- Australia

- /

- Capital Markets

- /

- ASX:ASW

Should You Be Tempted To Sell Advanced Share Registry Limited (ASX:ASW) Because Of Its P/E Ratio?

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. To keep it practical, we'll show how Advanced Share Registry Limited's (ASX:ASW) P/E ratio could help you assess the value on offer. Advanced Share Registry has a price to earnings ratio of 17.07, based on the last twelve months. That is equivalent to an earnings yield of about 5.9%.

View our latest analysis for Advanced Share Registry

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Advanced Share Registry:

P/E of 17.07 = A$0.600 ÷ A$0.035 (Based on the year to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

How Does Advanced Share Registry's P/E Ratio Compare To Its Peers?

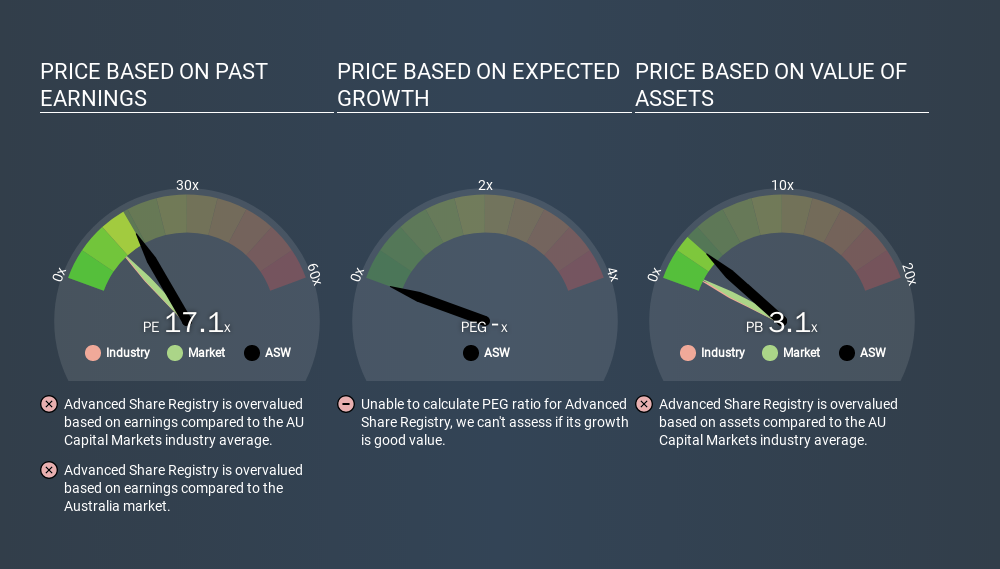

We can get an indication of market expectations by looking at the P/E ratio. The image below shows that Advanced Share Registry has a higher P/E than the average (12.5) P/E for companies in the capital markets industry.

Its relatively high P/E ratio indicates that Advanced Share Registry shareholders think it will perform better than other companies in its industry classification. Shareholders are clearly optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Advanced Share Registry shrunk earnings per share by 33% over the last year. And EPS is down 8.7% a year, over the last 3 years. This might lead to low expectations.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

The 'Price' in P/E reflects the market capitalization of the company. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Advanced Share Registry's Balance Sheet

With net cash of AU$4.2m, Advanced Share Registry has a very strong balance sheet, which may be important for its business. Having said that, at 16% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Bottom Line On Advanced Share Registry's P/E Ratio

Advanced Share Registry has a P/E of 17.1. That's higher than the average in its market, which is 12.1. The recent drop in earnings per share might keep value investors away, but the relatively strong balance sheet will allow the company time to invest in growth. Clearly, the high P/E indicates shareholders think it will!

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. Although we don't have analyst forecasts you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than Advanced Share Registry. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:ASW

Advanced Share Registry

Advanced Share Registry Limited provides registry services, including registry maintenance, capital raisings, corporate actions, company meetings, employee share plans, shareholder communications and in-house printing offering.

Flawless balance sheet medium.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion