to check on its balance sheet strength.

Are Findi Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth AU$1.6m) this was overshadowed by a mountain of buying, totalling AU$8.7m in just one year. This bodes well for Findi as it highlights the fact that those who are important to the company having a lot of faith in its future. Zooming in, we can see that the biggest insider purchase was by company insider Jack Yetiv for AU$8.4m worth of shares, at about AU$4.73 per share.

On top of the insider buying, we can also see that Findi insiders own a large chunk of the company. Owning 36% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about AU$91m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is Findi Worth Keeping An Eye On?

One important encouraging feature of Findi is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. You should always think about risks though. Case in point, we've spotted 2 warning signs for Findi you should be aware of, and 1 of them is concerning.

Keen growth investors love to see insider activity. Thankfully, Findi isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

Exceptional growth potential with imperfect balance sheet.

Market Insights

Community Narratives