- Australia

- /

- Capital Markets

- /

- ASX:ASX

How Investors Are Reacting To ASX (ASX:ASX) Conference Amid Banking Sector Volatility

Reviewed by Simply Wall St

- Earlier this week, ASX Limited presented at the Noosa Mining Investor Conference, where Head of Listings Compliance Giri Tenneti and James Rowe spoke at Peppers Noosa Resort in Queensland.

- The presentation came amidst heightened market volatility, with investor focus shifting to regulatory challenges and valuation concerns in Australia’s banking sector.

- We'll consider how recent bank-driven market weakness could affect ASX's investment narrative and outlook for its technology initiatives.

ASX Investment Narrative Recap

To own shares in ASX Limited, you need to believe in its ability to modernize core market infrastructure and sustain a leadership role in Australia’s capital markets, amid rising regulatory pressure and sector volatility. This week’s market-driven weakness, led by large banks, does not materially impact ASX’s short-term catalyst, which remains anchored in delivering operational upgrades through its technology initiatives. The biggest immediate risk continues to be potential regulatory actions arising from recent investigations, rather than broader market sentiment shifts.

Among ASX’s recent announcements, the addition of highly experienced director Anne Loveridge to the board stands out. Her deep expertise in financial services, governance and risk oversight aligns with the company’s ongoing focus on risk management, especially relevant as regulatory scrutiny intensifies and ASX pushes ahead with complex technology modernization projects. These changes may support institutional confidence in ASX as it works to maintain system reliability and compliance standards.

But in contrast, investors should be alert to how unresolved regulatory issues could still...

Read the full narrative on ASX (it's free!)

ASX's narrative projects A$1.2 billion revenue and A$541.3 million earnings by 2028. This requires a 9.3% annual revenue decline and an increase of A$54.1 million in earnings from the current A$487.2 million.

Uncover how ASX's forecasts yield a A$69.40 fair value, in line with its current price.

Exploring Other Perspectives

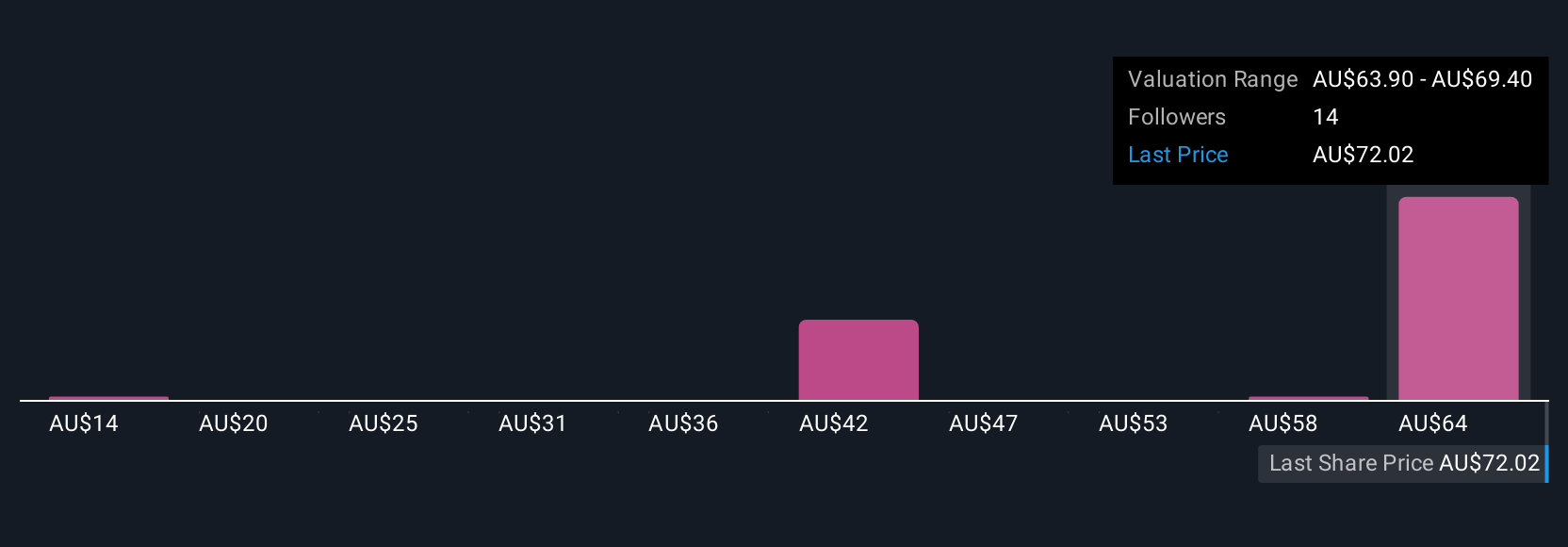

Fair value estimates from four Simply Wall St Community members for ASX range widely, from A$14.48 up to A$69.40. Amid these opinions, regulatory risk from ongoing investigations could shape both sentiment and future earnings outcomes, be sure to consider multiple viewpoints.

Build Your Own ASX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASX research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free ASX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASX's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASX

ASX

Operates as a multi-asset class and integrated exchange company in Australia and internationally.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives