- Australia

- /

- Capital Markets

- /

- ASX:MFF

Discover 3 ASX Penny Stocks With Market Caps Under A$3B

Reviewed by Simply Wall St

As Australian shares anticipate a modest gain amid the Reserve Bank's unexpected decision to hold rates, investors are navigating a complex landscape influenced by global trade tensions and fluctuating commodity prices. In this context, penny stocks—though an outdated term—remain relevant for those seeking opportunities in smaller or emerging companies. By focusing on financial health and growth potential, these stocks can offer both stability and upside, making them an intriguing option for investors looking to explore promising avenues within the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.43 | A$114.63M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.93 | A$451.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.70 | A$449.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.73 | A$847.84M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.485 | A$892.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.99 | A$189.33M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.79 | A$144.17M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 468 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market cap of A$825.98 million.

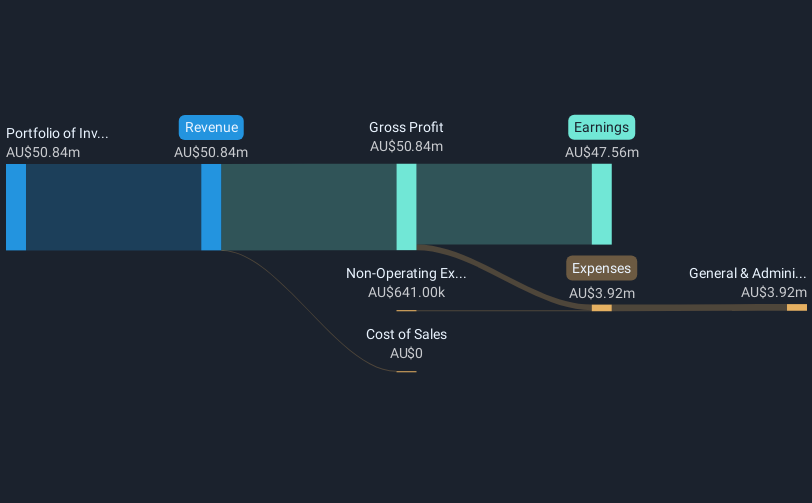

Operations: The company's revenue is primarily derived from its portfolio of investments, amounting to A$50.84 million.

Market Cap: A$825.98M

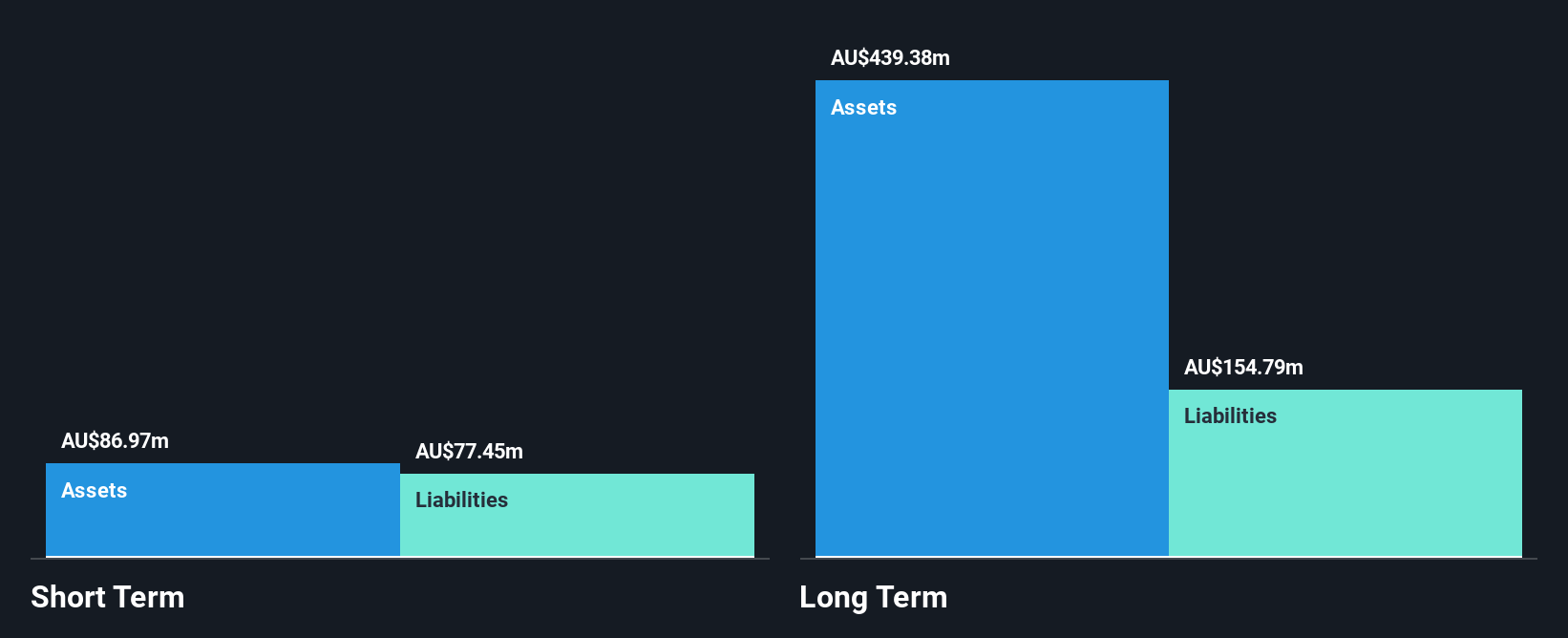

Djerriwarrh Investments demonstrates financial stability with short-term assets of A$53.2 million covering both short and long-term liabilities, while its debt is well covered by operating cash flow. The company's earnings have grown significantly, outpacing the broader Capital Markets industry over the past year. Despite a low Return on Equity of 5.4%, Djerriwarrh's interest payments are well covered by EBIT at 21.1 times coverage, indicating strong financial management. However, its dividend yield of 4.86% isn't fully supported by free cash flows, suggesting potential sustainability concerns in this area despite overall positive earnings growth trends and reduced debt levels over time.

- Take a closer look at Djerriwarrh Investments' potential here in our financial health report.

- Explore historical data to track Djerriwarrh Investments' performance over time in our past results report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties with a market capitalization of A$647.92 million.

Operations: The company's revenue is primarily generated from its Chatree segment, amounting to A$210.69 million.

Market Cap: A$647.92M

Kingsgate Consolidated Limited's financial profile highlights its robust earnings growth, with a remarkable 1203% increase over the past year, surpassing industry averages. The company's Return on Equity stands at an outstanding 74.4%, while its net debt to equity ratio is satisfactory at 17.9%. Despite high non-cash earnings and short-term assets exceeding short-term liabilities, long-term liabilities remain uncovered by current assets. Recent announcements of a share buyback program reflect strategic capital management aimed at enhancing shareholder value. Trading significantly below estimated fair value, Kingsgate presents potential opportunities within the penny stock segment in Australia’s mining sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Kingsgate Consolidated.

- Examine Kingsgate Consolidated's earnings growth report to understand how analysts expect it to perform.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.61 billion.

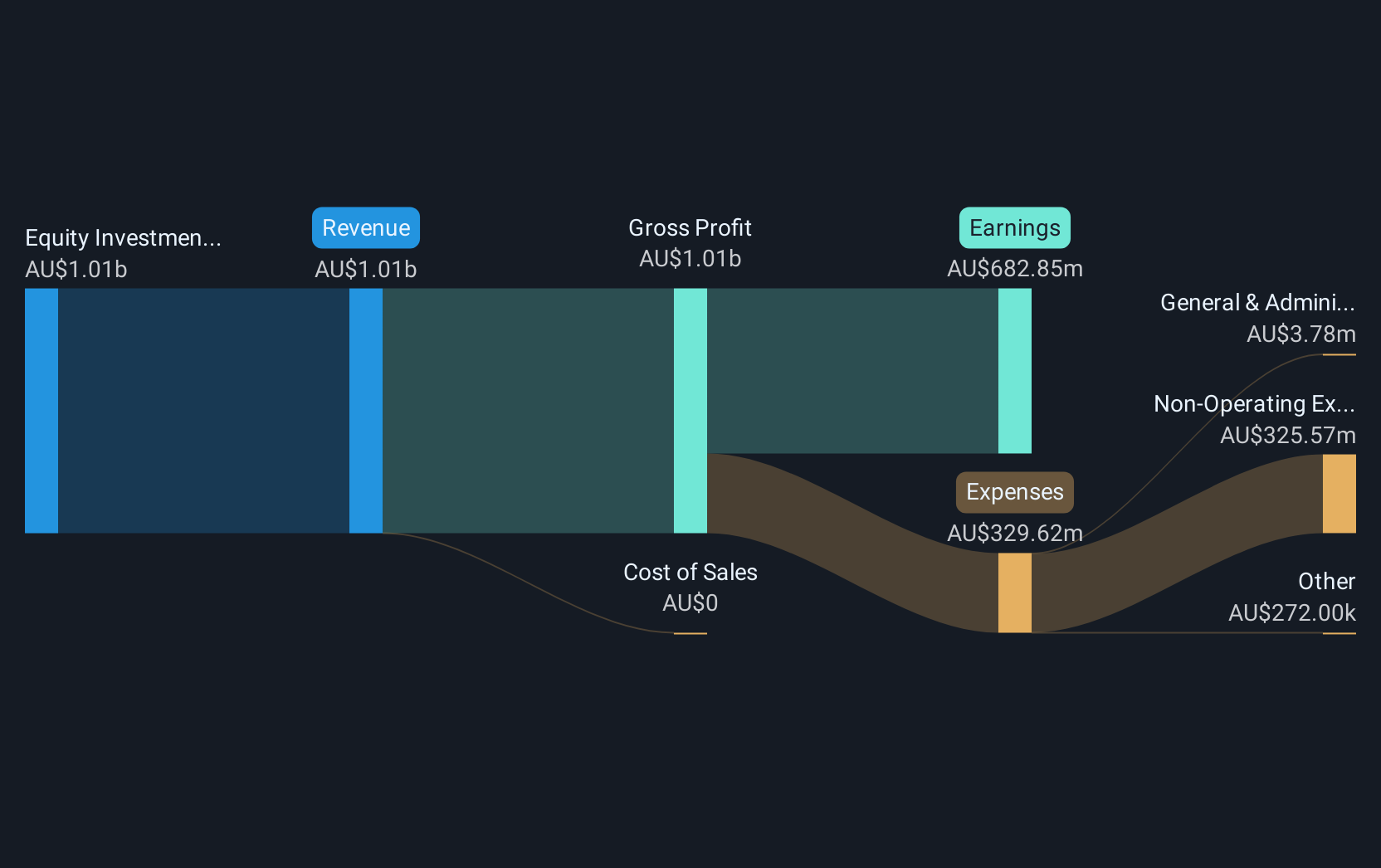

Operations: The company generates revenue primarily through its equity investment segment, amounting to A$1.01 billion.

Market Cap: A$2.61B

MFF Capital Investments demonstrates strong financial health, with cash exceeding total debt and short-term assets of A$3.0 billion covering both short-term and long-term liabilities. The company boasts high-quality earnings, a robust Return on Equity of 28.2%, and impressive earnings growth of 51.9% over the past year, outpacing industry averages. MFF's stable weekly volatility at 3% indicates consistent performance while maintaining shareholder value without significant dilution. Trading at a discount to fair value, it offers an attractive dividend yield of 3.6%. Its experienced board further supports strategic decision-making in the capital markets sector.

- Unlock comprehensive insights into our analysis of MFF Capital Investments stock in this financial health report.

- Review our historical performance report to gain insights into MFF Capital Investments' track record.

Taking Advantage

- Embark on your investment journey to our 468 ASX Penny Stocks selection here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives