- New Zealand

- /

- Industrial REITs

- /

- NZSE:PFI

3 Undervalued Small Caps In Global With Insider Buying

Reviewed by Simply Wall St

In a week where global markets have shown resilience despite uncertainties such as the U.S. government shutdown and mixed economic data, small-cap stocks have notably outperformed larger indices, buoyed by expectations of potential interest rate cuts. The Russell 2000 Index's strong performance highlights the potential opportunities within small-cap companies, which often benefit from lower borrowing costs and can be attractive during periods of economic adjustment. Identifying promising small-cap stocks involves evaluating those with solid fundamentals and strategic insider buying, signaling confidence in their future prospects amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.2x | 1.3x | 31.71% | ★★★★★☆ |

| Bytes Technology Group | 17.4x | 4.4x | 11.42% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 18.83% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.9x | 0.3x | 0.21% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.8x | 1.8x | 20.19% | ★★★★☆☆ |

| BWP Trust | 10.1x | 13.2x | 13.01% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 42.94% | ★★★★☆☆ |

| Sagicor Financial | 7.3x | 0.4x | -75.37% | ★★★★☆☆ |

| Cettire | NA | 0.4x | 4.72% | ★★★☆☆☆ |

| CVS Group | 46.6x | 1.4x | 36.04% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Volex (AIM:VLX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Volex is a global manufacturer and supplier of integrated manufacturing services and power products, with a market cap of approximately £0.8 billion.

Operations: Volex generates revenue primarily through its sales, with recent figures reaching $1.09 billion. The company's gross profit margin has shown a notable trend, peaking at 24.15% in early 2020 and slightly moderating to 21.43% by March 2025. Operating expenses have been a significant cost factor, rising alongside revenue growth, with general and administrative expenses being the largest component within operating costs.

PE: 19.0x

Volex, a company in the small-cap category, recently settled a patent dispute with Credo Technology Group, signaling an end to legal distractions. Insider confidence is evident as they have been purchasing shares over the past year. The company declared a final dividend of 3 pence per share for the fiscal year ending March 2025. Although reliant on external borrowing for funding, earnings are projected to grow at nearly 14% annually, suggesting potential growth despite financial risks.

Bell Financial Group (ASX:BFG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bell Financial Group is a financial services company offering broking, products and services, and technology platforms, with a market cap of approximately A$0.89 billion.

Operations: The company's revenue streams are primarily derived from Broking, Products & Services, and Technology & Platforms. Over the years, the net income margin has shown a notable upward trend, reaching 15.91% by the end of 2020 before experiencing fluctuations in subsequent periods. Operating expenses have been a significant component of costs, with General & Administrative Expenses consistently forming a large part of these expenses.

PE: 17.2x

Bell Financial Group, a smaller player in the financial sector, recently showcased its strategic vision at the ASX SMIDcaps Conference. Despite a dip in revenue to A$121.45 million and net income to A$9.35 million for the first half of 2025, insider confidence is evident with Daniel Droga purchasing 1.6 million shares worth approximately A$1.85 million, indicating potential optimism about future growth prospects. The company faces higher risk due to reliance on external borrowing but anticipates earnings growth of 32% annually.

- Click to explore a detailed breakdown of our findings in Bell Financial Group's valuation report.

Understand Bell Financial Group's track record by examining our Past report.

Property For Industry (NZSE:PFI)

