- Australia

- /

- Metals and Mining

- /

- ASX:KCN

Undiscovered Gems in Australia with Strong Potential for May 2025

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 closing up 0.58% following a rate cut by the RBA, signaling a positive shift in investor sentiment towards sectors like IT and Real Estate. In this environment of cautious optimism, identifying stocks that combine innovative potential with solid fundamentals can be key to uncovering hidden opportunities within the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Bell Financial Group (ASX:BFG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to a diverse client base across Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur with a market cap of A$420.17 million.

Operations: Bell Financial Group generates revenue primarily from broking (A$173.47 million), followed by products and services (A$51.01 million), and technology and platforms (A$29.89 million).

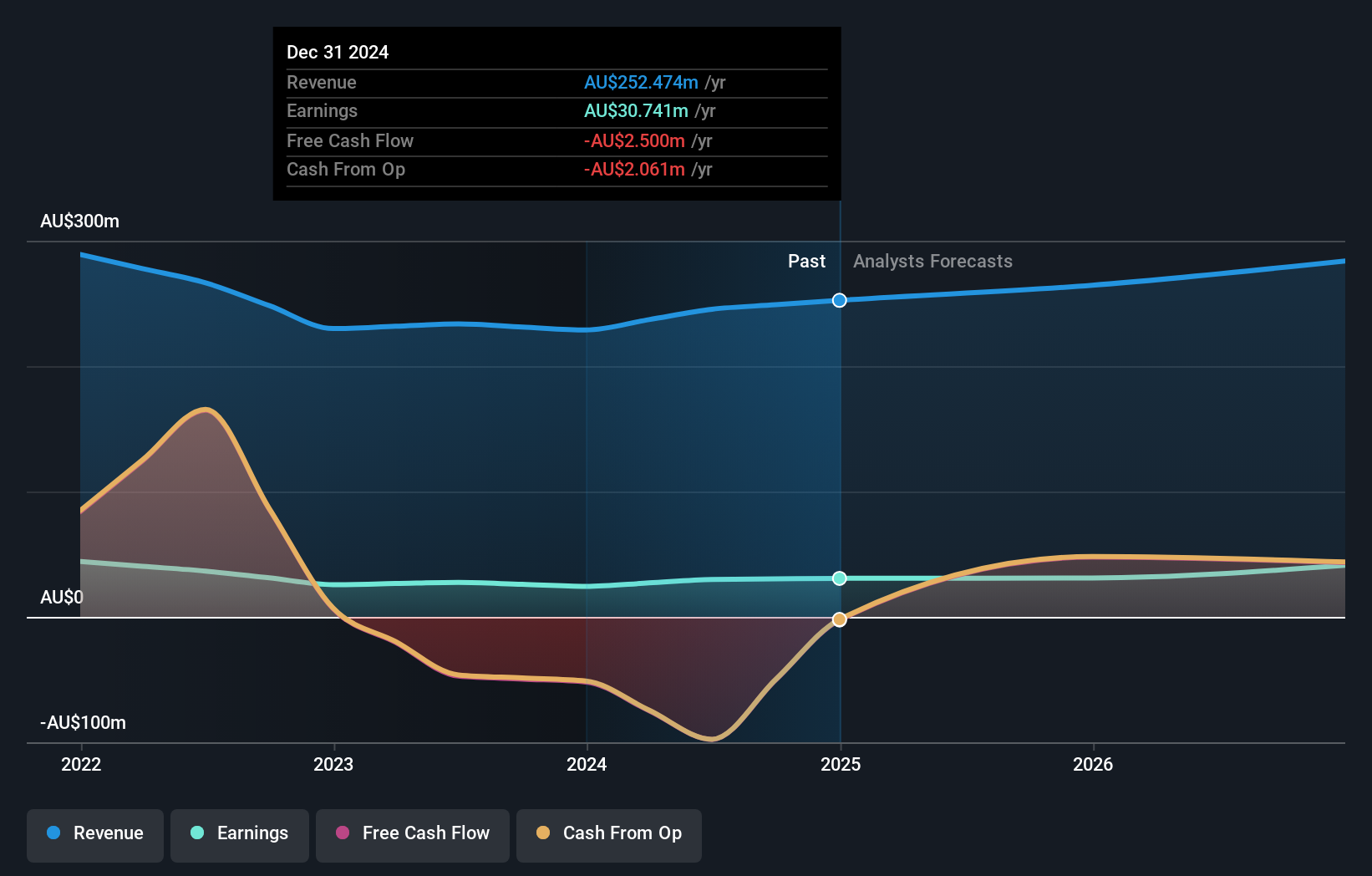

Bell Financial Group, a smaller player in Australia's financial sector, has shown impressive earnings growth of 26.4% over the past year, outpacing the Capital Markets industry average of 23.6%. Trading at 14.3% below its estimated fair value, it presents an attractive proposition compared to peers. Despite not being free cash flow positive recently with a levered free cash flow of -A$50.13 million as of September 2024, its debt management is commendable with a reduction in the debt-to-equity ratio from 83.9% to 17.7% over five years and more cash than total debt on hand, indicating robust financial health and potential for future growth.

- Navigate through the intricacies of Bell Financial Group with our comprehensive health report here.

Gain insights into Bell Financial Group's past trends and performance with our Past report.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Value Rating: ★★★★★★

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian listed investment company with a market capitalization of A$700.69 million, focusing on generating long-term capital growth by investing in high-conviction ideas from leading fund managers.

Operations: Revenue primarily stems from investment activities, amounting to A$191.25 million. The company's net profit margin reflects its financial efficiency in converting revenue into profit.

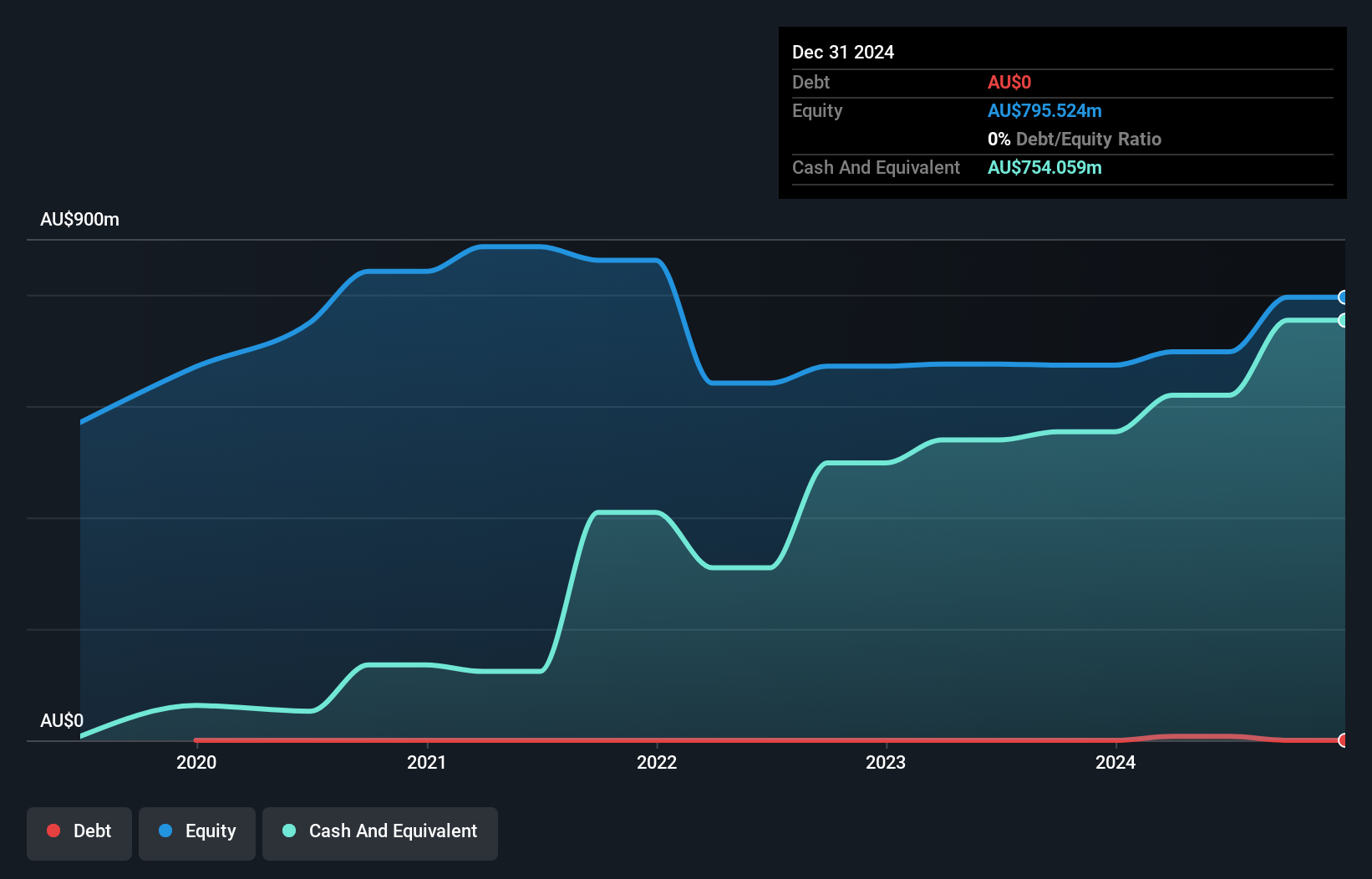

Hearts and Minds Investments, a small player in Australia's financial landscape, has shown remarkable earnings growth of 466% over the past year, outpacing its industry peers. With a price-to-earnings ratio of 5.5x compared to the broader Australian market's 17.8x, it appears attractively valued. The company operates debt-free, eliminating concerns about interest coverage and demonstrating financial prudence over the last five years. However, it's worth noting that despite these strengths, Hearts and Minds has not yet achieved positive free cash flow consistently in recent years. This mix of high growth potential with certain cash flow challenges paints a nuanced picture for investors considering this stock as an undiscovered gem in Australia’s market.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties with a market cap of A$494.88 million.

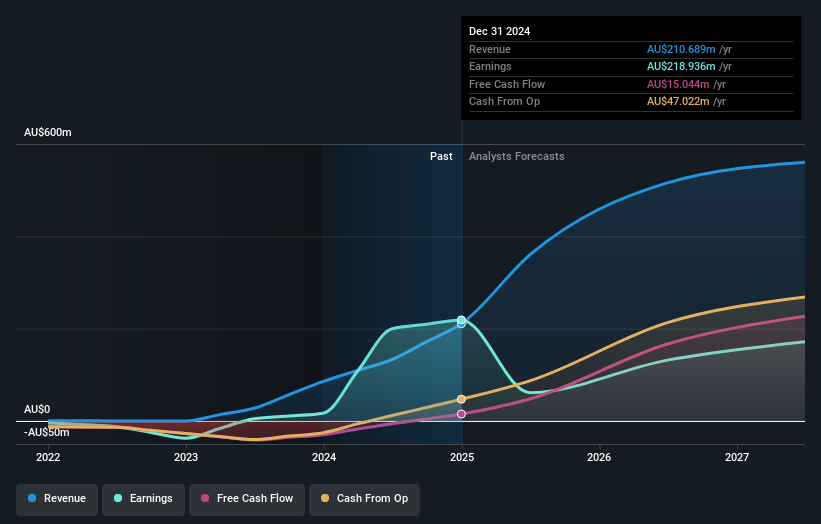

Operations: Kingsgate Consolidated generates revenue primarily from its Chatree segment, amounting to A$210.69 million.

Kingsgate Consolidated is making waves with its impressive earnings growth of 1203% over the past year, outpacing the broader Metals and Mining industry. The company's net debt to equity ratio stands at a satisfactory 17.9%, reflecting prudent financial management as it reduced from 52.5% to 23.2% over five years. Trading at a remarkable 93% below its estimated fair value, Kingsgate seems attractively priced compared to peers. Recent announcements include a share repurchase program aimed at boosting shareholder value, while their half-year sales surged to A$136 million from A$58 million, turning last year's net loss into a profit of A$2.45 million.

- Click here and access our complete health analysis report to understand the dynamics of Kingsgate Consolidated.

Learn about Kingsgate Consolidated's historical performance.

Next Steps

- Explore the 45 names from our ASX Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsgate Consolidated might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KCN

Kingsgate Consolidated

Engages in the exploration, development, and mining of gold and silver mineral properties.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives