- Australia

- /

- Metals and Mining

- /

- ASX:BIS

ASX Dividend Stocks Spotlight Australian United Investment And Two More

Reviewed by Simply Wall St

As the Australian market experiences a modest uptick, with the ASX200 rising by 0.21% to 8,135 points, investors are closely monitoring sector performances amidst ongoing corporate developments. In this context of fluctuating sector dynamics and leadership changes, dividend stocks remain an attractive option for those seeking steady income streams; their appeal is particularly strong when utilities and information technology sectors show resilience.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 6.87% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.70% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.36% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.39% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.35% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.54% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.38% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.22% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.86% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.36% | ★★★★☆☆ |

Click here to see the full list of 37 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.37 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily from investments, totaling A$57.76 million.

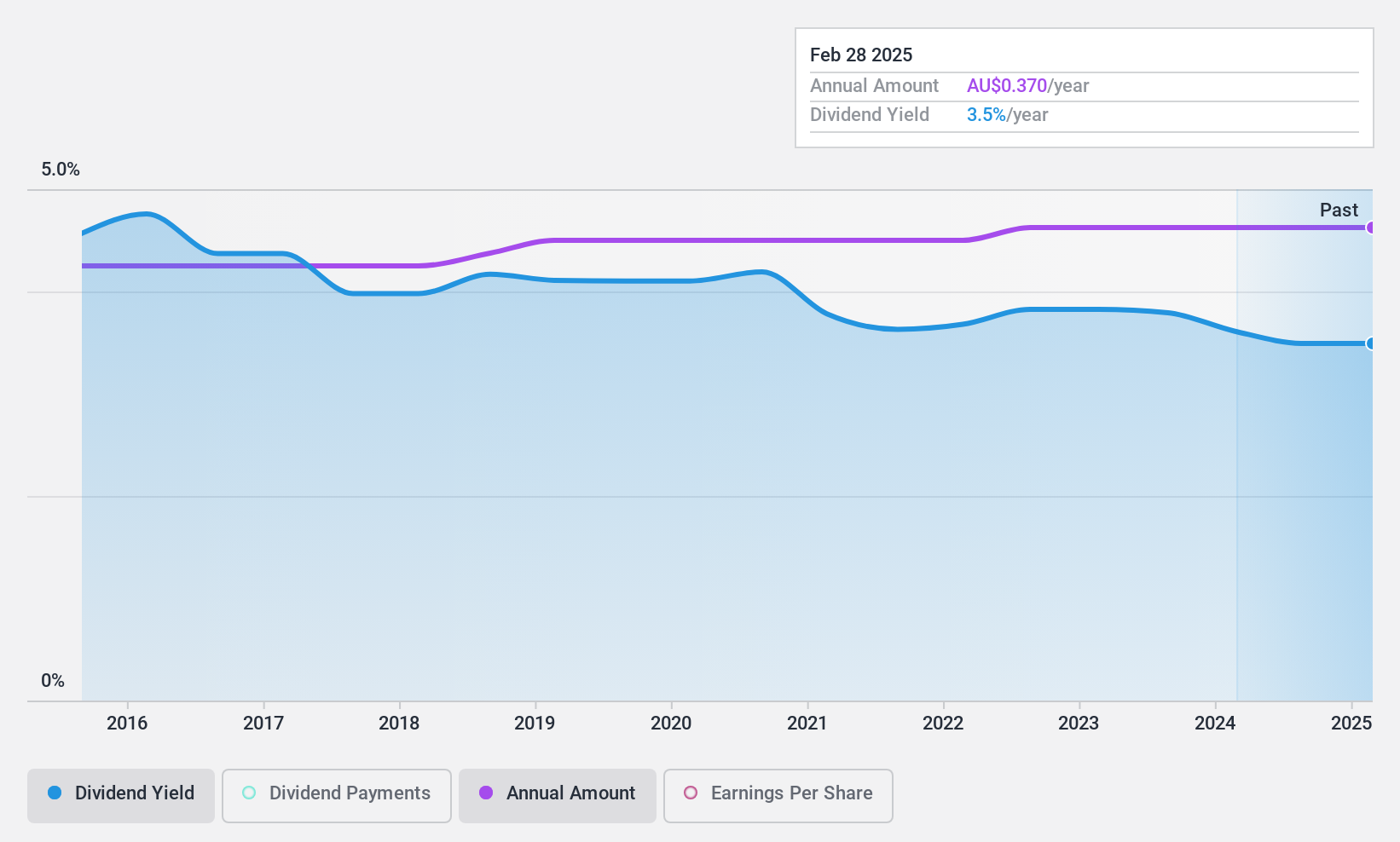

Dividend Yield: 3.4%

Australian United Investment's dividends, though stable and reliable over the past decade, present challenges for sustainability. The recent cash dividend of A$0.20 and special dividend of A$0.08 highlight a commitment to shareholder returns despite a high payout ratio of 95% that isn't well covered by earnings or cash flows. With net income declining to A$49.12 million from the previous year's A$56.36 million, maintaining current dividend levels could be challenging without improved financial performance.

