- Australia

- /

- Construction

- /

- ASX:TEA

Discovering Australia's Hidden Stock Gems This July 2025

Reviewed by Simply Wall St

As the Australian market experiences a slight pullback from its unexpected climb into the 8,700s, investors are keeping a close eye on how global events and US earnings reports might influence future movements. In this environment, identifying hidden stock gems involves looking for companies that can capitalize on unique opportunities or navigate challenges effectively, making them well-positioned to thrive despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Diversified United Investment (ASX:DUI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.16 billion.

Operations: DUI generates revenue primarily from its investment company segment, amounting to A$46.41 million. The company's financial performance is influenced by its ability to manage investment returns effectively.

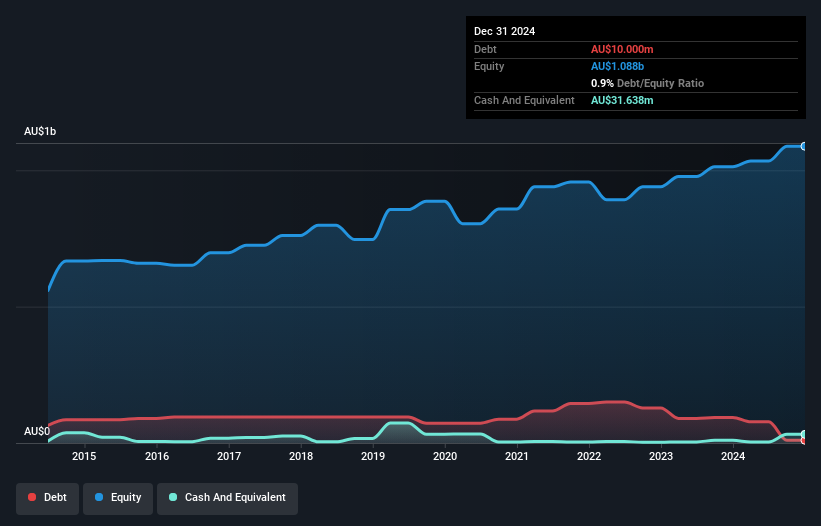

Diversified United Investment (DUI) showcases a strong financial position with its debt to equity ratio dropping from 8.2 to 0.9 over the past five years, reflecting prudent financial management. The company has more cash than total debt, and its interest payments are comfortably covered by EBIT at 12.2x coverage, indicating robust earnings quality. Despite facing a negative earnings growth of 7% last year compared to the industry's average growth of 23.6%, DUI remains profitable with positive free cash flow and recently extended its share buyback plan until May 2026, suggesting confidence in future performance improvements within the capital markets sector.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian-listed investment company with a market cap of A$751.06 million, focusing on generating capital growth by investing in a concentrated portfolio of high-conviction ideas from leading fund managers.

Operations: Hearts and Minds Investments derives its revenue primarily from investment activities, amounting to A$191.25 million. The company's financial performance is highlighted by a net profit margin of 25%.

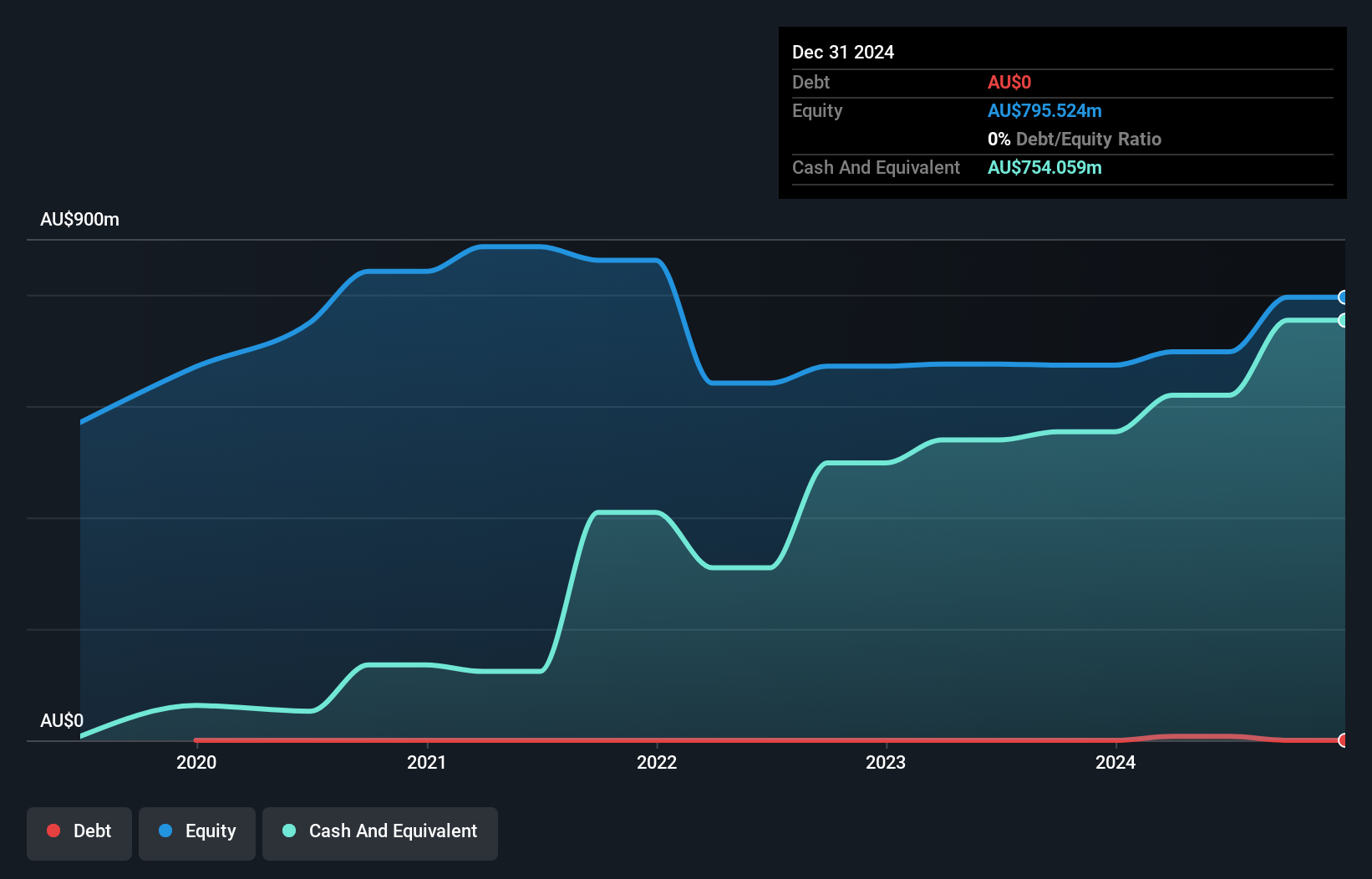

Hearts and Minds Investments, a nimble player in the Australian market, boasts a Price-To-Earnings ratio of 5.9x, considerably lower than the market average of 18.4x. This financial company is debt-free and has been for five years, eliminating concerns over interest payments. Its earnings skyrocketed by 466% last year, outpacing the Capital Markets industry growth of 23%. Despite not having positive free cash flow recently, its high level of non-cash earnings suggests robust operational efficiency. While future projections aren't specified here, its current valuation and growth metrics present interesting potential for investors exploring this sector.

- Click to explore a detailed breakdown of our findings in Hearts and Minds Investments' health report.

Gain insights into Hearts and Minds Investments' past trends and performance with our Past report.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia and has a market cap of A$843.66 million.

Operations: Tasmea generates revenue through its services in shutdown, maintenance, emergency breakdown, and capital upgrades within Australia. With a market capitalization of A$843.66 million, the company focuses on providing essential industrial services across various sectors.

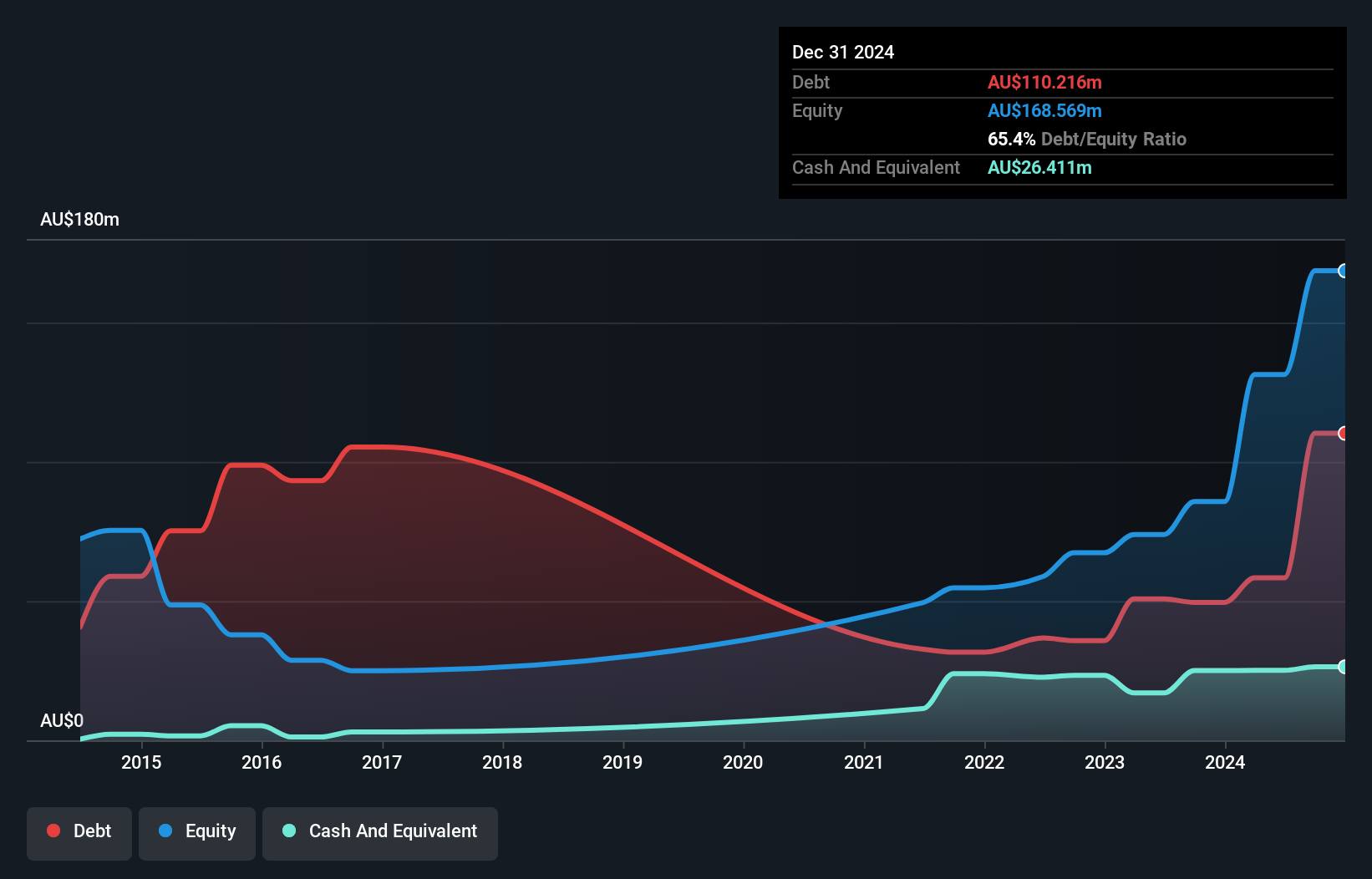

Tasmea, a promising player in the Australian market, has seen its earnings surge by 75% over the past year, outpacing industry growth of 28.7%. This robust performance is backed by high-quality earnings and a positive free cash flow position. The company has significantly reduced its debt to equity ratio from 137.6% to 65.4% over five years, although net debt remains relatively high at nearly 50%. With interest payments well covered by EBIT at a multiple of 10.7x and trading slightly below fair value estimates, Tasmea seems poised for continued profitable growth amid strong customer demand and strategic execution.

Turning Ideas Into Actions

- Embark on your investment journey to our 49 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tasmea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TEA

Tasmea

Provides shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives