- Australia

- /

- Metals and Mining

- /

- ASX:VSL

3 ASX Growth Stocks With Insider Ownership Up To 38%

Reviewed by Simply Wall St

The Australian stock market recently saw the ASX200 close up by 0.34% at 8,285 points, with sectors like IT and Telecommunications leading gains while Utilities and Materials lagged. In such a fluctuating environment, growth companies with significant insider ownership can be appealing as they often signal confidence in long-term prospects from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 20.2% | 91.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Change Financial (ASX:CCA) | 26.7% | 99.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$580.83 million, focusing on ethical and sustainable investment strategies.

Operations: The company generates revenue primarily through its funds management segment, which accounts for A$100.49 million.

Insider Ownership: 21.9%

Australian Ethical Investment is experiencing robust earnings growth, with forecasts indicating a 24.1% annual increase over the next three years, outpacing the Australian market's 12.5%. Despite slower revenue growth at 10.8% annually, it still surpasses the market average of 6%. The company's Return on Equity is projected to reach a very high level of 57% in three years. Recent shareholder engagement occurred during its Annual General Meeting in October 2024.

- Unlock comprehensive insights into our analysis of Australian Ethical Investment stock in this growth report.

- In light of our recent valuation report, it seems possible that Australian Ethical Investment is trading beyond its estimated value.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

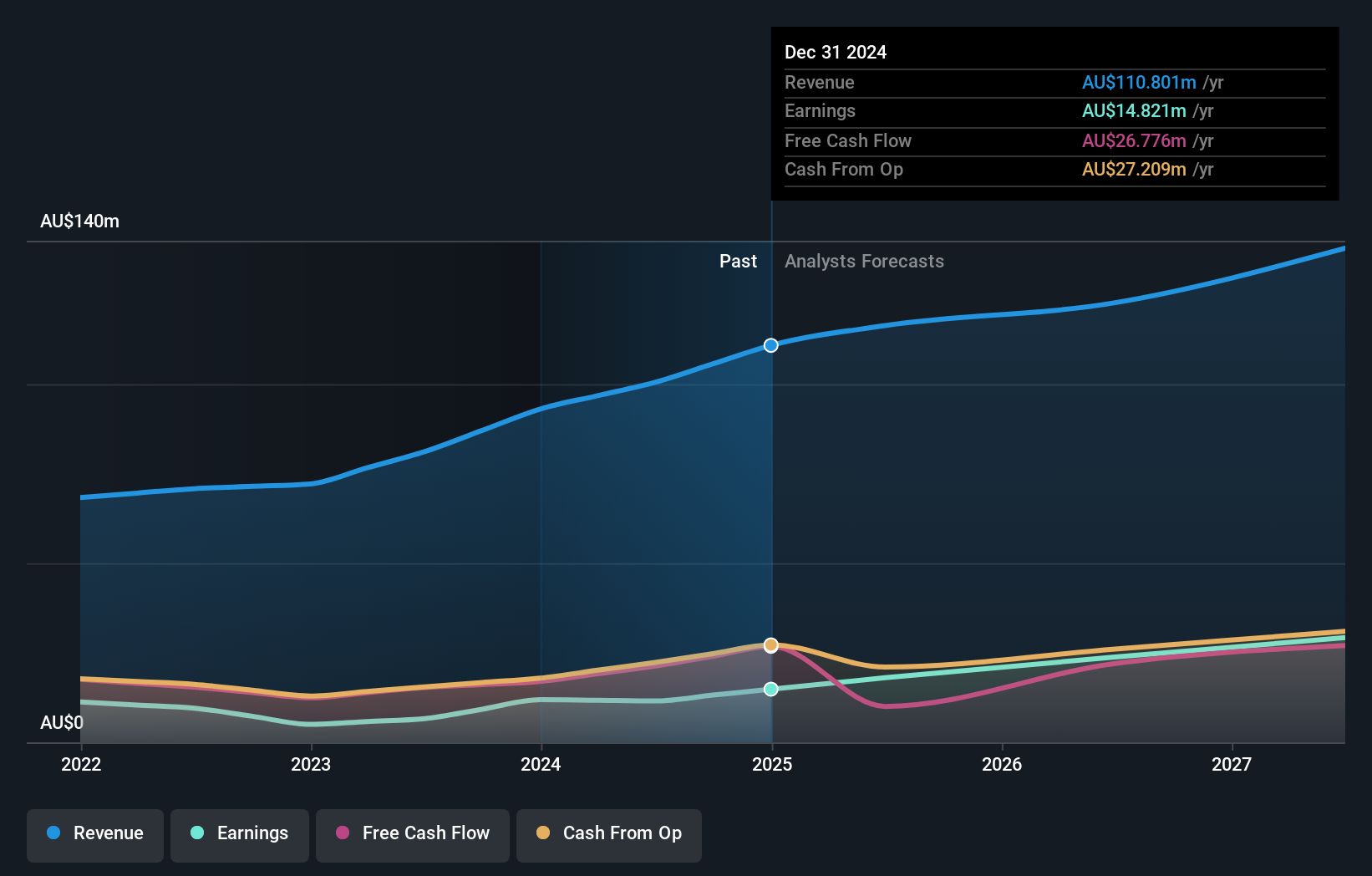

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market capitalization of A$646.76 million.

Operations: The company's revenue is primarily derived from its Software segment, contributing A$72.67 million, followed by the Advisory segment with A$31.41 million.

Insider Ownership: 10.5%

RPMGlobal Holdings is experiencing significant earnings growth, with a forecasted annual increase of 22.62%, surpassing the Australian market's 12.5%. Revenue growth, although slower at 10.4% annually, still exceeds the market average of 6%. Insider activity shows more buying than selling recently, though not in substantial volumes. The company reconfirmed its revenue guidance for 2025 between A$120 million and A$125 million during recent corporate communications.

- Take a closer look at RPMGlobal Holdings' potential here in our earnings growth report.

- Our valuation report here indicates RPMGlobal Holdings may be overvalued.

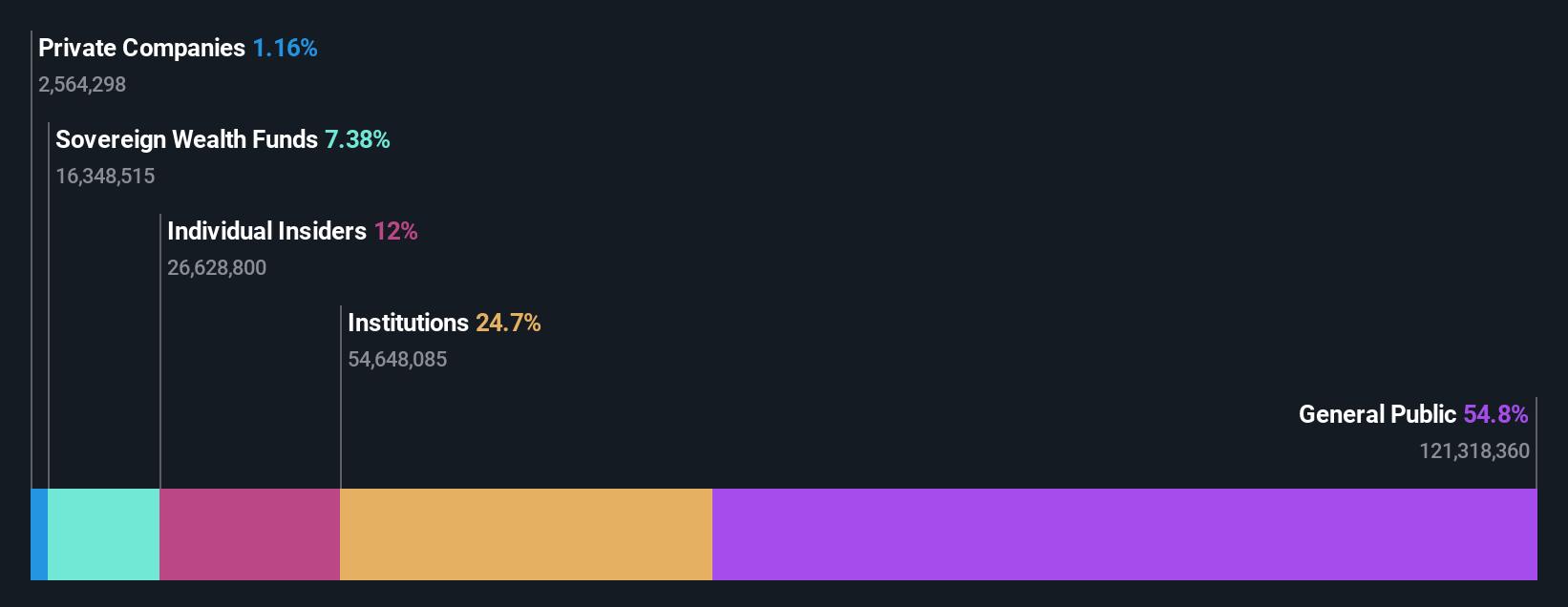

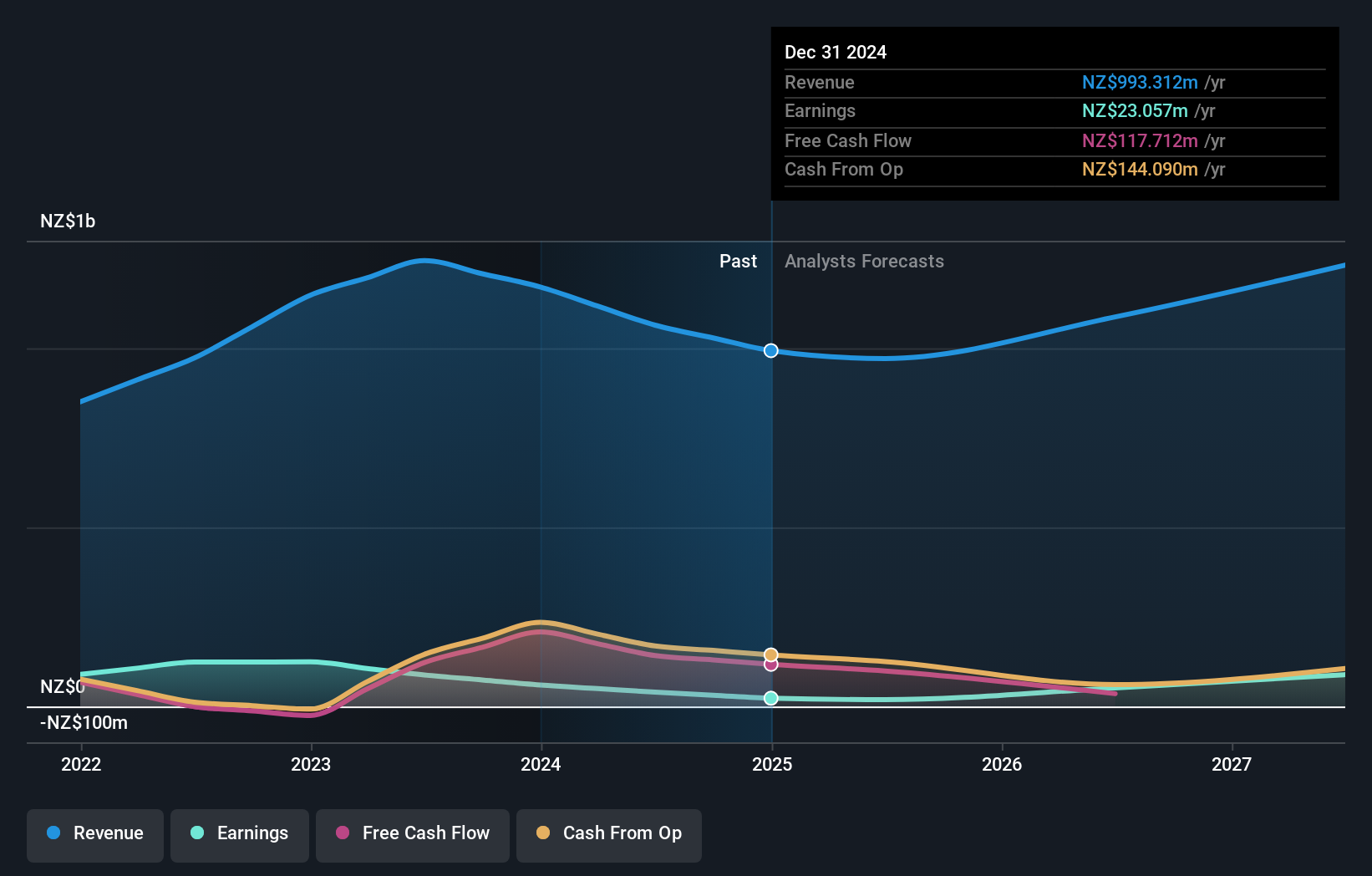

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vulcan Steel Limited, with a market cap of A$935.68 million, operates in New Zealand and Australia selling and distributing steel and metal products through its subsidiaries.

Operations: The company's revenue segments include NZ$471.29 million from steel and NZ$593.04 million from metals.

Insider Ownership: 38.7%

Vulcan Steel's earnings are forecast to grow significantly at 22.63% annually, outpacing the Australian market's 12.5%. Despite a decline in profit margins from 7.1% to 3.8%, insider activity indicates more buying than selling recently, albeit not substantially. Revenue growth is modest at 5.8% per year, trailing the market average of 6%. The company's financial position raises concerns with interest payments not well covered by earnings and an unstable dividend track record.

- Dive into the specifics of Vulcan Steel here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Vulcan Steel's current price could be inflated.

Summing It All Up

- Get an in-depth perspective on all 93 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSL

Vulcan Steel

Engages in the sale and distribution of steel and metal products in New Zealand and Australia.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives