- Australia

- /

- Capital Markets

- /

- ASX:EDC

Eildon Capital Fund's (ASX:EDC) Upcoming Dividend Will Be Larger Than Last Year's

Eildon Capital Fund's (ASX:EDC) dividend will be increasing to AU$0.02 on 23rd of July. This makes the dividend yield 7.6%, which is above the industry average.

Check out our latest analysis for Eildon Capital Fund

Eildon Capital Fund Is Paying Out More Than It Is Earning

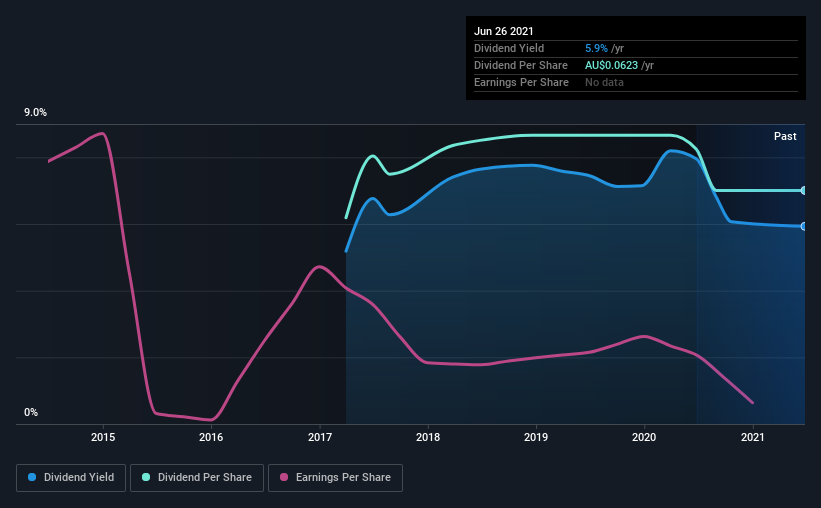

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before this announcement, Eildon Capital Fund was paying out 261% of what it was earning, and not generating any free cash flows either. This high of a dividend payment could start to put pressure on the balance sheet in the future.

Earnings per share could rise by 39.5% over the next year if things go the same way as they have for the last few years. Assuming the dividend continues along recent trends, we think the payout ratio could reach 206%, which probably can't continue without starting to put some pressure on the balance sheet.

Eildon Capital Fund's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. Since 2017, the dividend has gone from AU$0.055 to AU$0.062. This works out to be a compound annual growth rate (CAGR) of approximately 3.2% a year over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Eildon Capital Fund Might Find It Hard To Grow Its Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's encouraging to see Eildon Capital Fund has been growing its earnings per share at 39% a year over the past five years. EPS has been growing well, but Eildon Capital Fund has been paying out a massive proportion of its earnings, which can make the dividend tough to maintain.

We'd also point out that Eildon Capital Fund has issued stock equal to 15% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Eildon Capital Fund's payments are rock solid. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 5 warning signs for Eildon Capital Fund (1 is a bit unpleasant!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading Eildon Capital Fund or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eildon Capital Fund might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EDC

Eildon Capital Fund

A real estate investment firm specializing in senior financing, preferred equity, mezzanine and bridge financing, and equity financing.

Flawless balance sheet slight.

Market Insights

Community Narratives