- Australia

- /

- Capital Markets

- /

- ASX:DJW

ASX Penny Stocks Spotlight: Barton Gold Holdings And Two More To Watch

Reviewed by Simply Wall St

The Australian market has been a mix of ups and downs, with the ASX200 reflecting current economic shifts and investor sentiments. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer unique growth opportunities. By focusing on those with strong financials, investors may uncover potential gems among these lesser-known stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.72 | A$138.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.91 | A$1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.54 | A$72.65M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.69 | A$414.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.41M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.70 | A$451.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.34 | A$158.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.11 | A$709.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.54 | A$754.72M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.81 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 991 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Barton Gold Holdings (ASX:BGD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Barton Gold Holdings Limited focuses on the exploration and development of mineral projects in South Australia, with a market capitalization of A$123.69 million.

Operations: Barton Gold Holdings Limited has not reported any revenue segments.

Market Cap: A$123.69M

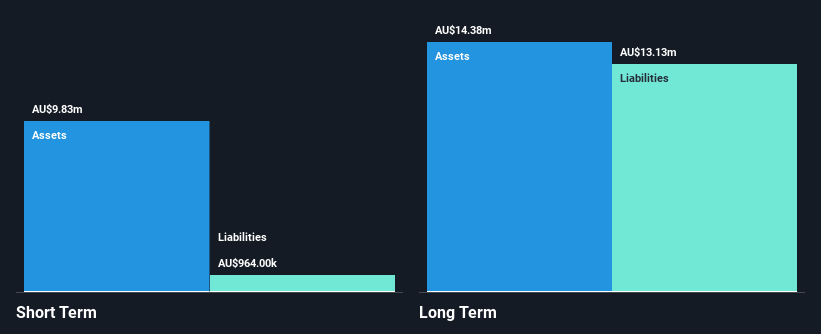

Barton Gold Holdings, with a market capitalization of A$123.69 million, is pre-revenue and currently unprofitable. The company has recently reported high-grade assays from its Tarcoola Gold Project, indicating potential for significant mineralization. Despite having no debt and an experienced management team, Barton faces financial challenges as short-term assets do not cover long-term liabilities. However, it maintains a cash runway exceeding one year based on current free cash flow levels. Revenue is forecast to grow significantly by 90.22% annually, though profitability remains elusive in the near term according to analyst estimates.

- Unlock comprehensive insights into our analysis of Barton Gold Holdings stock in this financial health report.

- Understand Barton Gold Holdings' earnings outlook by examining our growth report.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market capitalization of A$802.31 million.

Operations: The company generates revenue primarily from its portfolio of investments, amounting to A$50.84 million.

Market Cap: A$802.31M

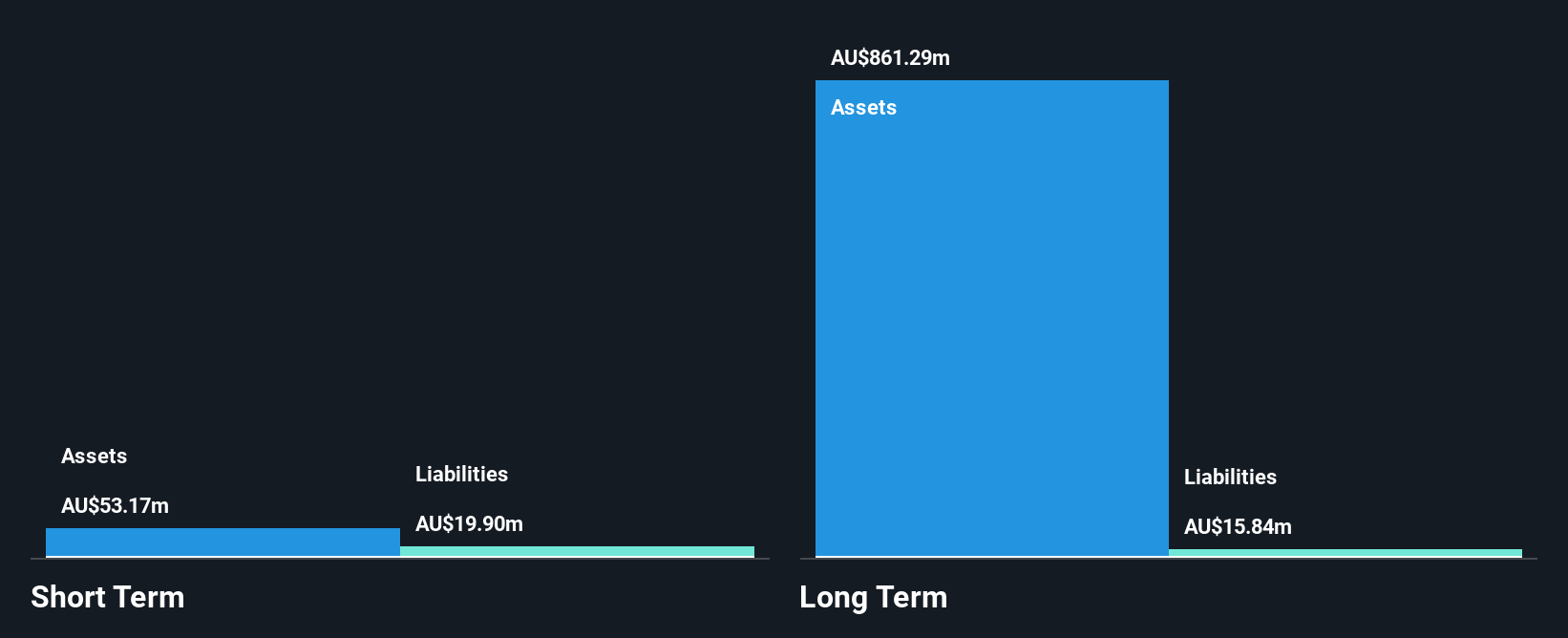

Djerriwarrh Investments, with a market cap of A$802.31 million, demonstrates stable financial health and consistent growth. Its earnings surged by 57.3% over the past year, outpacing the capital markets industry average of 23.6%. The company maintains a solid balance sheet with more cash than debt and short-term assets exceeding both short- and long-term liabilities. Despite low return on equity at 5.4%, Djerriwarrh's interest payments are well-covered by EBIT, reflecting strong operational efficiency. However, its dividend yield of 5% is not fully supported by free cash flows, requiring attention to sustainability in future payouts.

- Click here and access our complete financial health analysis report to understand the dynamics of Djerriwarrh Investments.

- Explore historical data to track Djerriwarrh Investments' performance over time in our past results report.

SomnoMed (ASX:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SomnoMed Limited, with a market cap of A$102.65 million, produces and sells devices for the oral treatment of sleep-related disorders across the Asia Pacific region, North America, and Europe.

Operations: The company generates revenue of A$100.25 million from its production and sale of products designed to treat sleep disordered breathing.

Market Cap: A$102.65M

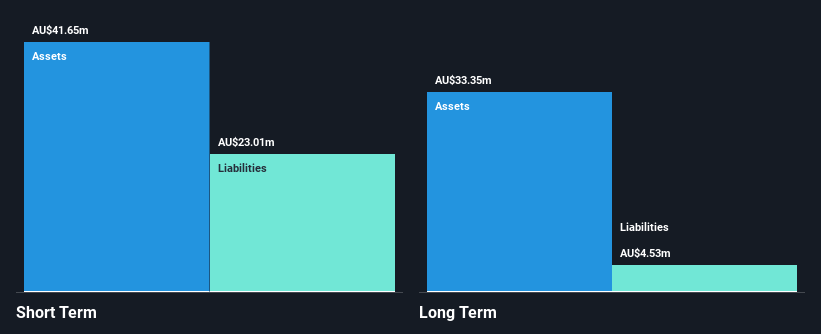

SomnoMed Limited, with a market cap of A$102.65 million, is navigating the challenges common to penny stocks by focusing on revenue growth and maintaining financial stability. Despite being unprofitable with a negative return on equity of -12.64%, it has managed to reduce its debt-to-equity ratio significantly over the past five years and holds more cash than total debt. The company forecasts revenue growth of 9.7% annually, supported by strong short-term assets that cover both short- and long-term liabilities comfortably. Management's experience and stable weekly volatility further bolster investor confidence in its strategic direction amidst earnings challenges.

- Jump into the full analysis health report here for a deeper understanding of SomnoMed.

- Learn about SomnoMed's future growth trajectory here.

Where To Now?

- Get an in-depth perspective on all 991 ASX Penny Stocks by using our screener here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DJW

Flawless balance sheet with solid track record.

Market Insights

Community Narratives