- Australia

- /

- Hospitality

- /

- ASX:WEB

Webjet Limited's (ASX:WEB) institutional investors lost 4.6% last week but have benefitted from longer-term gains

Key Insights

- Institutions' substantial holdings in Webjet implies that they have significant influence over the company's share price

- The top 16 shareholders own 51% of the company

- Recent purchases by insiders

A look at the shareholders of Webjet Limited (ASX:WEB) can tell us which group is most powerful. We can see that institutions own the lion's share in the company with 51% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Institutional investors was the group most impacted after the company's market cap fell to AU$2.5b last week. Still, the 33% one-year gains may have helped mitigate their overall losses. We would assume however, that they would be on the lookout for weakness in the future.

Let's take a closer look to see what the different types of shareholders can tell us about Webjet.

View our latest analysis for Webjet

What Does The Institutional Ownership Tell Us About Webjet?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

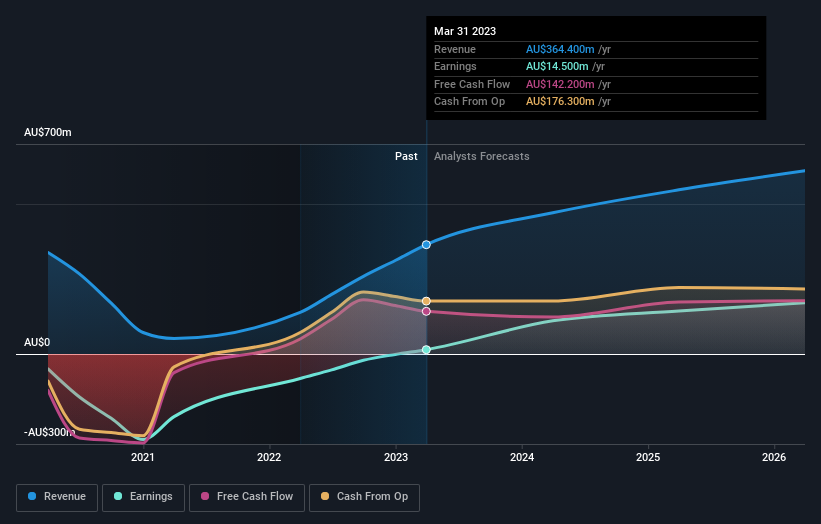

Webjet already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Webjet's historic earnings and revenue below, but keep in mind there's always more to the story.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Hedge funds don't have many shares in Webjet. Our data shows that First Sentier Investors (Australia) IM Ltd is the largest shareholder with 10% of shares outstanding. With 5.3% and 5.0% of the shares outstanding respectively, Ausbil Investment Management Limited and The Vanguard Group, Inc. are the second and third largest shareholders. Additionally, the company's CEO John Guscic directly holds 1.6% of the total shares outstanding.

A closer look at our ownership figures suggests that the top 16 shareholders have a combined ownership of 51% implying that no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Webjet

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in Webjet Limited. It is a pretty big company, so it is generally a positive to see some potentially meaningful alignment. In this case, they own around AU$95m worth of shares (at current prices). If you would like to explore the question of insider alignment, you can click here to see if insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 43% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Take risks for example - Webjet has 1 warning sign we think you should be aware of.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you're looking to trade Web Travel Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, New Zealand, the United Arab Emirates, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives