- Australia

- /

- Capital Markets

- /

- ASX:FID

3 Undiscovered Gems In Australia With Promising Potential

Reviewed by Simply Wall St

As the Australian market navigates a complex landscape marked by higher-than-expected CPI readings and fluctuating sector performances, investors are paying close attention to small-cap stocks that may offer unique opportunities amidst broader economic shifts. In such an environment, identifying undiscovered gems with strong fundamentals and growth potential can be particularly rewarding for those looking to capitalize on promising sectors and innovative companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Peet | 53.46% | 12.70% | 31.21% | ★★★★☆☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Carlton Investments (ASX:CIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market cap of A$895.60 million.

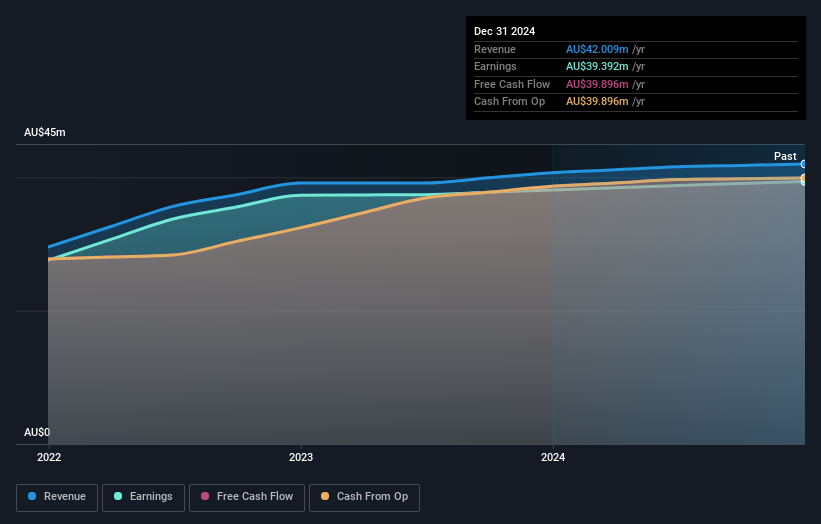

Operations: Carlton Investments generates revenue primarily through the acquisition and long-term holding of shares and units, totaling A$41.60 million. The company's net profit margin stands at 95.38%.

Carlton Investments, a compact player in the Australian market, showcases robust financial health with interest payments on its debt being well covered by EBIT at 3390.3x. Over the past five years, earnings have grown 8.7% annually, though recent growth of 0.09% lagged behind the Capital Markets industry's 12.7%. The company has high-quality earnings and a reduced debt-to-equity ratio from 0.03% to 0.02%, indicating prudent financial management. With more cash than total debt and positive free cash flow, Carlton seems well-positioned for stability despite industry challenges ahead of its AGM on October 29th in Sydney.

Fiducian Group (ASX:FID)

Simply Wall St Value Rating: ★★★★★★

Overview: Fiducian Group Ltd operates in the financial services sector in Australia through its subsidiaries and has a market capitalization of approximately A$387.33 million.

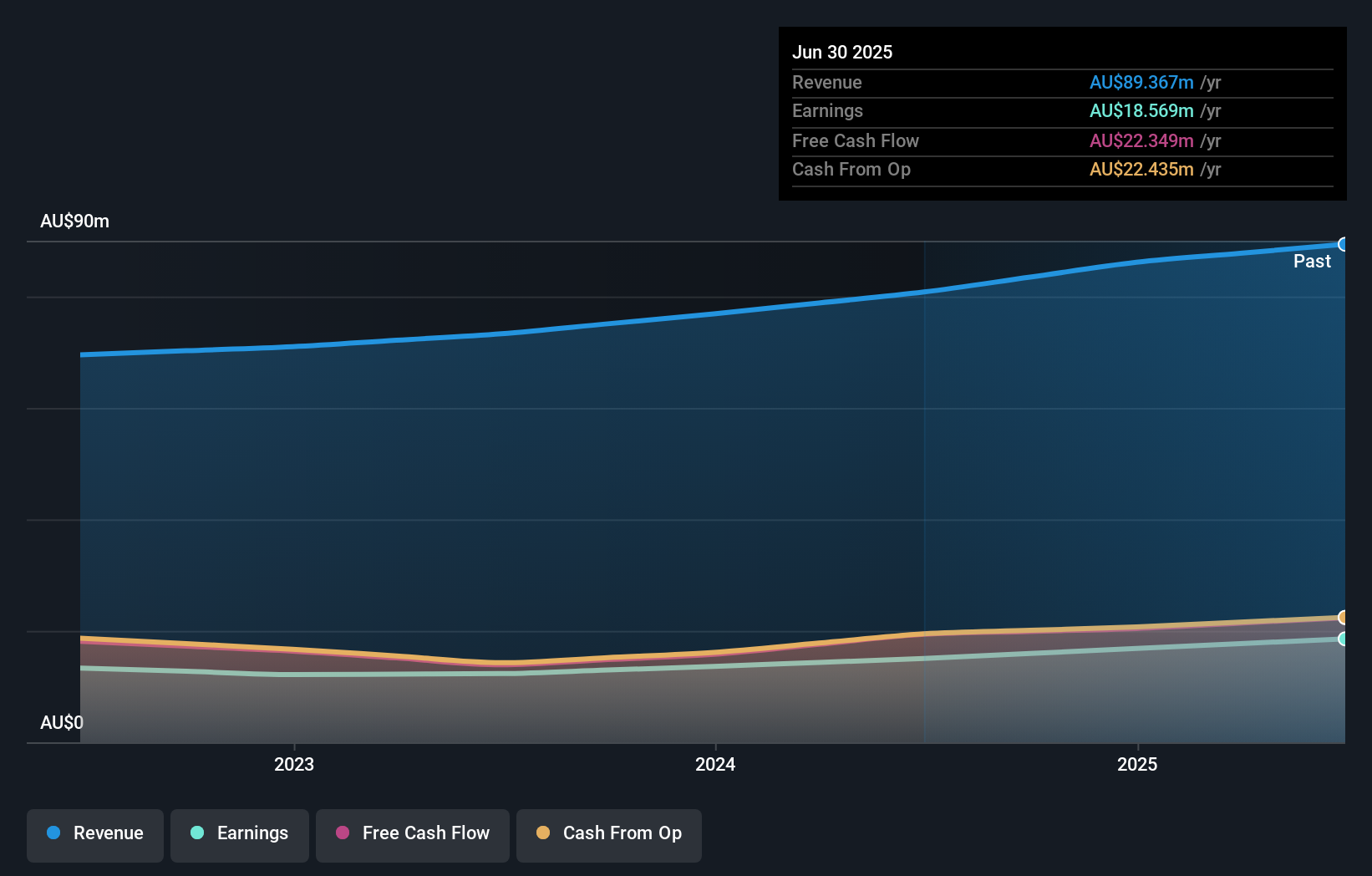

Operations: Fiducian Group's revenue streams are primarily derived from Financial Planning (A$29.66 million), Funds Management (A$25.59 million), Corporate Services (A$17.67 million), and Platform Administration (A$16.45 million).

Fiducian Group stands out with its robust financial health, highlighted by a debt-free balance sheet for the past five years and a P/E ratio of 20.9x, which is slightly below the Australian market average. The company has demonstrated impressive earnings growth of 23.5% over the past year, surpassing industry benchmarks. This growth aligns with its high-quality earnings profile and positive free cash flow status, suggesting a solid operational footing. With no debt to worry about and strong recent performance metrics, Fiducian seems well-positioned within its sector for continued stability and potential future expansion in Australia's capital markets landscape.

- Click here to discover the nuances of Fiducian Group with our detailed analytical health report.

Review our historical performance report to gain insights into Fiducian Group's's past performance.

Metals X (ASX:MLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of approximately A$784.46 million.

Operations: Metals X derives its revenue primarily from its 50% stake in the Renison Tin Operation, generating A$271.38 million.

Metals X shines as a small player in Australia's mining sector, boasting an impressive 708% earnings growth over the past year, far outpacing the industry's 10%. Its price-to-earnings ratio of 5.6x is notably lower than the Australian market average of 21.5x, suggesting it trades at a favorable valuation. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 58%, reflecting significant financial improvement. However, a one-off gain of A$38.4M has skewed recent results and future earnings are projected to decline by an average of 27.5% annually over the next three years.

- Navigate through the intricacies of Metals X with our comprehensive health report here.

Examine Metals X's past performance report to understand how it has performed in the past.

Summing It All Up

- Click here to access our complete index of 57 ASX Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success