Simply Wall St Value Rating: ★★★☆☆☆

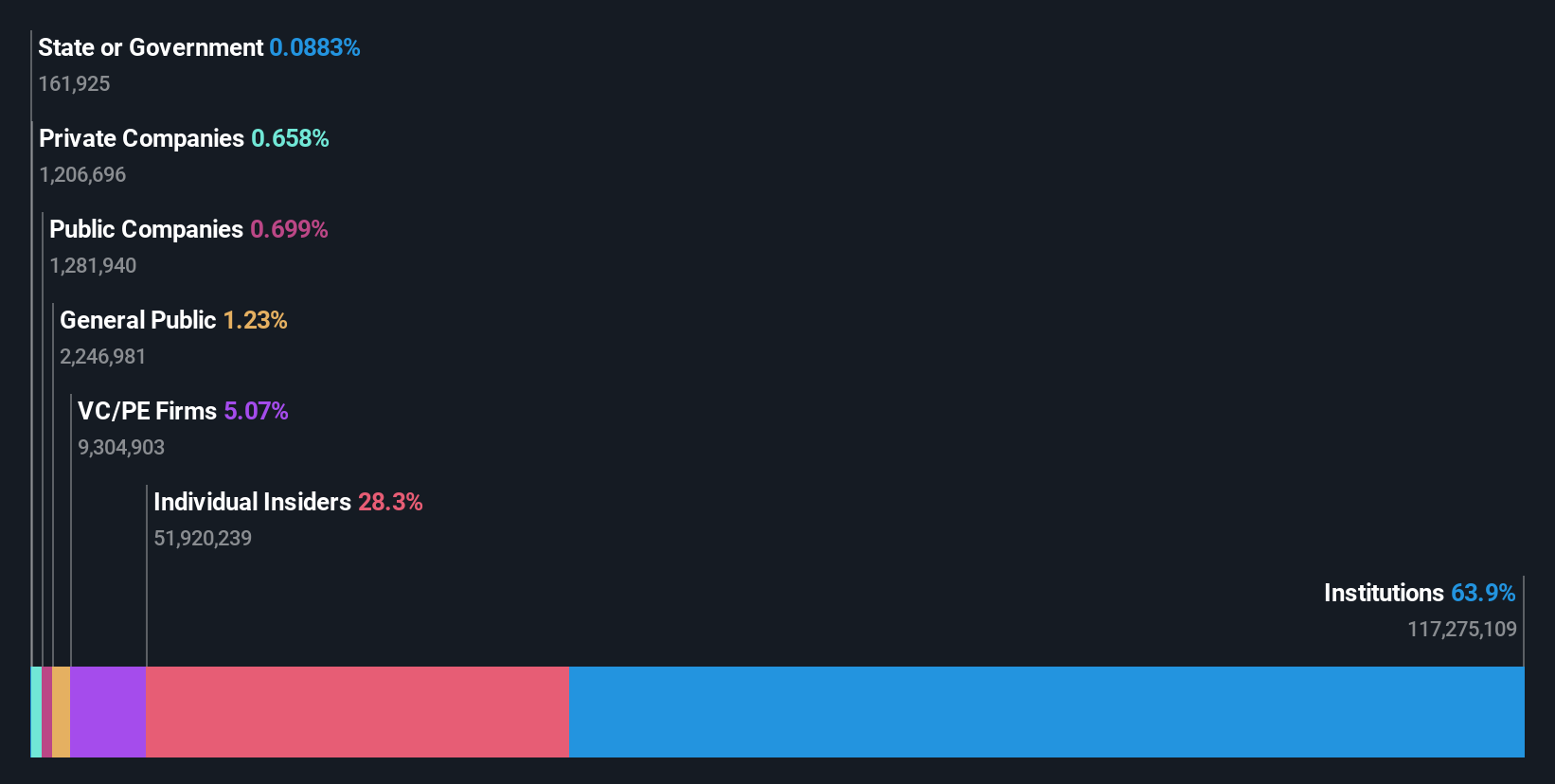

Overview: Property For Industry is a New Zealand-based company focused on property investment and management, with a market capitalization of NZ$1.53 billion.

Operations: The company generates revenue primarily through property investment and management, with a recent figure of NZ$127.46 million. The cost of goods sold was NZ$21.90 million, resulting in a gross profit margin of 82.82%. Operating expenses amounted to NZ$11.16 million, and the net income stood at NZ$106.02 million, reflecting a net income margin of 83.18%.

PE: 11.9x

Property For Industry, a smaller player in the market, reported sales of NZ$127.46 million and net income of NZ$106.02 million for the year ending June 30, 2025, reflecting a strong earnings profile with basic EPS at NZ$0.2111. However, its interest payments aren't well covered by earnings due to reliance on external borrowing for funding—considered riskier than customer deposits. Insider confidence is evident as they have been purchasing shares recently, suggesting belief in future growth prospects despite current financial challenges.

Seize The Opportunity

- Gain an insight into the universe of 109 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:PFI

Property For Industry

Engages in the property investment and management business in New Zealand.

Established dividend payer and fair value.

Market Insights

Community Narratives