- Get an in-depth perspective on Australian United Investment's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Australian United Investment is priced higher than what may be justified by its financials.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$152.81 million.

Operations: Bisalloy Steel Group Limited generates revenue through the production and distribution of high-performance steel plates across various markets, including Australia, Indonesia, Thailand, and other international regions.

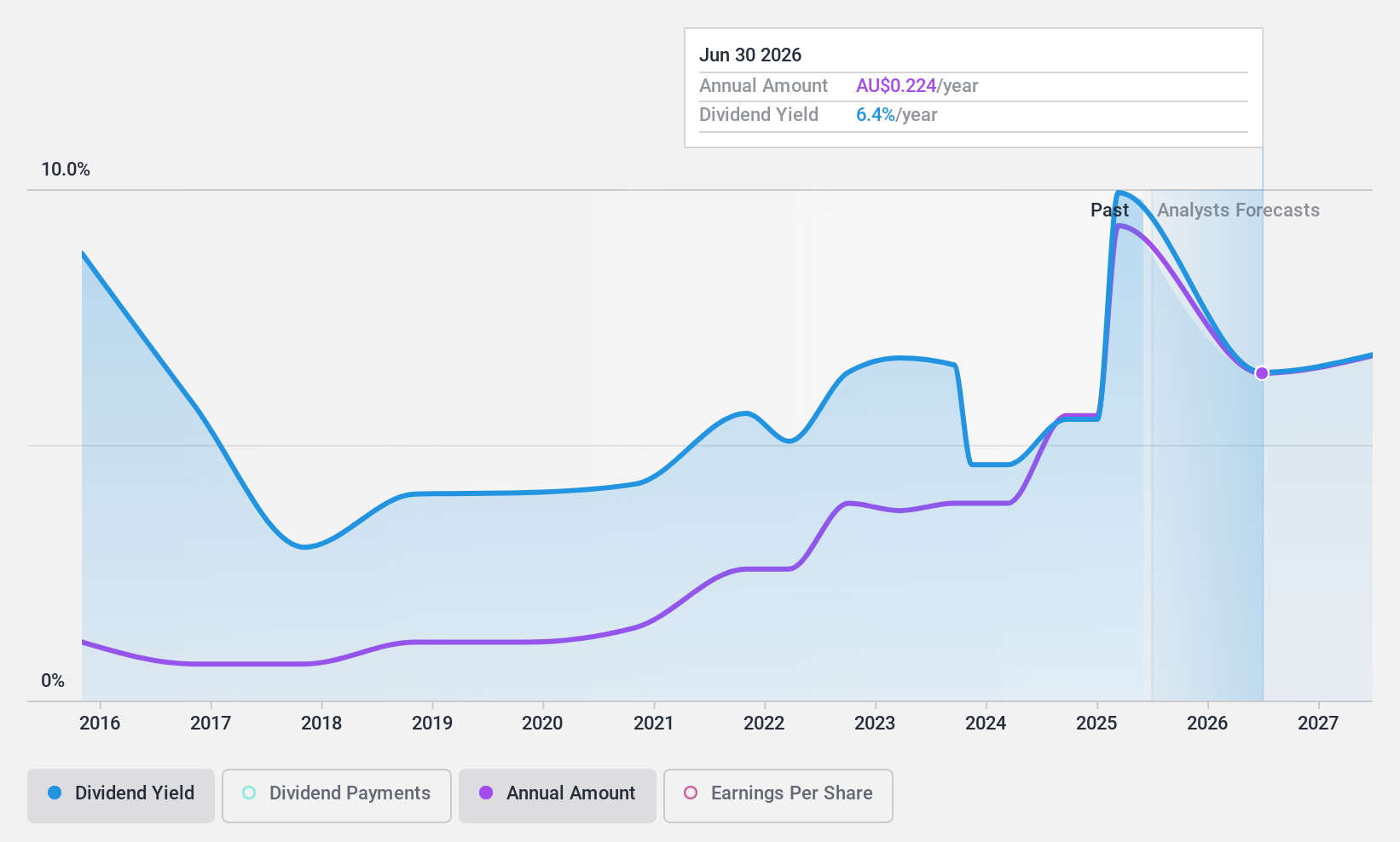

Dividend Yield: 6.1%

Bisalloy Steel Group's dividend yield of 6.11% ranks in the top 25% of Australian dividend payers, supported by a reasonable payout ratio of 59% and a cash payout ratio of 46.6%. Despite recent earnings growth to A$15.74 million, dividends have been volatile over nine years, with periods exceeding a 20% annual drop. The recent inclusion in the S&P/ASX Emerging Companies Index may enhance visibility but doesn't guarantee stability in future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Bisalloy Steel Group.

- Our expertly prepared valuation report Bisalloy Steel Group implies its share price may be lower than expected.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Corporation Limited is involved in the exploration, development, production, and processing of coal as well as oil and gas properties, with a market cap of A$4.19 billion.

Operations: New Hope Corporation Limited generates revenue primarily from its Coal Mining operations in New South Wales (A$1.56 billion) and Queensland, including Treasury and Investments (A$166.52 million).

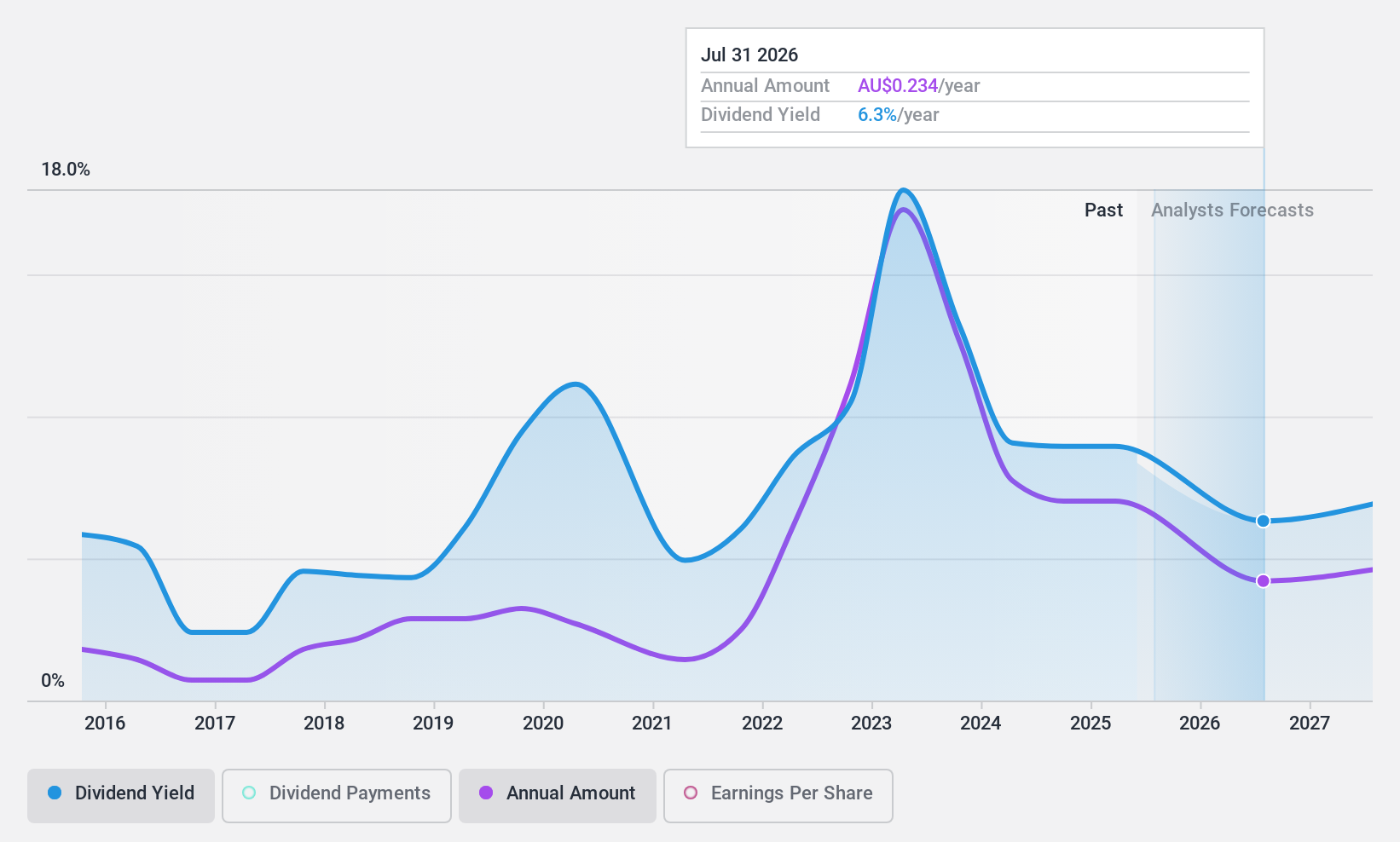

Dividend Yield: 7.9%

New Hope's dividend yield of 7.86% is among the top 25% in Australia, though its sustainability is questionable due to a high cash payout ratio of 113.7%. Despite increasing dividends over the past decade, they have been volatile and not consistently covered by earnings or cash flow. Recent financials show a decline in net income to A$475.86 million from A$1,087.4 million year-over-year, impacting dividend reliability despite a reasonable payout ratio of 69.3%.

- Unlock comprehensive insights into our analysis of New Hope stock in this dividend report.

- Upon reviewing our latest valuation report, New Hope's share price might be too pessimistic.

Next Steps

- Gain an insight into the universe of 37 Top ASX Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives