- Australia

- /

- Capital Markets

- /

- ASX:MFF

Undiscovered Gems in Australia to Explore This May 2025

Reviewed by Simply Wall St

As the Australian market experiences a modest uptick with the ASX 200 closing up 0.1% at 8,361 points, sectors like IT and Materials are leading the charge while Utilities lag significantly. In this environment, identifying promising small-cap stocks requires a keen eye for companies that not only show potential in their respective industries but also demonstrate resilience amid fluctuating sector performances.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cuscal (ASX:CCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cuscal Limited, with a market cap of A$532.54 million, offers payment and regulated data products and services to financial and consumer-focused institutions in Australia.

Operations: Cuscal Limited generates revenue through providing payment and regulated data services to financial institutions in Australia. The company's market cap stands at A$532.54 million, highlighting its presence in the financial services sector.

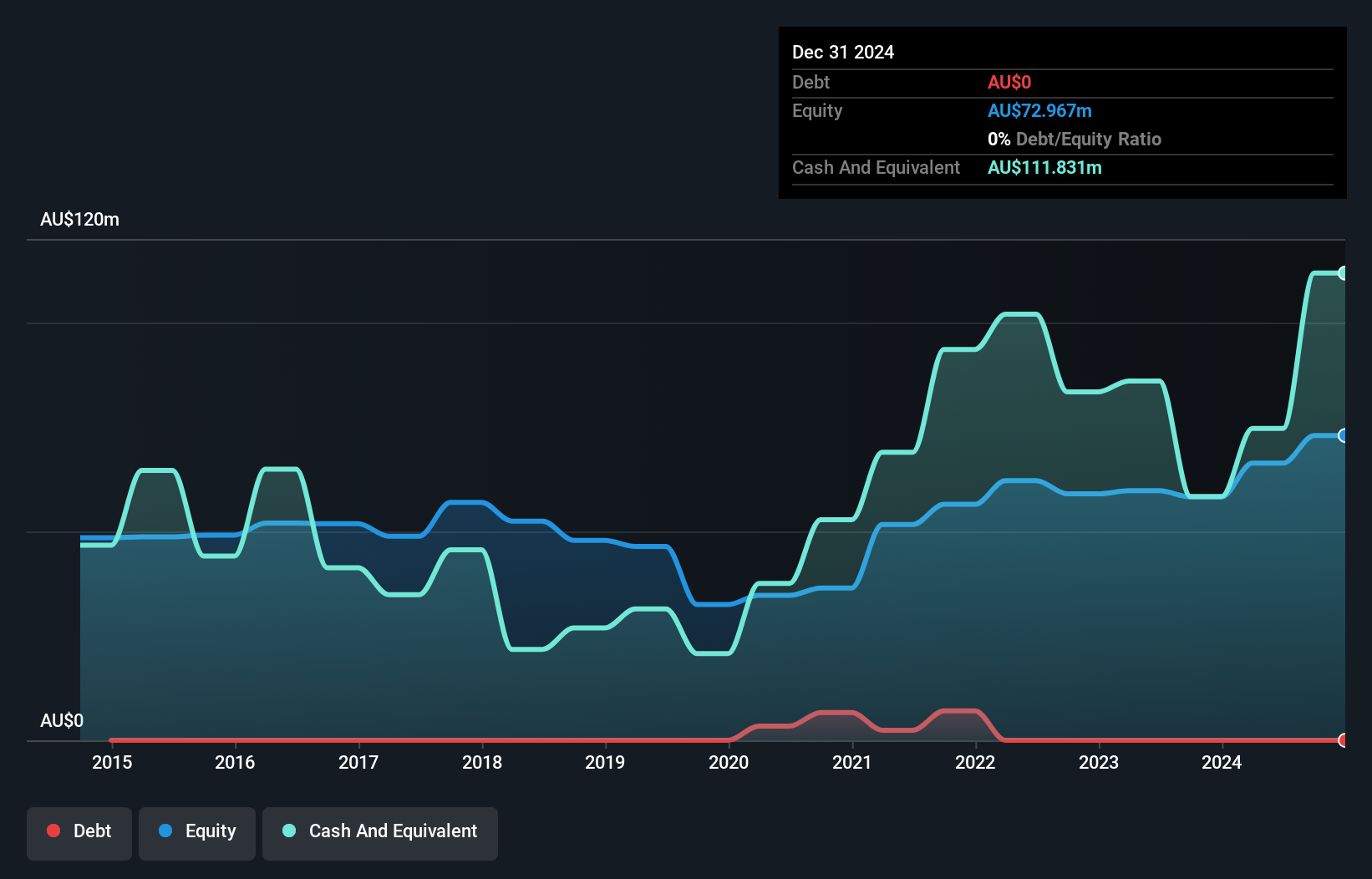

Cuscal, a player in the financial sector, has seen its debt-to-equity ratio drop significantly from 154.1% to 41.1% over the past five years, indicating improved financial health. Its earnings growth of 4.3% last year outpaced the broader Diversified Financial industry, which saw a -6.8%. Despite having high-quality earnings and being free cash flow positive, Cuscal's interest payments are not well covered by EBIT at just 1.3x coverage. Recently added to the S&P/ASX All Ordinaries Index, Cuscal seems poised for further visibility and potential growth within its sector in Australia.

- Unlock comprehensive insights into our analysis of Cuscal stock in this health report.

Gain insights into Cuscal's historical performance by reviewing our past performance report.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and internationally, with a market capitalization of approximately A$480.30 million.

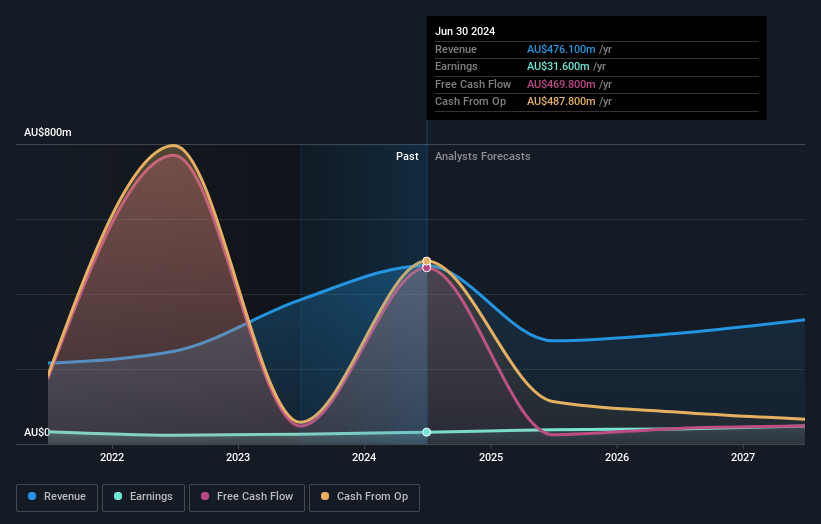

Operations: GR Engineering Services generates revenue primarily from two segments: Mineral Processing, contributing A$412.30 million, and Oil and Gas, with A$96.61 million. The company's financial performance is significantly driven by its Mineral Processing segment.

GR Engineering Services, a nimble player in the engineering sector, stands out with its robust financial health and industry-leading growth. Currently trading at 96% below its estimated fair value, it presents an intriguing valuation opportunity. The company boasts impressive earnings growth of 34% over the past year, significantly outpacing the Metals and Mining industry's 8%. Notably debt-free for five years, GR Engineering enjoys high-quality earnings and positive free cash flow. Recent client announcements indicate continued project momentum with Horizon Minerals awarding them a significant contract for gold processing plant refurbishment in Western Australia.

- Dive into the specifics of GR Engineering Services here with our thorough health report.

Assess GR Engineering Services' past performance with our detailed historical performance reports.

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.52 billion.

Operations: The primary revenue stream for MFF Capital Investments comes from its equity investments, generating A$1.01 billion.

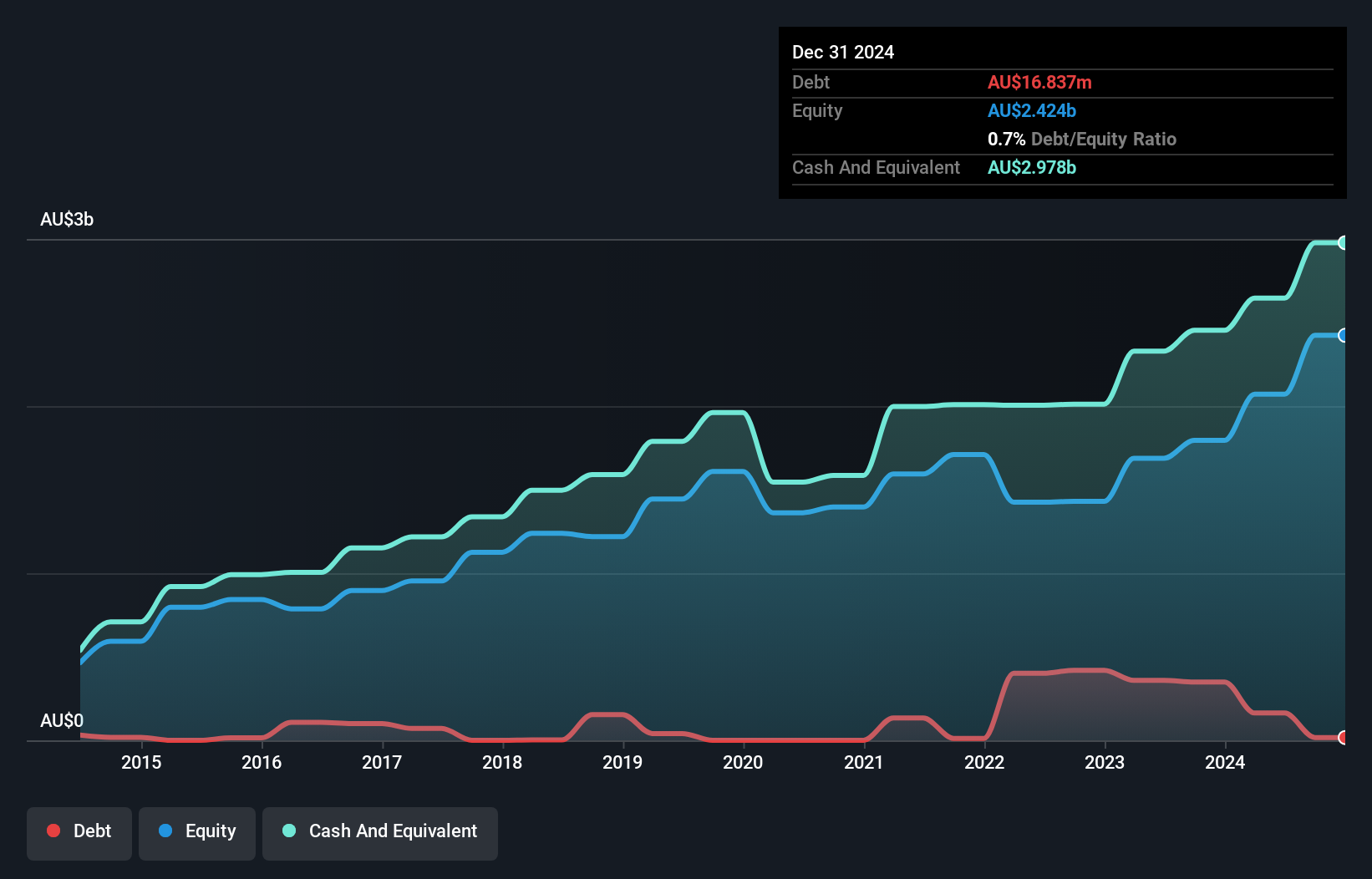

MFF Capital Investments, a small player in the financial sector, has shown impressive earnings growth of 51.9% over the past year, outpacing the industry average of 23.6%. Despite a slight increase in its debt to equity ratio from 0% to 0.7% over five years, MFF's interest payments are well covered with EBIT covering them 69 times over. The company is trading at a substantial discount of approximately 46% below its estimated fair value and remains free cash flow positive with A$372 million reported recently. With more cash than total debt, MFF's financial health seems robust and promising for future prospects.

- Click to explore a detailed breakdown of our findings in MFF Capital Investments' health report.

Understand MFF Capital Investments' track record by examining our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 47 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives