What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at the ROCE trend of Lottery (ASX:TLC) we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Lottery:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = AU$686m ÷ (AU$4.4b - AU$913m) (Based on the trailing twelve months to December 2024).

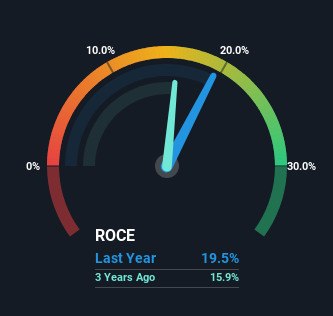

Thus, Lottery has an ROCE of 20%. In absolute terms that's a great return and it's even better than the Hospitality industry average of 9.2%.

Check out our latest analysis for Lottery

In the above chart we have measured Lottery's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Lottery .

What Can We Tell From Lottery's ROCE Trend?

Lottery's ROCE growth is quite impressive. The figures show that over the last three years, ROCE has grown 23% whilst employing roughly the same amount of capital. Basically the business is generating higher returns from the same amount of capital and that is proof that there are improvements in the company's efficiencies. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

The Bottom Line On Lottery's ROCE

As discussed above, Lottery appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. And given the stock has remained rather flat over the last year, there might be an opportunity here if other metrics are strong. So researching this company further and determining whether or not these trends will continue seems justified.

If you want to continue researching Lottery, you might be interested to know about the 2 warning signs that our analysis has discovered.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TLC

Lottery

Engages in provision of gaming and entertainment services in Australia.

Proven track record with limited growth.

Market Insights

Community Narratives