- Australia

- /

- Hospitality

- /

- ASX:XRG

It May Be Possible That xReality Group Limited's (ASX:XRG) CEO Compensation Could Get Bumped Up

Key Insights

- xReality Group will host its Annual General Meeting on 21st of November

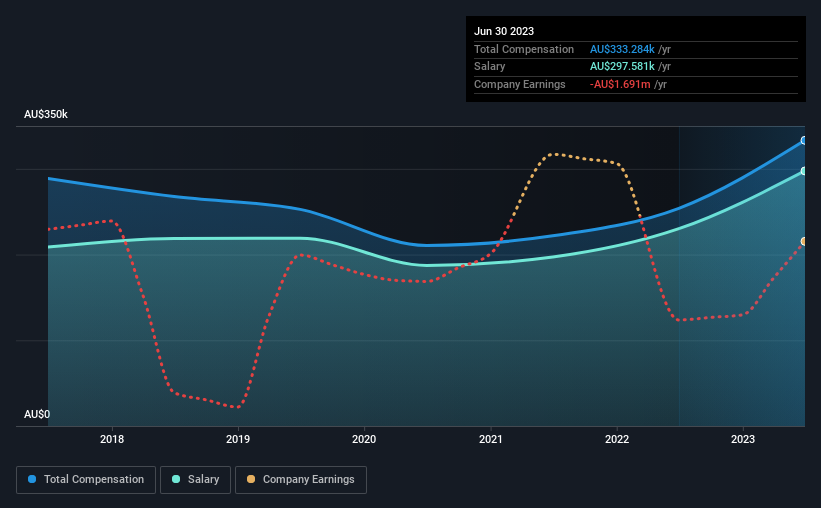

- Total pay for CEO Wayne Jones includes AU$297.6k salary

- The total compensation is 50% less than the average for the industry

- xReality Group's total shareholder return over the past three years was 135% while its EPS was down 17% over the past three years

The decent performance at xReality Group Limited (ASX:XRG) recently will please most shareholders as they go into the AGM coming up on 21st of November. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

View our latest analysis for xReality Group

Comparing xReality Group Limited's CEO Compensation With The Industry

At the time of writing, our data shows that xReality Group Limited has a market capitalization of AU$16m, and reported total annual CEO compensation of AU$333k for the year to June 2023. Notably, that's an increase of 31% over the year before. In particular, the salary of AU$297.6k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Australian Hospitality industry with market capitalizations below AU$306m, we found that the median total CEO compensation was AU$672k. Accordingly, xReality Group pays its CEO under the industry median. Moreover, Wayne Jones also holds AU$683k worth of xReality Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$298k | AU$230k | 89% |

| Other | AU$36k | AU$24k | 11% |

| Total Compensation | AU$333k | AU$254k | 100% |

On an industry level, roughly 57% of total compensation represents salary and 43% is other remuneration. xReality Group pays out 89% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

xReality Group Limited's Growth

Over the last three years, xReality Group Limited has shrunk its earnings per share by 17% per year. In the last year, its revenue is up 47%.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has xReality Group Limited Been A Good Investment?

We think that the total shareholder return of 135%, over three years, would leave most xReality Group Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for xReality Group that you should be aware of before investing.

Important note: xReality Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if xReality Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:XRG

xReality Group

Develops and operates physical and digital simulations in the Asia Pacific and the United States.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives