- Australia

- /

- Diversified Financial

- /

- ASX:CCL

Exploring Cuscal And 2 Other Promising Small Caps In Australia

Reviewed by Simply Wall St

Australia's market has seen mixed performance recently, with the ASX200 closing down 0.38%, while sectors like Energy and Staples showed resilience. In this fluctuating landscape, identifying promising small-cap stocks requires a keen eye for companies that demonstrate strong fundamentals and potential for growth amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Cuscal (ASX:CCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cuscal Limited, with a market cap of A$517.22 million, offers payment and regulated data products and services to financial and consumer-focused institutions in Australia.

Operations: Cuscal Limited generates revenue primarily through its payment and regulated data services offered to financial and consumer-focused institutions in Australia. The company has a market capitalization of A$517.22 million.

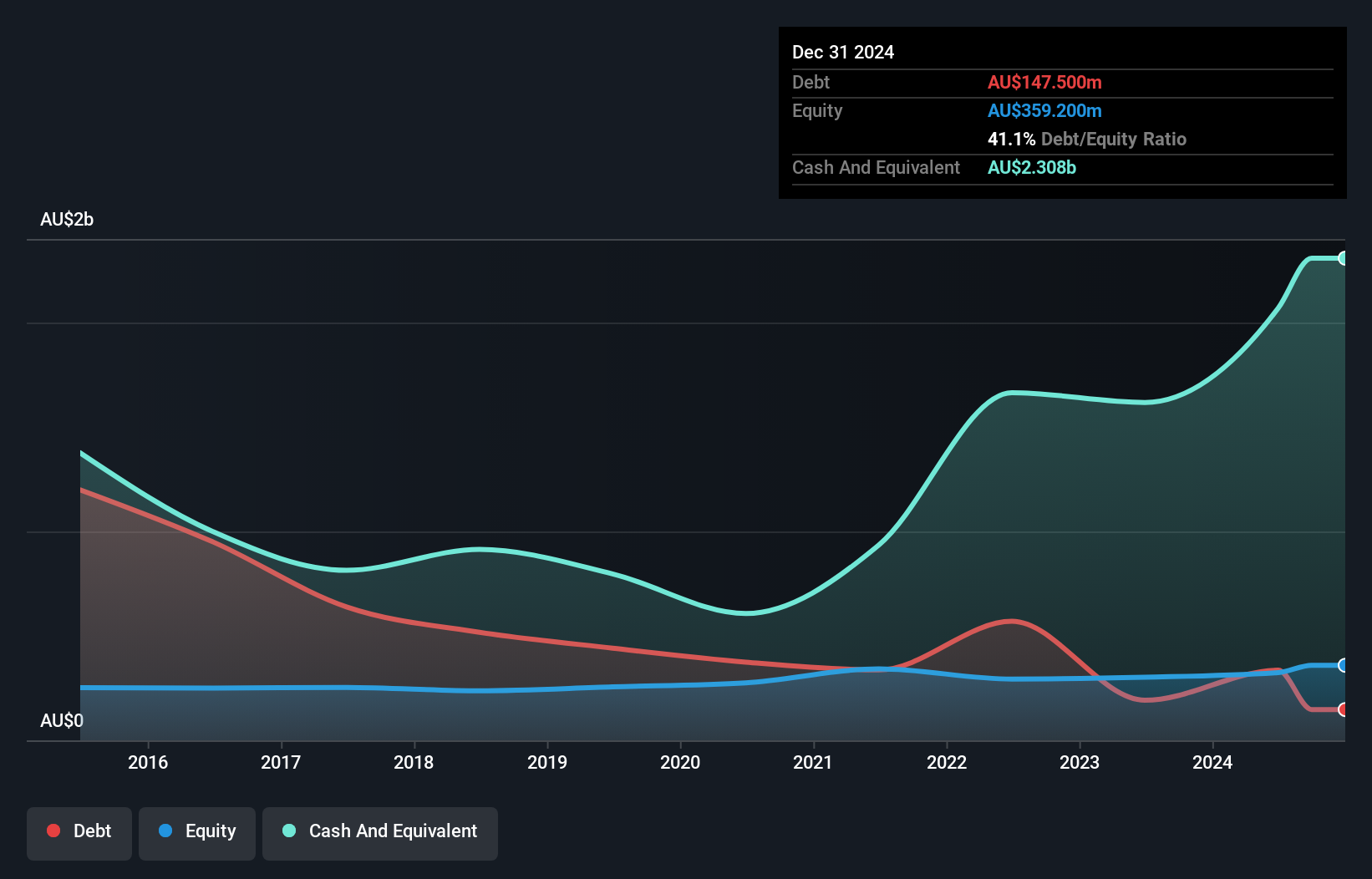

Cuscal Limited, a financial entity in Australia, has shown resilience with earnings growth of 4.3% over the past year, outpacing the Diversified Financial industry. The company's debt management is commendable, as its debt to equity ratio improved significantly from 154.1% to 41.1% over five years. Despite this progress, interest payments remain a concern with EBIT covering only 1.3 times these costs; ideally, it should be at least three times for comfort. Recent inclusion in the S&P/ASX All Ordinaries Index marks a positive development for Cuscal's market presence and potential investor interest moving forward.

- Dive into the specifics of Cuscal here with our thorough health report.

Examine Cuscal's past performance report to understand how it has performed in the past.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services primarily to the mining and mineral processing sectors both in Australia and globally, with a market capitalization of approximately A$499.89 million.

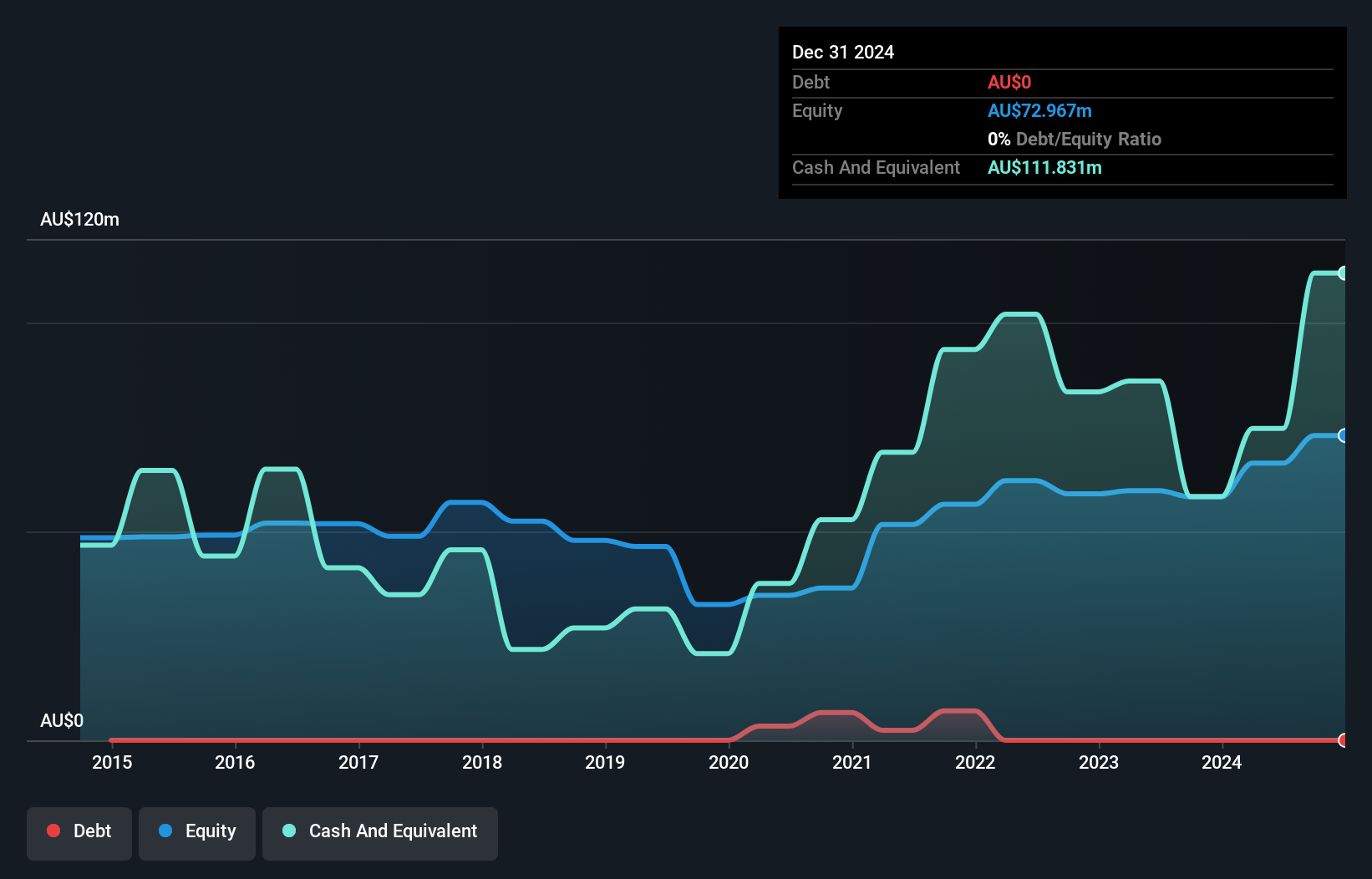

Operations: GR Engineering Services generates revenue primarily from its Mineral Processing segment, which accounts for A$412.30 million, and the Oil and Gas segment with A$96.61 million.

GR Engineering Services shines as a promising player in the Australian market, with its recent half-year sales reaching A$272.11 million, up from A$187.27 million the previous year. Net income also saw an increase to A$21.82 million from A$14.3 million, while basic earnings per share rose to A$0.13 from A$0.09 a year ago, indicating robust financial health and growth potential in this small-cap space. The company declared a fully franked dividend of 10 cents per share for the six months ending December 2024, reflecting confidence in its cash flow position and commitment to returning value to shareholders amidst strong industry performance exceeding sector averages by 34%.

- Delve into the full analysis health report here for a deeper understanding of GR Engineering Services.

Gain insights into GR Engineering Services' past trends and performance with our Past report.

SRG Global (ASX:SRG)

Simply Wall St Value Rating: ★★★★★☆

Overview: SRG Global Limited, with a market cap of A$718.65 million, offers engineering-led maintenance and industrial services as well as engineering and construction services across Australia, New Zealand, and internationally.

Operations: SRG Global generates revenue from two primary segments: Engineering and Construction, contributing A$453.78 million, and Maintenance and Industrial Services, which brings in A$724.53 million.

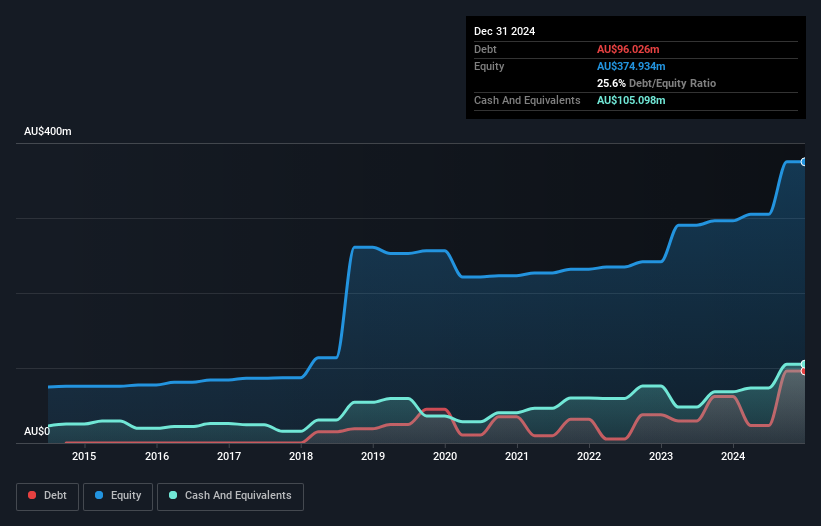

SRG Global, a nimble player in the construction sector, has seen its earnings grow by 50% over the past year, outpacing the industry’s 28.7%. With a debt to equity ratio rising from 17.6% to 25.6% over five years, SRG's interest payments are well covered by EBIT at 47 times coverage. Recently added to both the S&P/ASX Small Ordinaries and ASX 300 Indexes, SRG reported half-year sales of A$619 million and net income of A$18.94 million compared to last year’s figures of A$511 million and A$15.27 million respectively, reflecting solid performance amidst market challenges.

Taking Advantage

- Embark on your investment journey to our 51 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCL

Cuscal

Provides payment and regulated data related products and services for financial and consumer centric institutions in Australia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives