- Australia

- /

- Capital Markets

- /

- ASX:BFG

Do Bell Financial Group's (ASX:BFG) Earnings Warrant Your Attention?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Bell Financial Group (ASX:BFG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Bell Financial Group

How Quickly Is Bell Financial Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Bell Financial Group has managed to grow EPS by 23% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

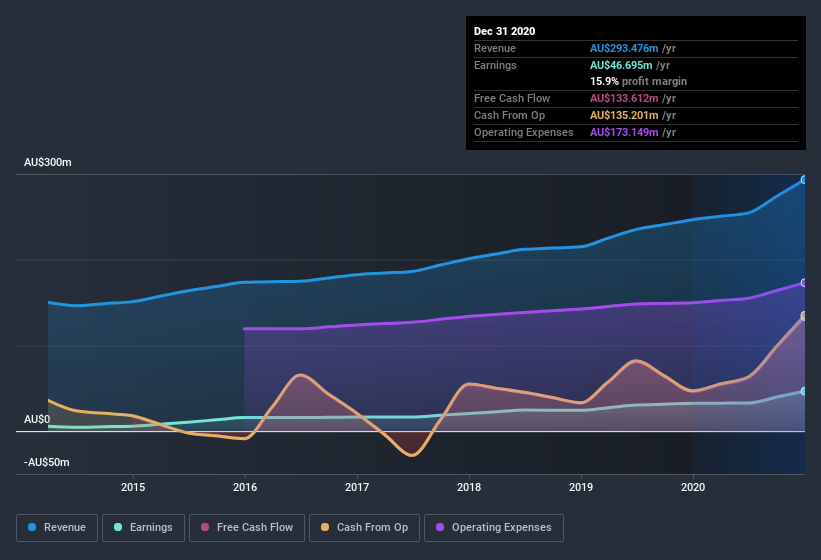

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Bell Financial Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Bell Financial Group maintained stable EBIT margins over the last year, all while growing revenue 19% to AU$293m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Bell Financial Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Bell Financial Group top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Executive Chairman & MD, Alastair Provan, paid AU$255k to buy shares at an average price of AU$1.27.

On top of the insider buying, it's good to see that Bell Financial Group insiders have a valuable investment in the business. Indeed, they hold AU$50m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 9.1% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Bell Financial Group To Your Watchlist?

You can't deny that Bell Financial Group has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 1 warning sign for Bell Financial Group that you need to be mindful of.

The good news is that Bell Financial Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Bell Financial Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bell Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BFG

Bell Financial Group

Engages in the provision of full-service broking, online broking, corporate finance, and financial advisory services to private, institutional, and corporate clients in Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives