- Australia

- /

- Capital Markets

- /

- ASX:ASX

ASX (ASX:ASX) Valuation Insights Following New Restrictions on Corporate Crypto Reserves

Reviewed by Simply Wall St

ASX (ASX:ASX) is drawing attention after reports revealed it has introduced stringent new rules aimed at restricting listed companies from turning into digital asset treasury vehicles that hold cryptocurrencies as main reserves. This move brings ASX in line with other major exchanges across the Asia-Pacific region.

See our latest analysis for ASX.

The recent clampdown on crypto reserves arrives just as ASX shares continue to slide. The latest share price is $56.73, and the year-to-date share price return is -13.08%. Momentum has clearly faded. Over the past twelve months, the total shareholder return is -13.02%, hinting at increasing caution among investors despite steady underlying earnings growth.

If you’re rethinking your investment strategy in light of these regulatory shifts, this is a good moment to broaden your scope and discover fast growing stocks with high insider ownership

But with ASX shares trading well below analyst price targets despite solid earnings growth, investors now face a pivotal question: Are these levels undervaluing the company, or is the market already factoring in ASX’s future prospects?

Most Popular Narrative: 14.7% Undervalued

ASX is trading at $56.73, while the most popular narrative values the company at A$66.51. This suggests the share price lags confident growth expectations by a wide margin. See what’s driving this outlook below.

Expansion and demand in high-margin technology and data offerings, driven by appetite for analytics, connectivity, and market information from both domestic and global market participants, provides opportunity for recurring, diversified non-transactional income. This supports overall margin expansion and earnings stability.

Curious how recurring income streams could turbo-boost margins and future profits? Discover which rapid advancements and financial catalysts underpin this valuation. Don’t miss what could set ASX apart for years to come.

Result: Fair Value of $66.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising technology costs and mounting regulatory scrutiny could pressure margins, which may potentially alter even the most optimistic projections for ASX’s future growth.

Find out about the key risks to this ASX narrative.

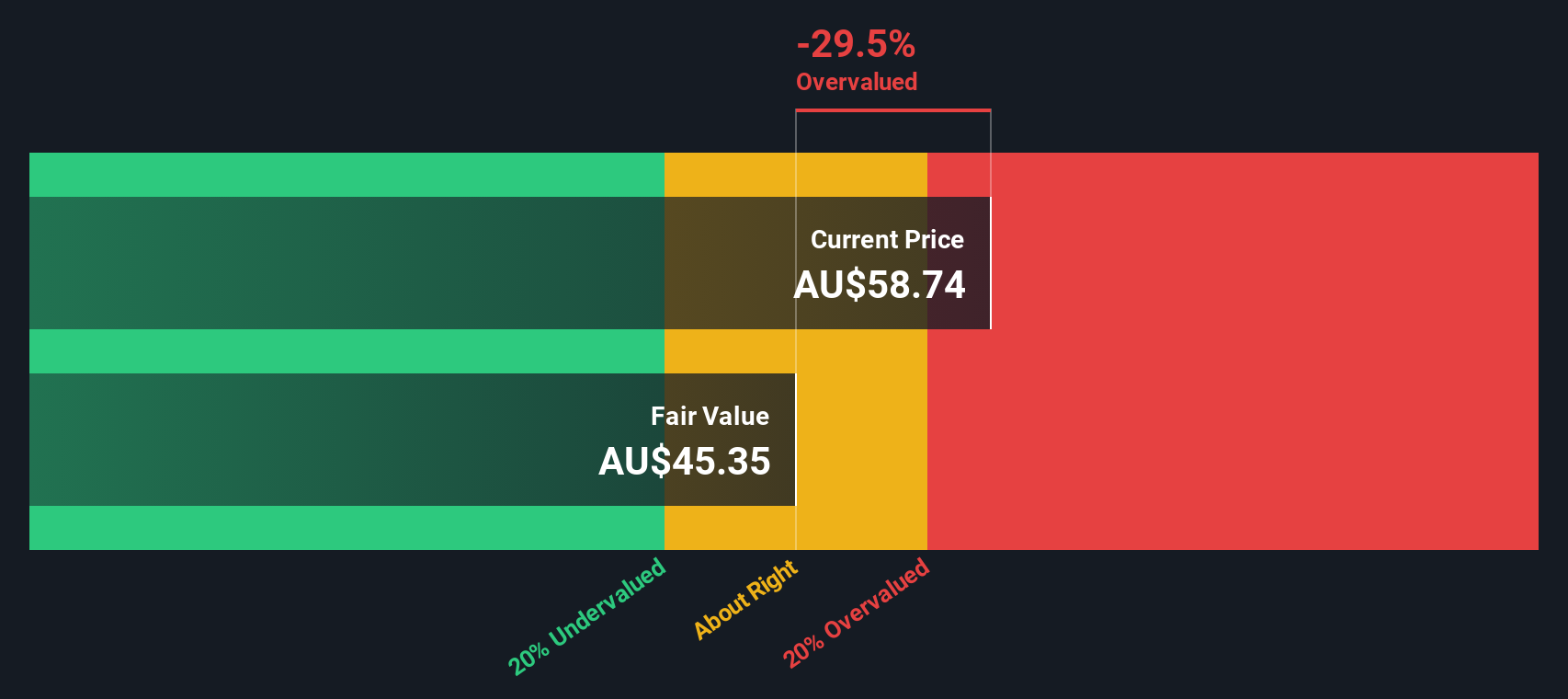

Another View: SWS DCF Model Offers a Caution Flag

While analysts see ASX as undervalued based on expected earnings and price targets, our SWS DCF model suggests a different story. The DCF calculation places fair value at A$46.02, which is notably below the current price. Could the market be overly optimistic about ASX's long-term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASX Narrative

If you want to dig deeper, challenge these assumptions, or put your own spin on the numbers, you can craft a personal narrative in just minutes, then Do it your way

A great starting point for your ASX research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next investing move count and stay ahead of the curve. These unique stock ideas could be exactly what you need. Don’t let opportunity pass you by.

- Capture the momentum of cutting-edge healthcare by checking out these 33 healthcare AI stocks, which shapes the intersection of AI innovation and medical advancement.

- Unlock income potential and stability with these 17 dividend stocks with yields > 3%, offering generous yields above 3% for reliable returns.

- Take a position early in the digital currency space through these 80 cryptocurrency and blockchain stocks, and benefit from growth in blockchain technology and next-generation financial platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASX

ASX

Operates as a multi-asset class and integrated exchange company in Australia and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives